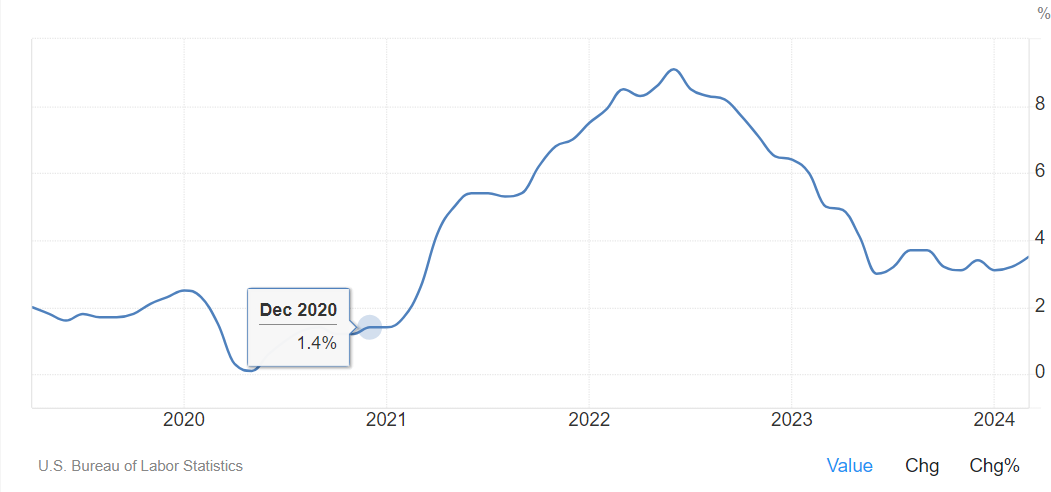

Crypto markets were notably dull this week, and Bitcoin dropped below $60,000. The strengthening belief that the Fed will cut interest rates less frequently and later this year is pressuring risk markets. Today’s unemployment claims data also fell below expectations.

Comments from a Fed Member

On the macroeconomic front, concerns about persistent inflation are becoming more apparent, and expectations for a rate cut have been postponed until the September meeting. To better understand the current conditions, it might be useful to review the latest statements from the members. At the time of writing, Fed‘s Williams was making statements.

“Economic imbalances have diminished. I don’t feel an urgency for rate cuts. Eventually, interest rates will need to be lower. Rate cuts will be determined based on economic activity. Rate hikes are not my baseline prediction. If the data had required higher rates, the Fed would have raised them. The economy has returned to its pre-pandemic growth trajectory. I am monitoring the performance of the Chinese economy.”

The statements made by Williams indicate that there is no major issue from his side until the inflation data for April. If the inflation data for the fourth month also does not come in as low as expected, this could increase pressure on the markets. The employment drop needed for further easing does not seem likely at the moment.