With only hours left until a major event that occurs every four years, Bitcoin block rewards are set to drop to 3.125. So far, 93.7% of BTC supply has entered circulation. The remaining portion will enter the market over the next 120 years at a slowing rate. With increasing demand and a decreasing rate of new supply issuance, the Bitcoin price has been rising for years. The same trend is expected in this cycle.

Bitcoin (BTC)

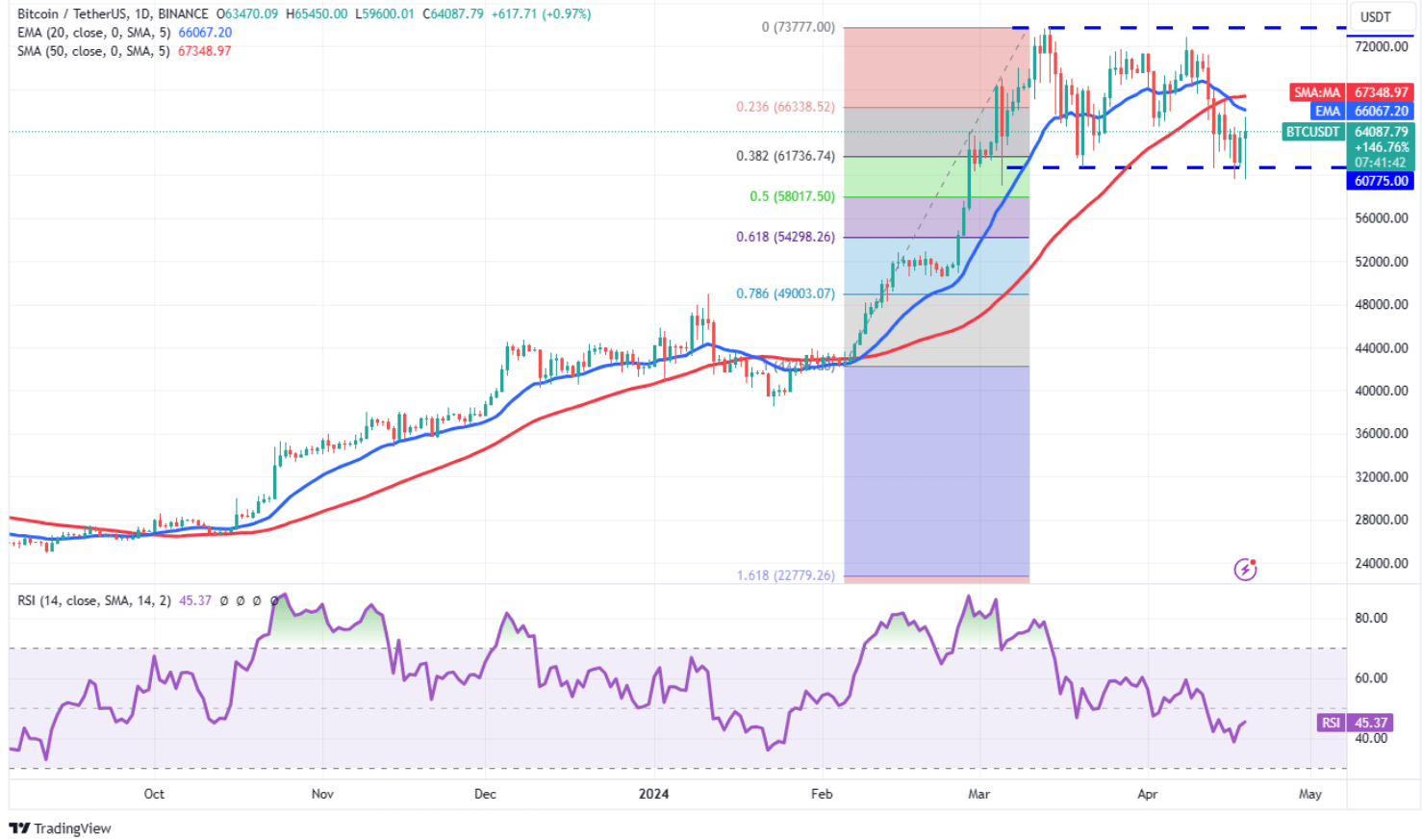

In his latest market assessment, Julio Moreno stated that after the BTC price dropped to $60,000, the selling pressure should weaken. The CryptoQuant executive, a research head at one of the largest companies in the on-chain area, believes that traders have now found the support region. This belief is based on data tracking investor costs.

According to CryptoQuant data, investors accumulated 27,000 BTC during the 24 hours between April 16 and April 17. Turning to technical analysis, the long tail in the last day’s candlestick indicates that bulls actively bought at the bottom.

The relief rally is based on the 20-day exponential moving average ($66,067), which could pose a strong challenge from bears. This level is one of the main barriers before $71,700 and $73,777. However, if the BTC price loses the $60,775 support, sales could continue down to $47,773. The historical decline story with halving is an important detail not to be overlooked.

The ultimate upward target will be a peak of $84,000 in a few months. Of course, for this to happen, April’s inflation data must come in below expectations, and geopolitical risks must be mitigated. Thus, demand through the ETF channel could revive, providing the support bulls need.

Ethereum (ETH)

Altcoin king experienced a frightening drop below $3,000 in the early hours of the day. Bears tried to pull Ether below the lowest level of April 13, $2,852, but failed because BTC recovered much faster. To truly talk about a real bottom, we needed to see such a quick turnaround from a local bottom, which indeed happened.

For ETH, the short-term goal is to close above the 20-day EMA at $3,261, and if successful, a return to $3,679 could begin. Otherwise, the risks of dropping to $2,717 and $2,200 will persist.