Cryptocurrencies started a tough week with Bitcoin price falling to $61,785. BTC struggled to find buyers at lower levels, increasing concerns about the hours ahead. Investors reduced their risk by exiting ETFs last week, while spot markets were dominated by sales.

Why This Week Is Important

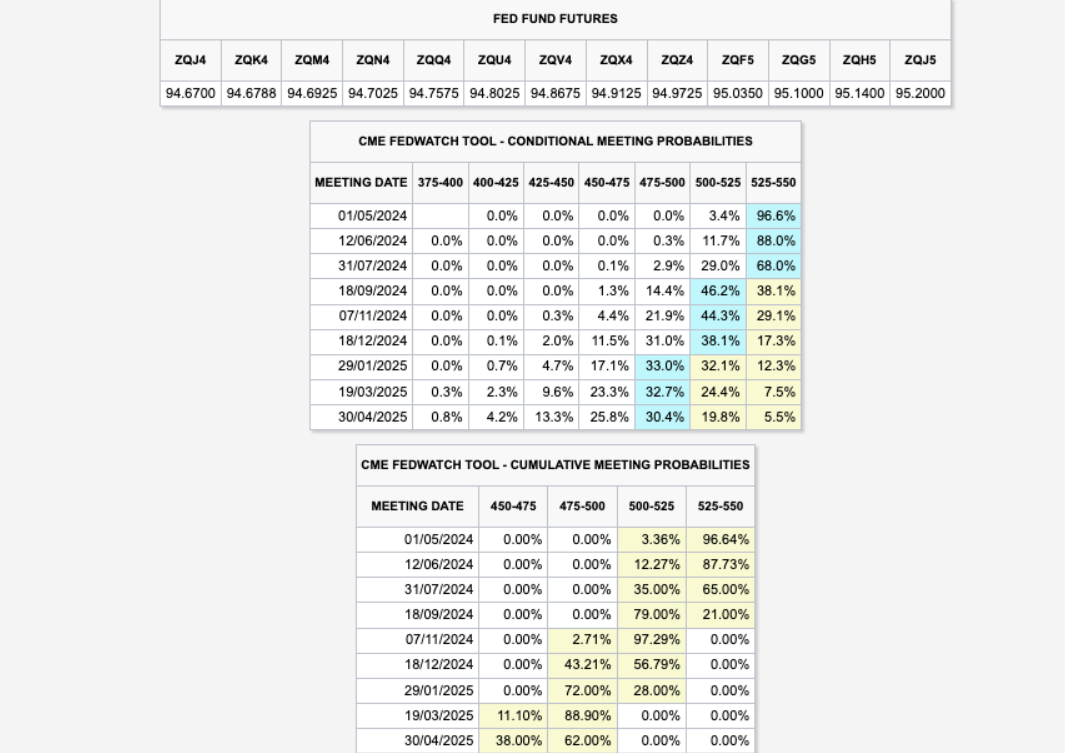

The current outlook, as we have been saying for days, suggests a continuation of the decline in light of negative data from the US side. Announcements from the Fed on Wednesday are justifiably increasing anxiety during this period. Changes in predictions from the CME Group’s FedWatch Tool are dizzying.

While a reduction of 150bp and more was expected at the beginning of the year, now no cut is expected before September. The Kobeissi Letter wrote;

“After a month filled with hot inflation data, we will finally receive updated views from the Fed.”

This week is not only about the potential change in the Fed’s stance, possibly adopting a more hawkish approach, but also new data that will shake the markets on May 2 and 3 with unemployment claims and unemployment data coming in.

Will Cryptocurrencies Fall?

Cryptocurrencies do not always rise or fall, but there is a trend. The crypto markets are still in an upward trend. Bitcoin and altcoins are expected to reach historic highs by mid-2025. However, the Fed adopting a more hawkish stance in the medium term or saying it could cut rates by 75bp+ this year despite sticky inflation could make things worse/better.

Skew, a known crypto analyst, wrote in his latest assessment;

“The worst-case scenario is consecutive bad periods for risky assets and potentially leading to bets that the economy could somehow break apart. We will likely see the $50,000 – $46,000 range. For this, convincing closures below $58,000 are needed (by the bears).”

Another major development this month will be the next stages of ongoing battles between the SEC and crypto companies. The SEC has built many crypto cases on such grounds that winning any could turn it into a killer for most altcoins.

Türkçe

Türkçe Español

Español