Chainlink’ten researchers believe that as financial asset infrastructures digitize, asset managers have a significant opportunity to accelerate the tokenization process. In the industry report titled Beyond Token Issuance, the blockchain network Chainlink explained where the opportunity lies and how interoperability and real-world data can reveal the value of tokenized assets.

Insightful Report from Chainlink Team

The report highlights the potential benefits of tokenization for asset managers. This step involves unlocking dormant capital, increasing asset usability, and creating new revenue models.

In addition, Chainlink stated that asset managers could also create unified customer portfolios, differentiate their service offerings, and enhance risk management due to the tokenization process allowing for more automated risk assessment.

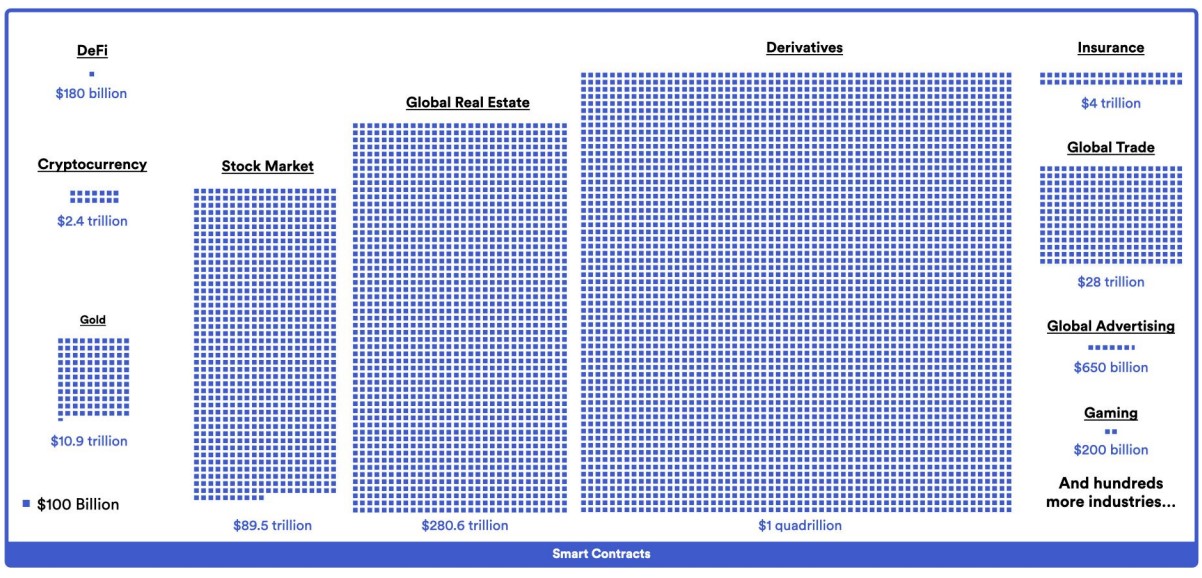

The report also argued that blockchain networks continue to become an integral component of the existing financial ecosystem. It further emphasized that traditional and blockchain-based assets are already merging into a single financial ecosystem. Researchers believe this is due to blockchain networks providing superior infrastructure for asset storage and transactions, stemming from ongoing digitization.

Integration of Blockchain and Traditional Systems

Chainlink Labs‘ Director of Capital Markets, Ryan Lovell, mentioned that the tokenization process has been in the research and development phase for several years. Lovell explained that institutions have been transferring simple account balances into the ecosystem and are just beginning to understand the potential impact of the tokenization process on their operations. Lovell commented:

“This was like building a concept car without an engine or interior. Just a basic shell of what the future might hold.”

However, the executive believes that the next phase of tokenization will involve building more fundamental infrastructure. This is necessary to make tokenized assets interoperable and programmable between traditional systems and both private and public chains.

Meanwhile, the Chainlink executive believes that enhancing these assets with real-world data and enabling their interoperability between blockchain networks and traditional systems could unlock powerful applications. Lovell stated that these use cases would include greater transparency, lower costs, and smoother administrative processes compared to traditional financial infrastructure:

“We are actively working on various exciting initiatives to enable institutions to go beyond just issuing tokens, to manage tokenized assets throughout their entire lifecycle, and to transact in an interchain economy.”

Türkçe

Türkçe Español

Español