As we approach the end of April, we’ve seen a suppression in prices this month compared to the impressive performance in the first quarter of the year. Appetite has weakened for various reasons. Even the halving could not boost the risk appetite of cryptocurrency investors. So, what is the current situation in the cryptocurrency markets as of Sunday, April 21?

Bitcoin (BTC)

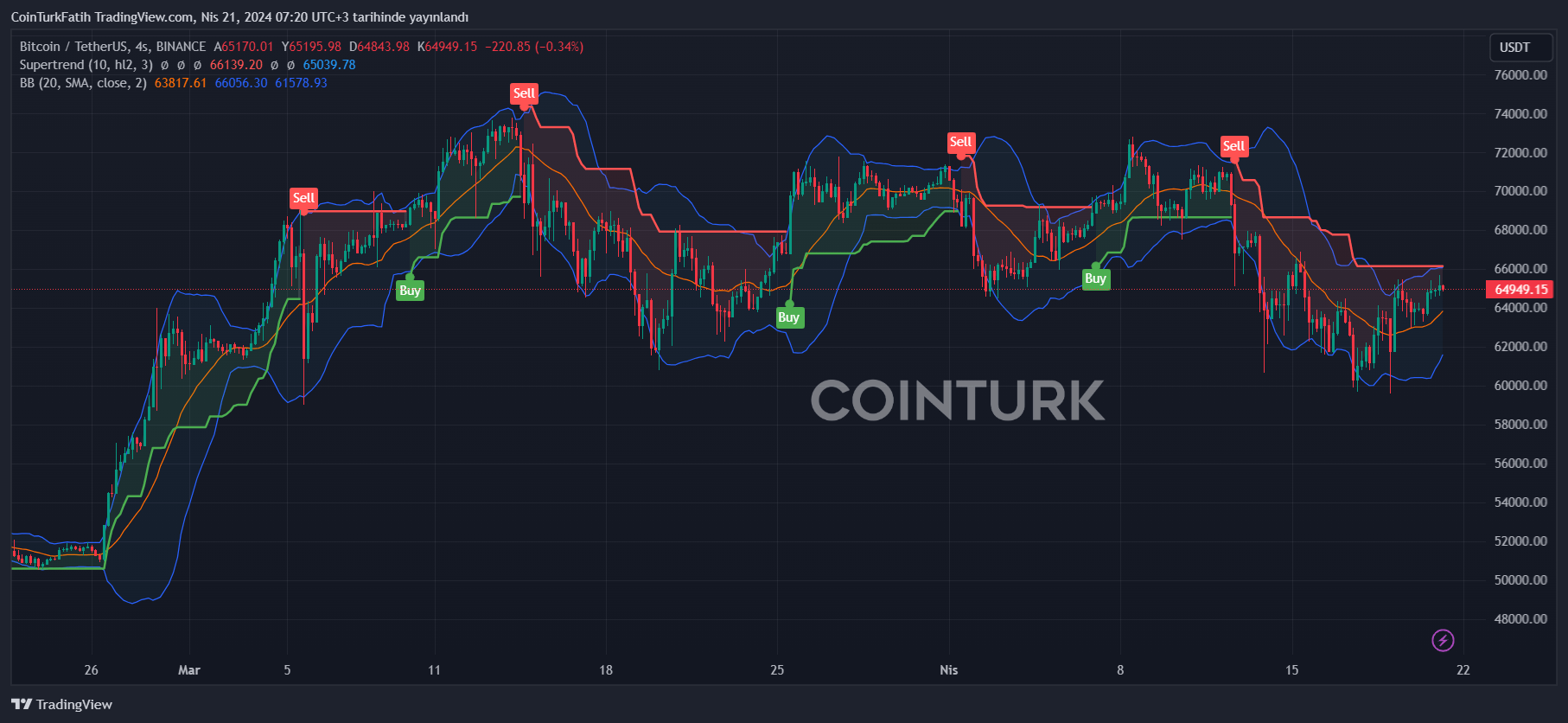

As this article is being prepared, the price of Bitcoin stands at $65,000, and altcoins are performing relatively positively. Many cryptocurrencies have seen gains of 5%. The resurgence of BTC above $65,000 is a positive sign. Some experts say the halving has already been priced in, but it’s still too early to be sure.

On the macroeconomic front, recent data and statements now indicate that April’s inflation data could be decisive for 2024. If next month’s inflation data comes in below expectations and we avoid new war rhetoric, Bitcoin could start its journey to an all-time high (ATH).

The $63,350 region is currently holding as support, but $65,470 remains a resistance point. Since April 13, this area has not been consistently breached. If closures above this are seen, we could witness a move towards $66,860 and $67,804. If the second resistance is also breached, BTC could again target the $71,700 and $73,777 barriers.

Current Status of Cryptocurrencies

Among the top 100 cryptocurrencies, BONK Coin was the day’s biggest gainer. This meme coin, significantly outperforming other cryptocurrencies, saw an increase of nearly 40%. FLOKI and SHIB also gained 18%. The double-digit rises in meme coins post-halving indicate that investors are starting to take risks again.

The only issue is that volumes have dropped below $60 billion with the halving. The 43% decline in volume will likely increase on Monday, the first trading day after the halving, supported by ETFs. The highest volatility of the day now occurs during the US market opening/closing hours because inflows into spot Bitcoin ETFs have already surpassed $12 billion and have become more influential than an average exchange.

Türkçe

Türkçe Español

Español