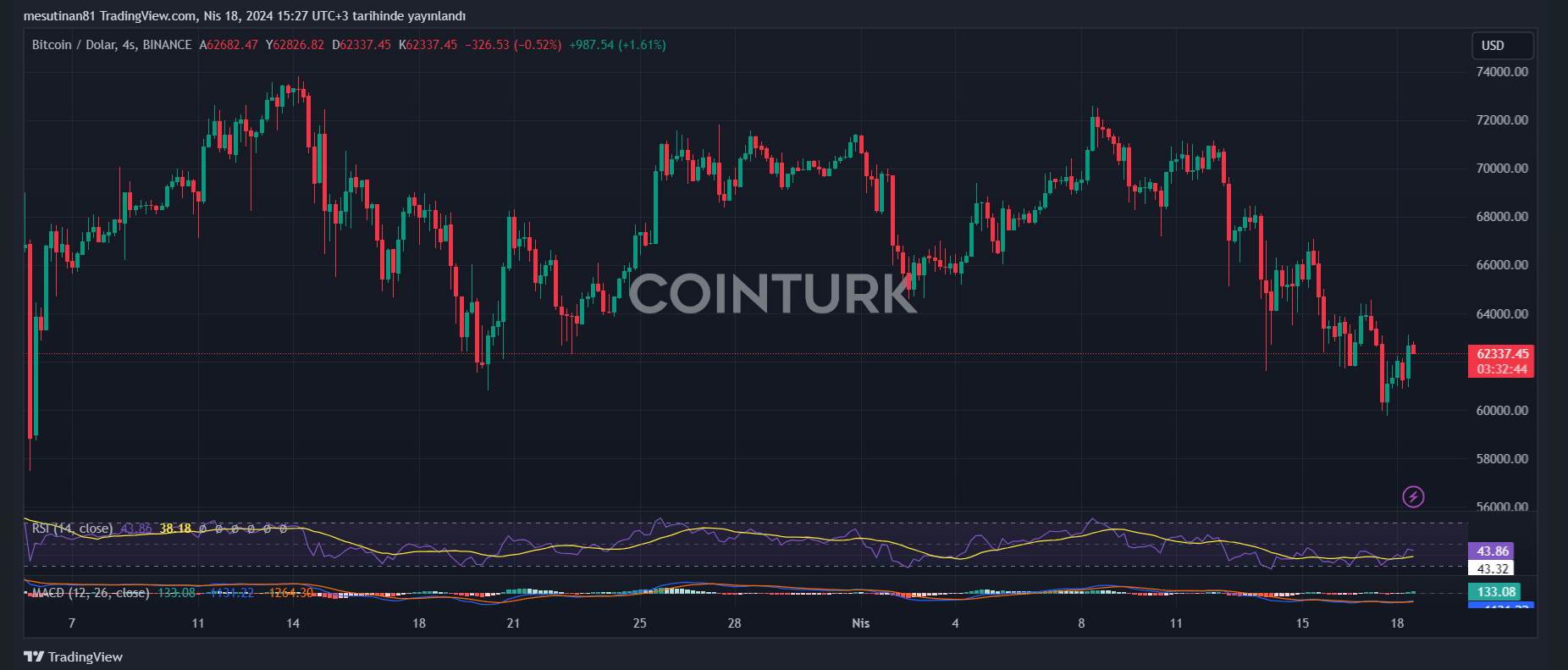

In recent days, the cryptocurrency markets have seen significant movement, which continues to worry investors. Bitcoin experienced a sudden drop yesterday. This drop was followed by some recovery. The flagship of cryptocurrencies today moved from levels of $61,000 to $63,072. However, this rise left behind a trail of liquidations. Accordingly, a liquidation of $255 million occurred in the market.

Bitcoin Struggles to Hold Above $62,200

According to data, BTC is trading around $62,337 while writing this article. In the last 24 hours, there has only been a 0.1% decrease, while there was an 11.1% loss in value compared to last week. Similarly, the global crypto market, despite the sudden drop yesterday, is hovering at $2.4 trillion with a 0.1% decrease.

However, yesterday’s sudden drop not only affected prices but also led to the liquidation of over $255 million in futures contracts. This situation could force exchanges and brokers to liquidate their positions if the volatility continues.

Crypto Traders Face Challenges

It has been a tough week for traders on crypto derivative platforms. Over the weekend, more than $700 million worth of long positions needed to be liquidated. Long positions bet on the rise in asset prices, while short positions bet on price declines.

However, there are some glimmers of hope for the future. Philip Swift, the founder of Look Into Bitcoin, mentioned that the improvement in global liquidity could have a more pronounced effect on the markets than the upcoming halving. The next Bitcoin halving event is scheduled for Friday night.

However, it remains uncertain how long it will take for liquidity to recover. Bitcoin billionaire Arthur Hayes expressed concerns about liquidity and suggested that the halving could lead to a major upheaval in crypto assets.

Bitcoin ETFs Continue to Be Monitored

Bitcoin ETFs continue to attract interest as the market prepares for further development. Some platforms may experience fluctuations in flows, but the overall direction of institutional investment in the crypto sector remains optimistic.

Although there has been a 50% outflow from Grayscale, it is believed that these outflows will slow down especially after the halving. With eyes now turned to the halving, fluctuations in the BTC price are expected to continue.