The cryptocurrency market’s latest data shows ongoing withdrawals from US spot Bitcoin exchange-traded funds (ETFs). Accordingly, US spot Bitcoin ETFs closed April 29 in the red, with a significant net outflow of $51.5 million.

Current Status of US Spot Bitcoin ETFs

Surprisingly, Grayscale Bitcoin Trust (GBTC) was not the primary contributor to these outflows. According to SoSoValue’s data, ARK 21Shares Bitcoin ETF topped the list with a net outflow of $31.34 million. GBTC followed with a net outflow of $24.66 million. Additionally, Fidelity Wise Origin Bitcoin ETF ranked third with a net outflow of $6.85 million.

In the midst of these outflows, some US-listed spot Bitcoin ETFs saw net inflows. Notably, Bitwise‘s spot Bitcoin ETF led with a net inflow of $6.84 million. Meanwhile, Valkyrie Bitcoin ETF and Franklin Bitcoin ETF saw net inflows of $2.67 million and $1.82 million, respectively. In contrast, other spot Bitcoin ETFs, including BlackRock‘s iShares Bitcoin Trust, ended the day with zero dollars.

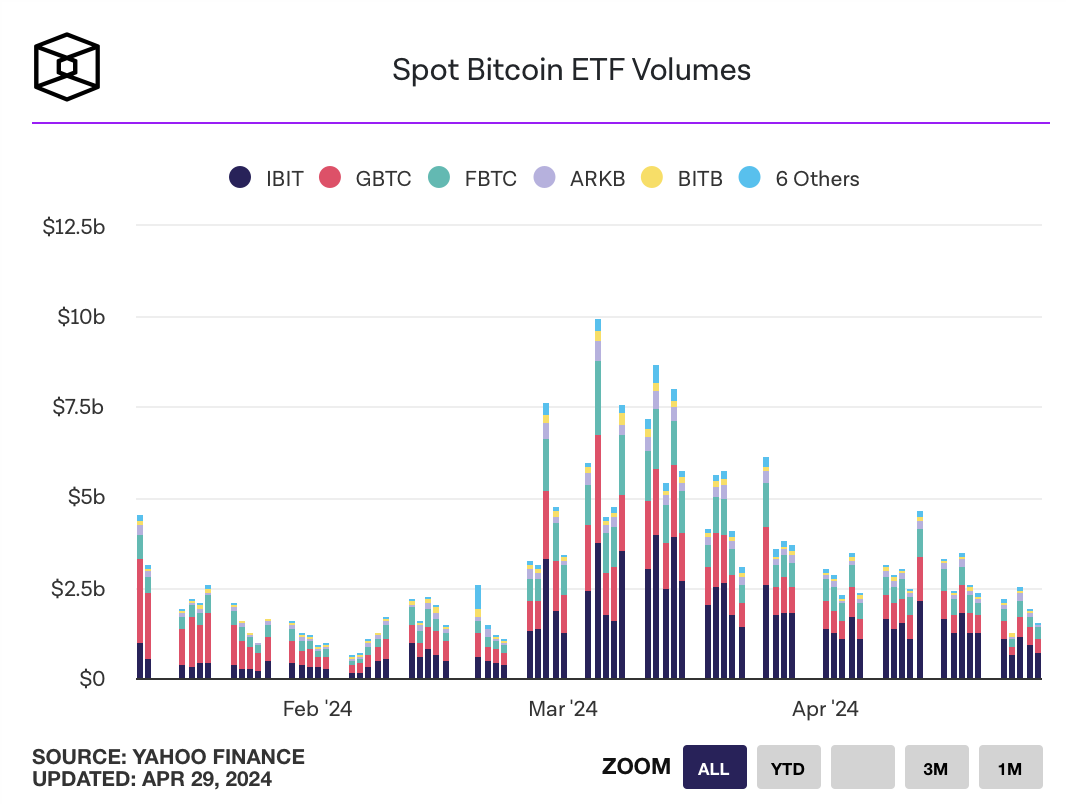

Despite recent net outflows, US spot Bitcoin ETFs have cumulatively gathered about $12 billion in net inflows since their regulatory approval and subsequent listing. However, trading volumes have been steadily declining since peaking on March 5.

Focus on Hong Kong’s ETFs

The cryptocurrency market’s attention is currently turned to the Asian market, particularly the Hong Kong Stock Exchange. Significant developments occurred with the listing and trading of six spot Bitcoin and Ethereum ETFs.

Hong Kong Exchanges and Clearing (HKEX) launched these ETFs, including Bosera HashKey Bitcoin ETF (3008.HK), Bosera HashKey Ether ETF (3009.HK), ChinaAMC Bitcoin ETF (3042.HK), ChinaAMC Ether ETF (3046.HK), Harvest Bitcoin Spot ETF (3439.HK), and Harvest Ether Spot ETF (3179.HK), in the early hours of the day.

Hong Kong Stock Exchange-listed ETFs indicate a significant expansion in the accessibility of cryptocurrency investment products in the Asian market. As investors worldwide navigate the evolving landscape of crypto investments, the emergence of such ETFs offers additional avenues for investing in cryptocurrencies, shaping the global investment environment.

Türkçe

Türkçe Español

Español