Bitcoin‘s upcoming halving has led to a noticeable market downturn, sparking fears of a potential bear market. While Bitcoin experienced a significant 19% drop, altcoins saw even more dramatic declines, with some plummeting by as much as 70%. Given this trend, the future of cryptocurrencies continues to be a hot topic among investors with the halving just around the corner.

Current State Before Bitcoin Halving

Historically, Bitcoin halvings have acted as catalysts for bullish trends. The upcoming event is known to significantly reduce BTC supply, which theoretically could drive prices up if demand remains steady.

However, Garry Kabankin, a leading market analyst from Santiment, noted that such significant events do not solely operate on fundamental factors.

The recent price trends in Bitcoin and altcoins are not just reflections of a basic downturn but also the result of emerging rumors, according to Kabankin.

Kabankin stated:

The sharp decline in altcoins, even more so than in Bitcoin, highlights the high volatility and speculative trading that can occur before such events. This situation reminds us of the market’s sensitivity to changes in supply dynamics; a reduction in block rewards post-halving could lead to decreased supply pressure.

When Will the Halving Impact Show?

On the other hand, it’s important to remember that the true impact of the halving might become more apparent in the weeks to follow. As the market adjusts to the new supply outlook, the effects of Bitcoin’s scarcity and its new value can be more clearly observed.

The recent price decline is a reflection of the cyclical patterns observed in past halvings, and it is not incorrect to say that corrections have emerged as expected.

However, Kabankin, considering current on-chain metrics and social sensitivity, commented on the perspective that should be maintained, stating:

Historically, we have seen enthusiasm during halving periods, which usually leads to a reassessment of positions post-event. Monitoring social sensitivity and whale behavior is crucial for more immediate market signals.

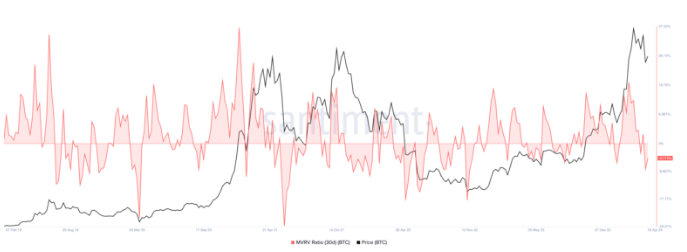

Moreover, the Market Value to Realized Value (MVRV) ratio is known for providing clearer insights into market sentiment. It reveals whether a crypto asset is overvalued or undervalued within a specific timeframe.

According to Kabankin’s view, investors should also pay attention to the average age of cryptocurrencies. Significant declines could indicate broader market movements and potential selling pressure.

These indicators, when combined with technical analyses and traditional support levels, have the potential to guide investors when they lose direction.

On the other hand, an increase in stablecoin supply moved to exchanges could indicate bullish expectations and suggest that investors are stepping in to buy. Additionally, increases in trading volume could also support a rising trend.

This situation could indicate a smoother accumulation phase for a potential bull run. Looking at resistance barriers and on-chain signals is crucial for identifying potential reversals.

Türkçe

Türkçe Español

Español