Bitcoin (BTC) investors are closely monitoring the upcoming halving event, while the behavior of large Bitcoin holders, known as whales, is under intense scrutiny. Analysts indicate that these major investors are positioning themselves at a crucial point ahead of a historically significant milestone that affects Bitcoin’s price and market dynamics.

Bitcoin Analytical Reports

Recent data from blockchain analysis platforms like CryptoQuant and Santiment reveal a notable change in whale activity. According to a tweet by CryptoQuant, there has been an increase in Bitcoin accumulation by whales. This could indicate a bullish outlook for those expecting a supply squeeze post-halving. Bitcoin entries to accumulation addresses reached an all-time high on April 18th. CryptoQuant commented on the issue:

Bitcoin entries to accumulation addresses yesterday reached an all-time high of 27,700 BTC.

IntoTheBlock provides further information showing that large-scale holders (1,000+ BTC) increased their holdings by 16,300 BTC over the last seven days, equivalent to about 1 billion dollars at current prices. However, according to the company, the largest whales have not yet started buying. IntoTheBlock stated:

The largest whales, holding at least 0.1% of the supply, have not started accumulating and even reduced their assets yesterday.

Statement from a Prominent CEO

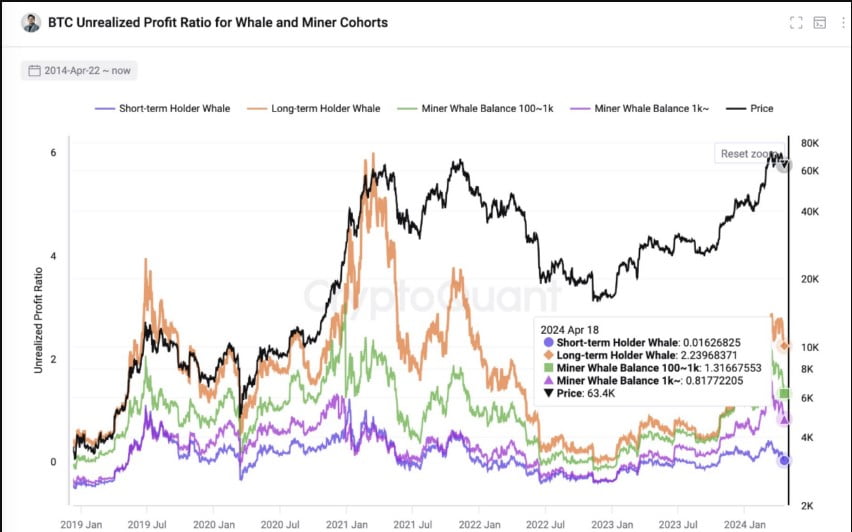

CryptoQuant CEO Ki Young Ju highlighted that the increased holding periods around the halving indicate a strong sense of ownership, which could align with the general expectation that reduced supply and steady or increasing demand will drive prices up. Young Ju noted that unrealized profits remain positive for on-chain groups, particularly miners and whales, and commented:

There is not enough profit yet to end this cycle.

Similarly, Santiment’s analysis shows that despite Bitcoin reaching $63,800 as of April 18th, the general consensus remains bearish. However, Santiment emphasized that this could be seen as a sign of potential recovery, adding:

It consistently maintains a bearish trend against upper limits, strengthening the argument for further rises.