Omnichain protocol Omnity has announced the start of an integration process that enables trading of Rune tokens without transaction fees or clogging the Bitcoin network. The protocol’s integration is based on the chain fusion technology of the Internet Computer Protocol network, which facilitates transactions across Bitcoin and other blockchain networks.

Omnity Team Makes a Notable Move

Omnity and Octpus Network’s founder Louis Liu stated that this process will be significantly different from other Bitcoin interoperability protocols and added that support for Bitcoin Ordinals and Ethereum mainnet NFTs is expected in the coming months:

“Omnity does not rely on wrapped tokens with trust assumptions or vulnerable off-chain transmitters. For instance, while Wormhole relies on wrapped tokens and off-chain transmitters, LayerZero requires an Oracle and a Relayer, both off-chain entities.”

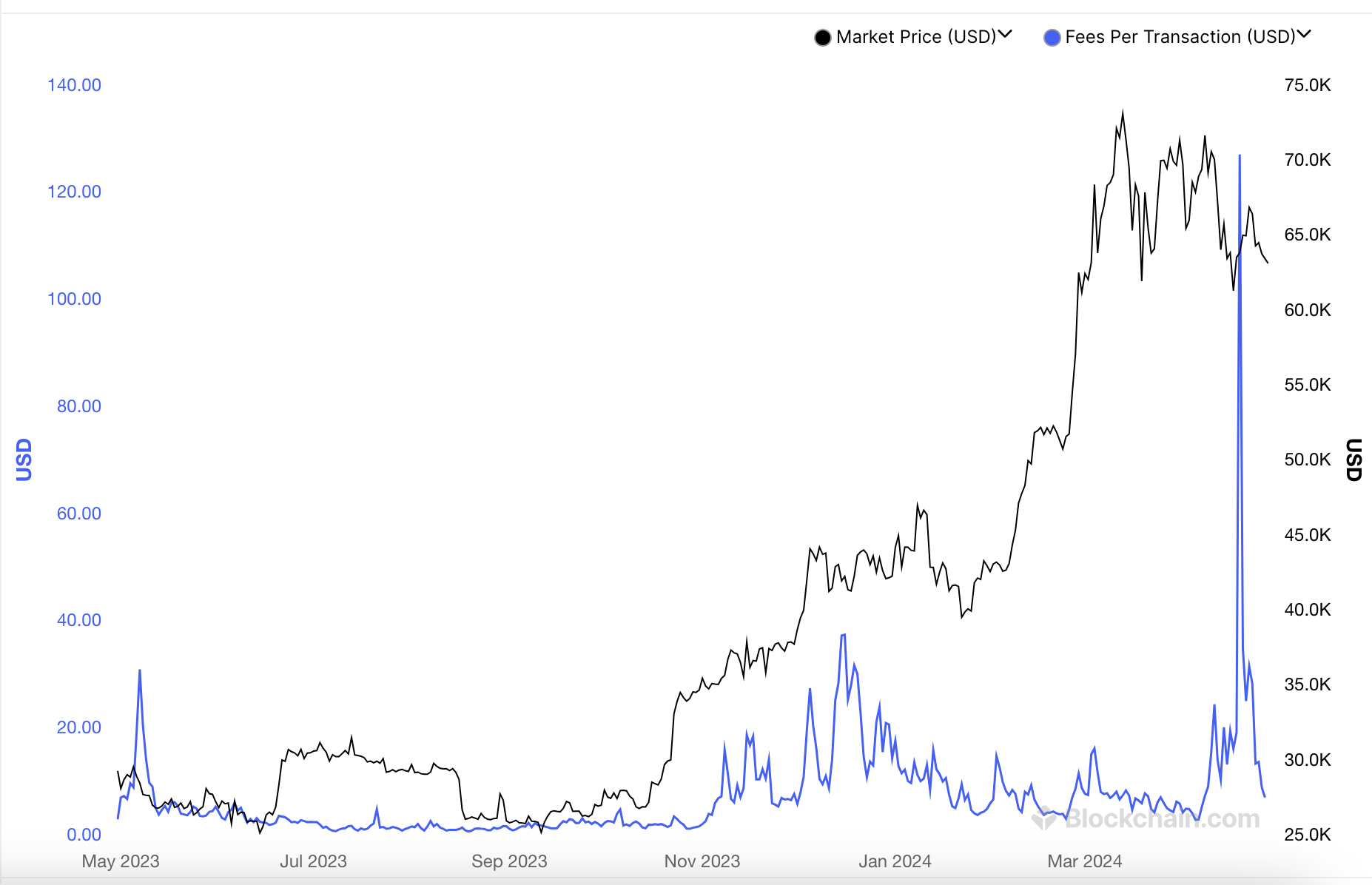

The integration aims to address the demand for scaling the Bitcoin blockchain network. The network has seen increased activity supported by the launch of new technologies like Bitcoin exchange-traded funds and a new protocol for minting tokens on the Bitcoin network, such as Runes.

What’s Happening in the Bitcoin Ecosystem?

On April 20th, the Bitcoin network reached an all-time high with 926,842 transactions, with transactions for Runes tokens constituting 68% of the blockchain traffic. According to data from blockchain analytics platform Dune, 3.6 million Runes transactions were conducted that day. Louis Liu commented on the matter:

“With all these exciting developments in the Bitcoin ecosystem, developers are finding solutions to conduct Bitcoin asset trades without creating bottlenecks on the network, thus increasing the risk of exorbitant transaction fees for users.”

Bitcoin is expected to lead innovation in the crypto space in 2024. Trends surrounding the first blockchain network include integration with Layer-2, roll-ups, and decentralized finance (DeFi). Ledn CEO Mauricio Di Bartolomeo previously stated:

“Most of the world cannot access products listed in the US, yet they will still need and want to borrow against Bitcoin and earn interest.”

Türkçe

Türkçe Español

Español