According to CoinMarketCap, the cryptocurrency token ORDI, closely associated with the Bitcoin Ordinals protocol, recorded a double-digit price increase in the last 24 hours. The token’s price increase follows the completion of Bitcoin’s fourth halving event and the launch of the Runes Protocol in the early trading hours of April 20th.

New Protocol Draws Attention

The Runes protocol, created by Bitcoin Ordinals inventor Casey Rodarmor, represents a new way of creating fungible tokens on the Bitcoin Blockchain.

The launch of the protocol coincided with Bitcoin’s halving event, and as users attempted to mint new tokens on the network, transaction fees reached new highs. According to Rune Alpha, at the time of writing, 1447 Runes had been “minted” on the Bitcoin network, with $16.41 million spent on fees.

Will ORDI Continue to Rise?

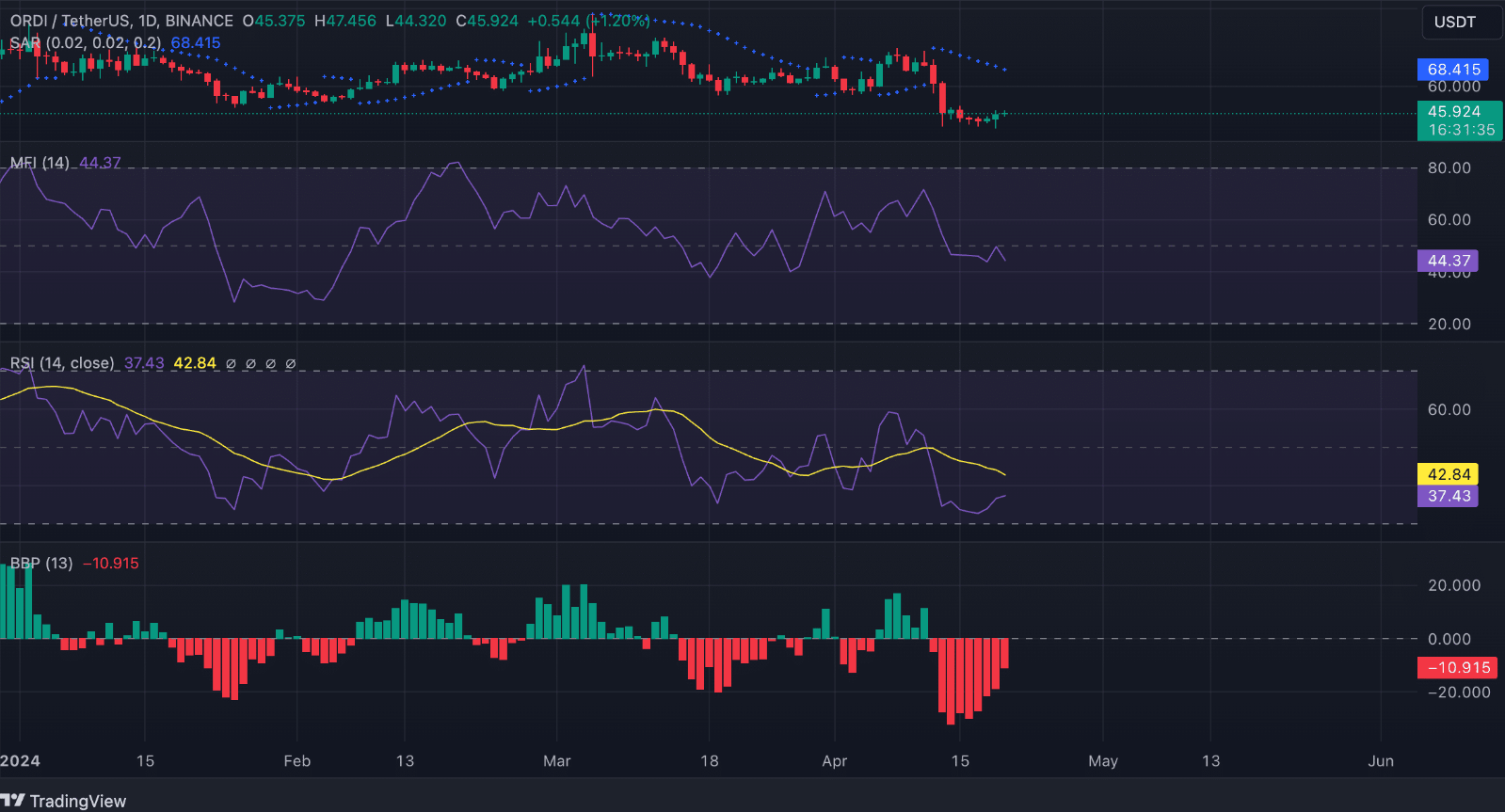

An evaluation of ORDI’s fundamental indicators on the 24-hour chart suggests that due to significantly low demand for the token, price gains may be short-lived.

Indeed, readings from basic momentum indicators reveal that market participants prefer selling the token rather than accumulating it. For example, the Relative Strength Index (RSI) was at 37.46 while the Money Flow Index (MFI) stood at 44.36.

At the time of writing, the declining trend of these indicators suggests that selling pressure significantly outweighs buying activity.

A Metric Reveals Negative Values

Furthermore, the Elder-Ray Index, which measures the bull/bear power of the token, indicates a significant downtrend. The indicator has only shown negative values since April 12th. When this indicator trends this way, it indicates that the market is in a downtrend and that the decline is likely to continue.

Similarly, the points forming ORDI’s Parabolic SAR indicator are fixed above its price. This indicator identifies potential trend directions and reversals for an asset. When the points are above an asset’s price, it indicates a bearish market, suggesting that the asset’s price is falling and may continue to drop, prompting traders to take short positions.

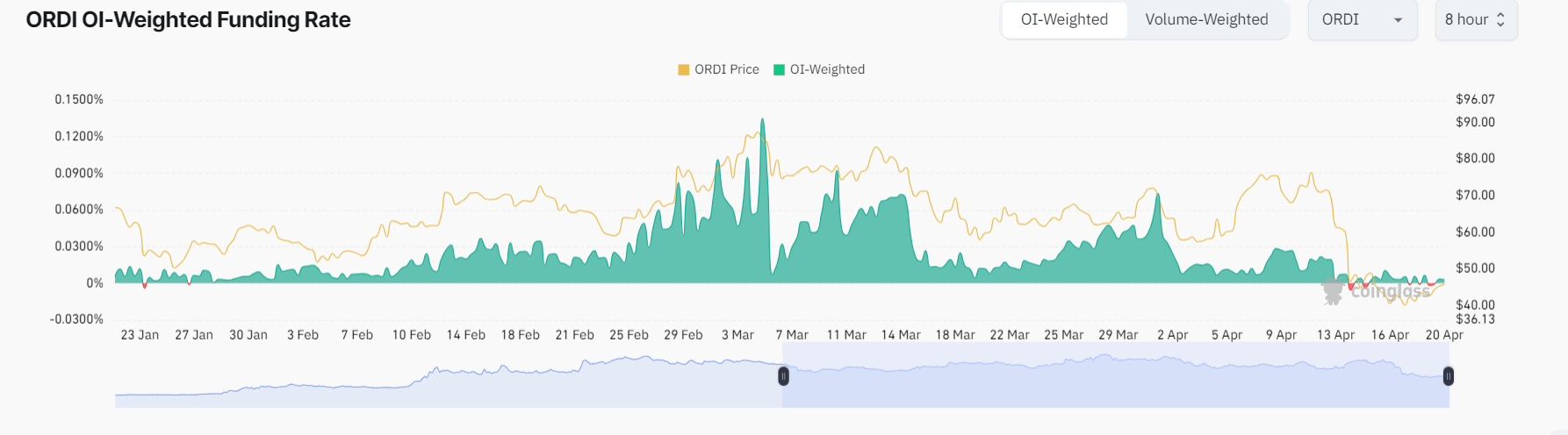

Increase in Open Positions

According to Coinglass data, the open interest in ORDI’s futures market has shown a 10% increase in the last 24 hours. At the time of writing, ORDI’s futures open interest was $211 million.

Meanwhile, the funding rates on crypto exchanges were negative during the same period. This situation indicates that Futures market participants are betting in favor of ORDI’s price decline when taking trading positions.

Türkçe

Türkçe Español

Español