Bitcoin price once again exceeded $66,000 today but failed to reach new peaks after the US market opened. Although a more moderate week in crypto was expected, it’s hard to speak of a great performance on the first day. Most altcoins achieved modest gains and are maintaining important support levels. So, what are the latest predictions from experts?

Bitcoin (BTC)

After the sales experienced last week, there is a promising recovery underway. Despite the promising return, it does not resemble previous recoveries. Demand is weak and BTC has not yet reached $69,000. The lack of momentum after the weekly peak is frustrating for bulls. Popular cryptocurrency analyst Skew wrote the following;

“So far, the spot flow has basically been a sea of algorithmic sales against a single person’s bid. Could be a boring session until later?”

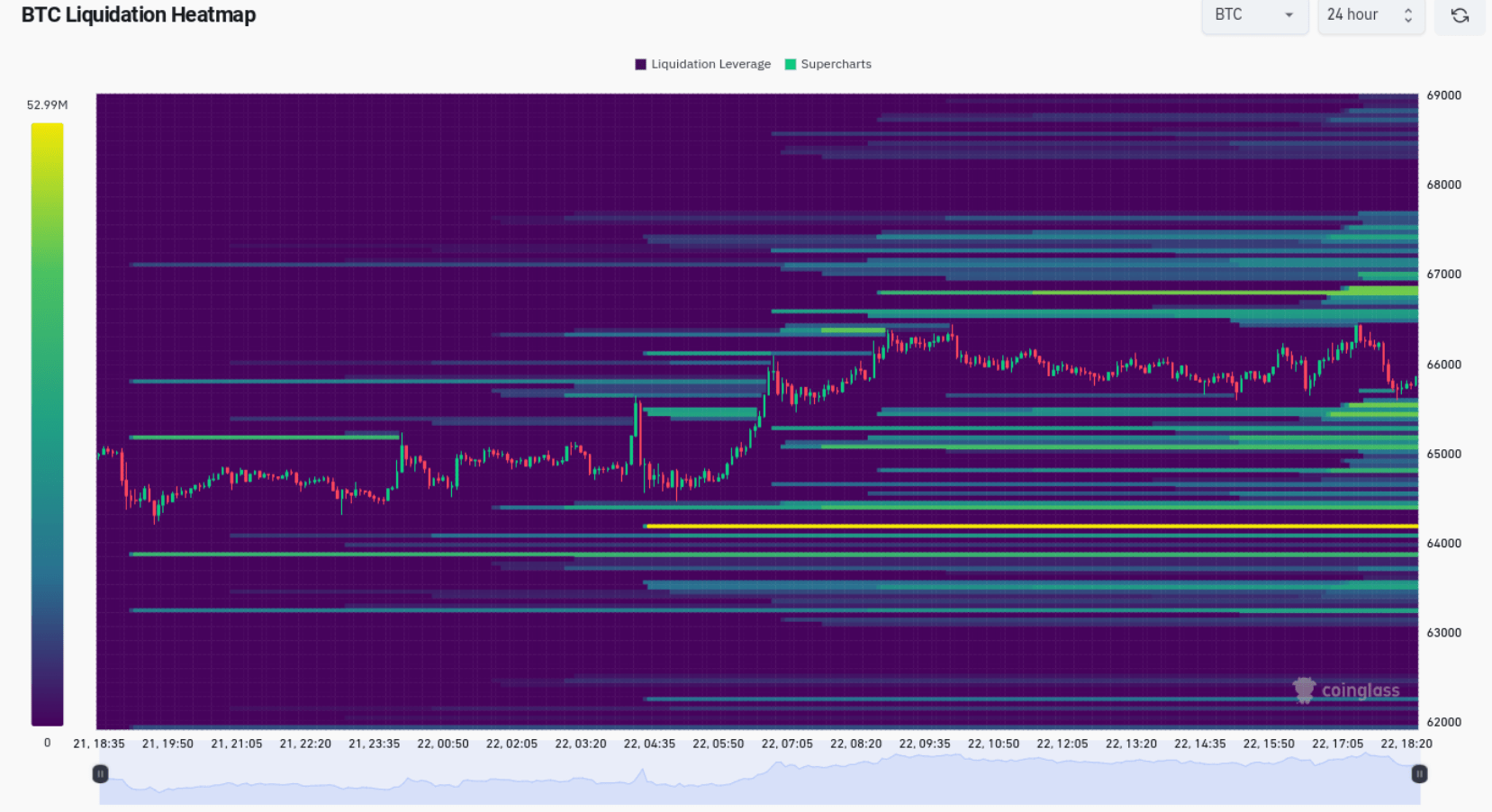

According to CoinGlass data, a new buyer concentration formed today between $64,000 and $65,500. A similar scenario was also observed between $66,500 and $67,750. Regarding the stacked demand liquidity, Skew said, “Time will tell whether these are fake orders or not.”

Will Bitcoin Price Increase?

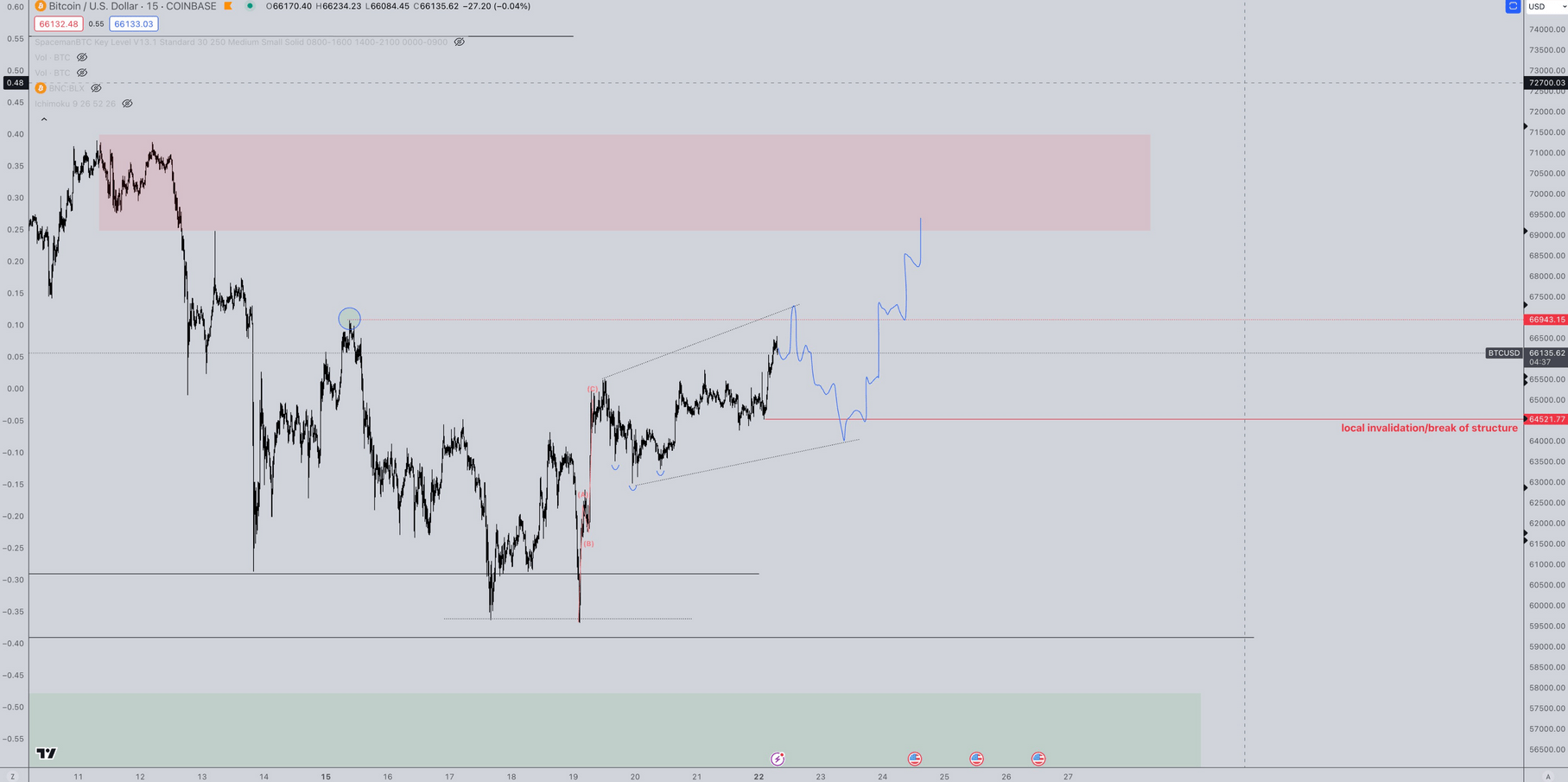

The focus this week was on the close, and for now, we know a level that prevents deeper lows has been maintained. Throughout the week, many experts mentioned that at least $62,000 needed to be preserved. Analyst Matthew Hyland was pleased with the preservation of a significant moving average in the last weekly close.

Bitcoin‘s 10-week simple moving average is an important support line for bulls, and we saw that the recovery in October 2023 started from here. Now, with the expectation of a second and larger rise wave after the halving, the current outlook is promising.

Credible Crypto is concerned that early long positions before the major rise movement will be exposed to a new liquidity cleanup.

“If this movement pauses before it really starts, then I would expect such a development. Since the movement began, there has been a good short-term open position rise. A downward move to clean up longs before the real rally wouldn’t surprise me.”