Bitcoin‘s (BTC) recent halving did not lead to the immediate large-scale sell-off that some investors feared. Although the situation might change later this week, the $60,000 support level was defended on April 19. CryptoQuant CEO Ki Young Ju highlighted on social media that we are not near the peak of this cycle.

Whale Activity in Bitcoin

The unrealized profit ratio indicates that long-term whales have only made a 234% profit. The 2021 run saw these whales at a peak profit of 599% in February 2021. Although BTC reached new highs later that year, the unrealized profit metric did not match this peak.

Comparing the 2020-21 cycle with the 2017-18 rally, it’s noted that long-term whale profits were over 1700% in 2017. This figure falls short when compared. This situation raises the question of whether whale profits will decline further at the peak of this cycle. Therefore, expectations for Bitcoin reaching $200,000 might be ambitious, but only time will tell.

Current State of Bitcoin

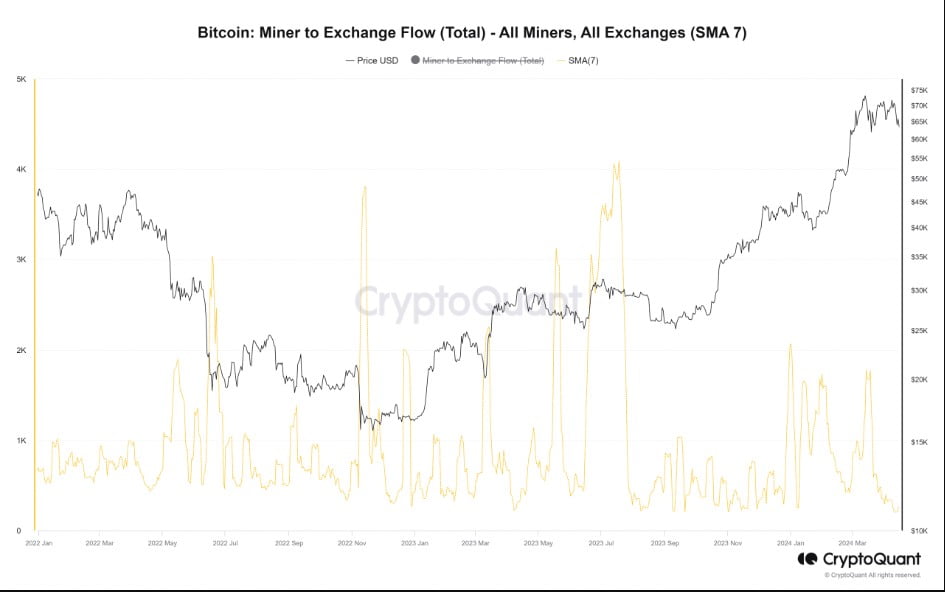

In mid-March, with a 286% increase, bulls hoped the halving would boost these figures. Prominent crypto analyst Ali Martinez pointed out the sentiment around Bitcoin reaching its peak. According to the NUPL metric, we have not yet reached the “euphoric” stage typically accompanying a Bitcoin peak. While the long-term outlook supports higher prices, short-term fluctuations are expected. Data from CryptoQuant noted that miners sent less BTC to exchanges last month.

A decrease in the 7-day simple moving average of miner inflows to exchanges could be evidence of this. One piece of data suggested that miners are accumulating Bitcoin to sell post-halving, which could significantly pressure the market downwards. In conclusion, the Bitcoin halving did not lead to a major sell-off, the $60,000 support was maintained. Long-term whale profits are lower than in previous cycles, and miners are waiting to sell.

Türkçe

Türkçe Español

Español