According to industry observers, Ethereum‘s largest re-staking protocol in terms of Total Value Locked (TVL), EigenLayer, might face a significant yield crisis. Chudnov from 3Jane exchange suggests that EigenLayer’s rapid TVL growth could be surpassing its Actively Verified Services (AVS), potentially leading to a major drop in yields.

Notable Comments from a Prominent Figure

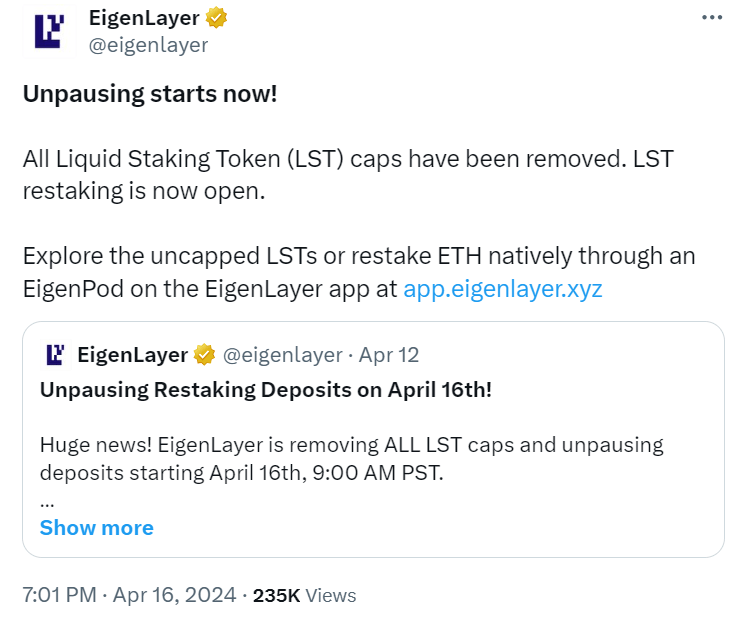

In a post dated April 22, Chudnov mentioned that EigenLayer’s TVL exceeds $15 billion, but the security needs for AVS would actually require less than 10% of this, which could precipitate a yield crash. Following an announcement on April 16, EigenLayer removed all limits on liquid staking tokens (LSTs). EigenLayer was launched on the mainnet on April 10.

When a user stakes an LST through EigenLayer, it is automatically transferred to a node operator; this operator uses the deposits to secure an AVS on EigenLayer while receiving staking rewards. A portion of the staking rewards is transferred to the user.

However, according to Chudnov, the Actively Verified Services in the protocol require much less staked Ethereum for security, which could lead to future problems:

“The issue is that none of the AVSs will need security even close to $1.5 billion, let alone $15 billion. The main purpose of Proof-of-Stake is to have the stake value higher than the potential profit from dishonest behavior by the validator.”

Details on EigenLayer

EigenLayer, following the Lido staking protocol, is the second largest protocol in the Ethereum ecosystem. According to blockchain data analysis platform DefiLlama, EigenLayer’s TVL increased by 16% last month to $14.15 billion. As altcoin prices drop, the problem could worsen since AVSs are not encouraged to hold excess on-chain capital. The first solution could be a series of token launches to temporarily increase the security budget requirements, which might be akin to throwing the box away.

However, integrating EigenLayer more deeply into the decentralized finance (DeFi) ecosystem and creating more benefits for LSTs could offer a permanent solution. Chudnov summarized the issue with these words:

“If the EigenLayer ecosystem can embed itself more deeply into the DeFi ecosystem through financial primitive elements, then this becomes a much more defensible moat and gives AVS more time to solve issues well below cost.”

Türkçe

Türkçe Español

Español