Bitcoin‘s price drop below $63,000 earlier this week led to Bitcoin holders adding assets worth $1.7 billion to their accumulation wallet addresses in a single day. According to the latest data from CryptoQuant, over 27,700 Bitcoins valued at $1.75 billion were sent to accumulation addresses during a single 24-hour period between April 16-17.

Another Record for Bitcoin

While this development marked a new daily record for Bitcoin, the previous record was set on March 23 this year when 25,500 Bitcoins were sent to accumulation addresses as Bitcoin’s price hovered around $63,500. These data indicate high levels of motivated buying around $63,000, demonstrating the strong and persistent confidence of major investors in accumulating and holding Bitcoin for the long term.

A Bitcoin accumulation address refers to Bitcoin wallets that have not shown any withdrawal transactions previously and hold a balance of over 10 Bitcoins. These addresses are considered excluding wallets known to be connected to Bitcoin miners and crypto exchanges, and these addresses must have been active at some point in the last seven years.

Prominent Investor Comments on Bitcoin

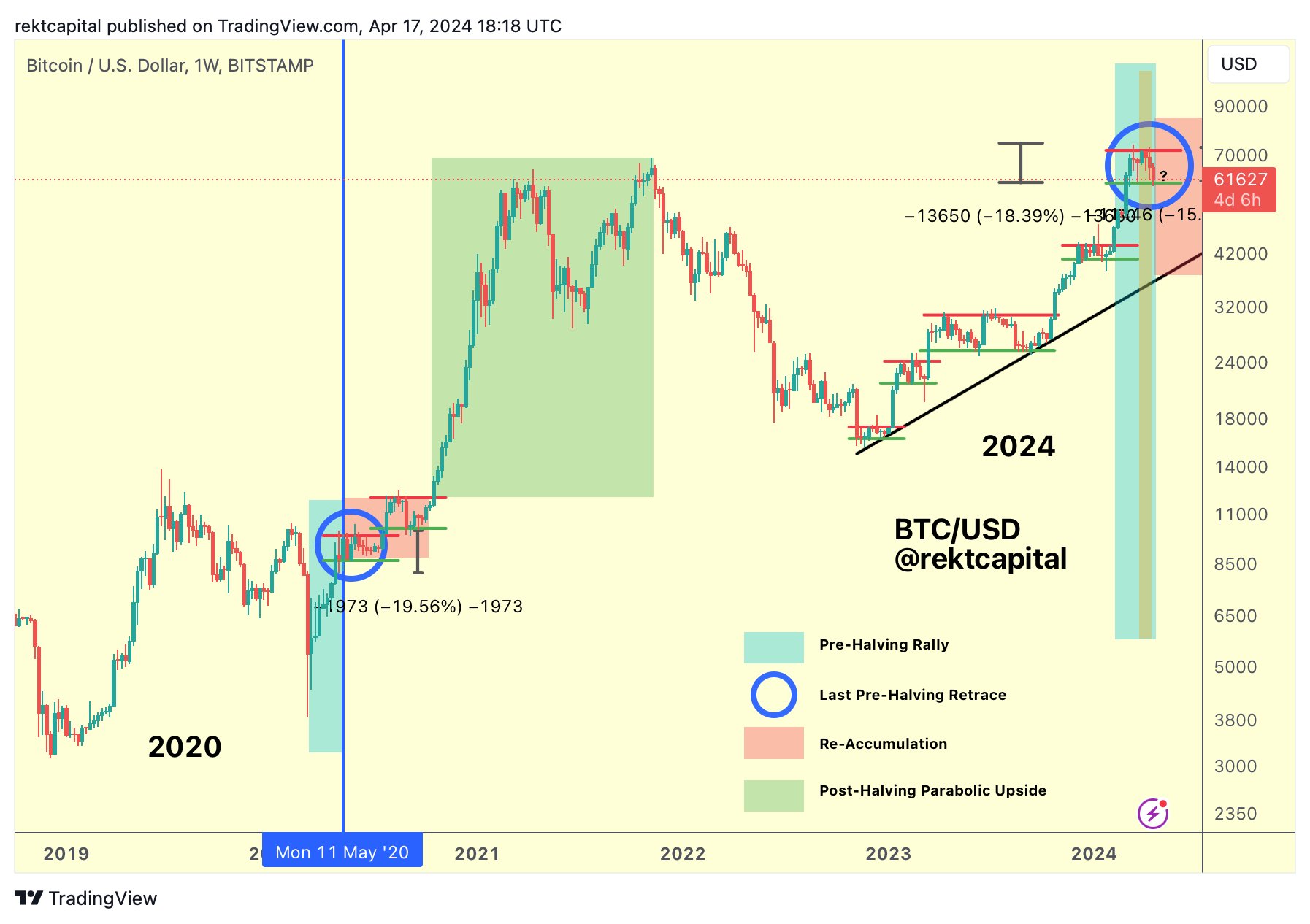

Several market analysts, including popular investor Rekt Capital, have suggested that the first few months of this year might be the last chance to buy Bitcoin at bargain prices before a post-halving rally event. On April 17, Rekt Capital stated in a post on platform X that Bitcoin’s price movement is currently following a pattern similar to previous halving cycles.

Rekt explained that the recent drop in Bitcoin’s price to $73,600 on March 13, a decline of more than 14%, was an expected part of the pre-halving pullback. He predicted that Bitcoin might re-enter an accumulation phase after the upcoming halving event scheduled for April 20, sharing the following statement:

“When Bitcoin exits the accumulation zone and enters a parabolic rise, historically this phase lasts just over a year, but the potential accelerated cycle occurring now could halve this duration in the current market cycle.”

Türkçe

Türkçe Español

Español