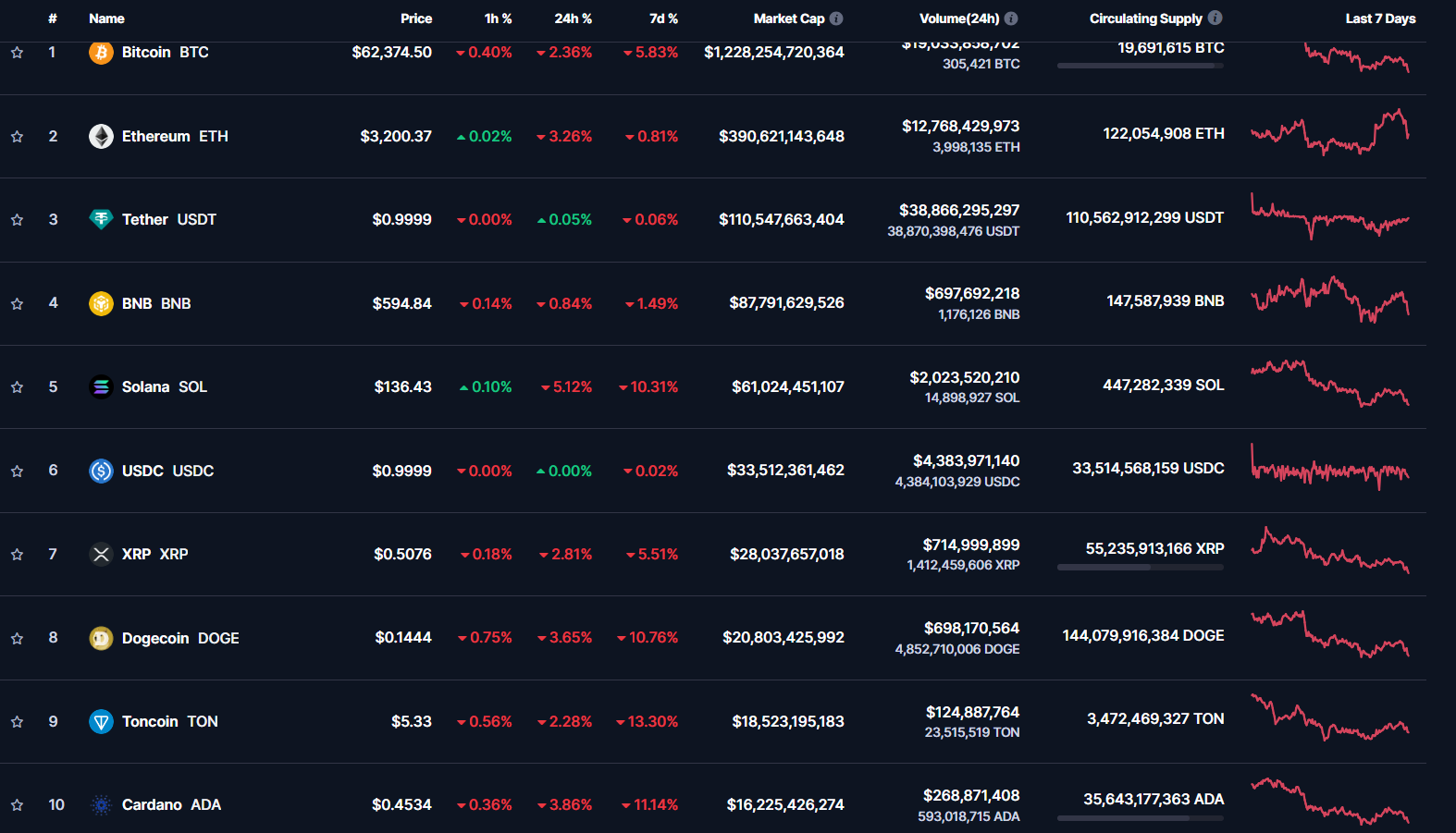

Amid high inflation and weak GDP pressures, expectations that the FED will not change interest rates have created some selling pressure on Bitcoin prices. Over the past weekend, the cryptocurrency market experienced widespread pressure. Bitcoin’s price fell below $62,500, undergoing a 2.2% correction. On the other hand, altcoins were under even greater selling pressure, with corrections ranging from 4% to 10% among the top ten altcoins.

What Awaits Bitcoin and Altcoins?

This week, significant economic developments are expected to begin with the U.S. Federal Reserve’s interest rate decision on May 1. Analysts predict a 95.6% likelihood that the FED will keep interest rates at current levels. Additionally, the U.S. unemployment rate for April will be announced on May 3. However, expectations for a rate cut in the U.S. this year have significantly decreased.

Concerning data from the U.S. caught attention this week. Weaker than expected GDP data indicates a slowing economy, while high Core PCE figures point to persistent inflation issues for the Federal Reserve. Although there are concerns that the U.S. could enter a stagflation scenario characterized by negative GDP growth and high inflation, this situation remains speculative at the moment.

Market sentiment has changed to the point where expectations now price in only one rate cut for 2024. This is a sharp departure from the seven cuts predicted at the beginning of the year and three in March. However, the uncertainty in the FED’s interest rate policy is causing some selling pressure in the cryptocurrency market, particularly affecting Bitcoin prices.

Changing Dynamics in the Crypto Market

Recent market updates signal a significant shift in the crypto world. Volatility decreases in leading cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) indicate a major squeeze in the market. The drop in Bitcoin’s volatility from 70% to 50% was long-awaited and has caused deep reflection among investors.

However, it remains unanswered whether these declines are just a pause or signify a permanent change in market sentiment. Particularly, the increased downside skewness in Ethereum’s risk returns to 13% has heightened market uncertainty.

At this point, attention is focused on the launch of spot Bitcoin and Ethereum ETFs in Hong Kong this week. This move could boost the interest of institutional capital in Asia towards the crypto space and create new momentum in the market. Especially if these ETFs are successful, an increase in confidence in cryptocurrencies and more institutional investors entering the market are expected.

Türkçe

Türkçe Español

Español