Bitcoin price set a new record of around $73,835 on March 14, then fell more than 8% in a week and 12% in the last 30 days. The decline in Bitcoin coincides with an inadequate response to the launch of spot Bitcoin and Ethereum exchange-traded funds in Hong Kong and rising stagflation fears in the US.

Shocking Prediction for Bitcoin

Bitcoin, reached all-time highs before the halving event, displaying unprecedented price movements by 2024. This has led market participants to wonder whether the flagship cryptocurrency has reached its peak. Currently, Bitcoin’s price is trading 17% below its all-time high and has fallen 7% since the halving event on April 20.

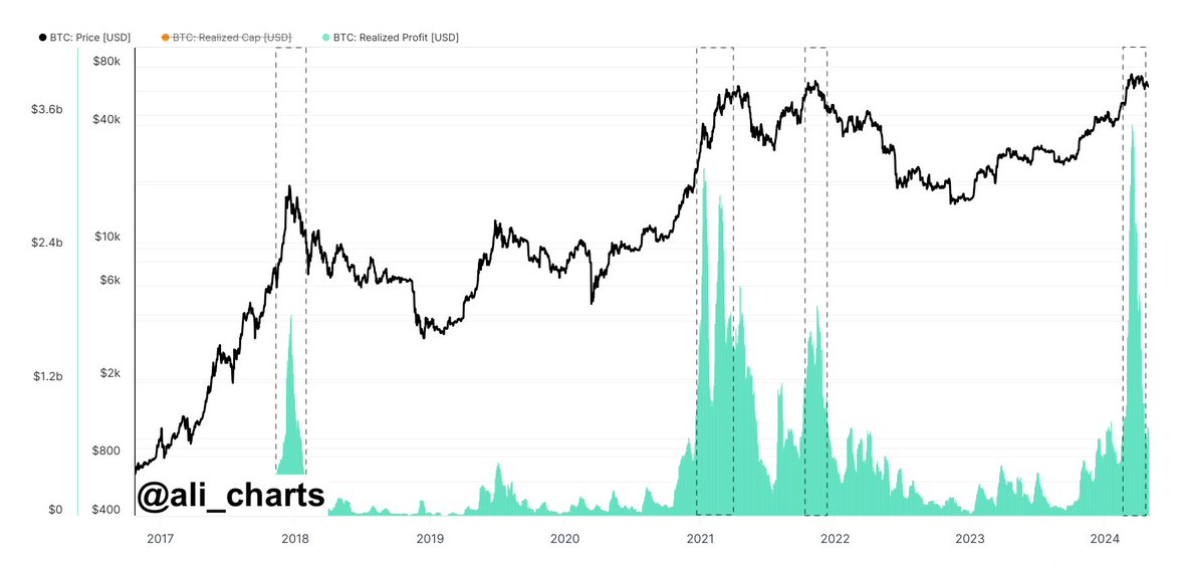

Independent investor and X user Ali, in his comment on X on April 29, tried to figure out whether Bitcoin’s price had reached the market peak. He compared the sudden rises in Bitcoin with previous halving cycles, noting that historically they coincided with market peaks.

Referring to Glassnode data showing that the profit realized when Bitcoin reached its all-time high on March 14 soared to $3.52 billion, Ali noted that similar levels were observed during the 2021 bull market. The investor mentioned waiting for another confirmation involving a sustainable close below the realized price of Bitcoin’s short-term holder before searching for the market peak:

“If the market peak is confirmed, Bitcoin’s price could drop to $51,530, even $42,700!”

Notable Statements from a Famous Figure

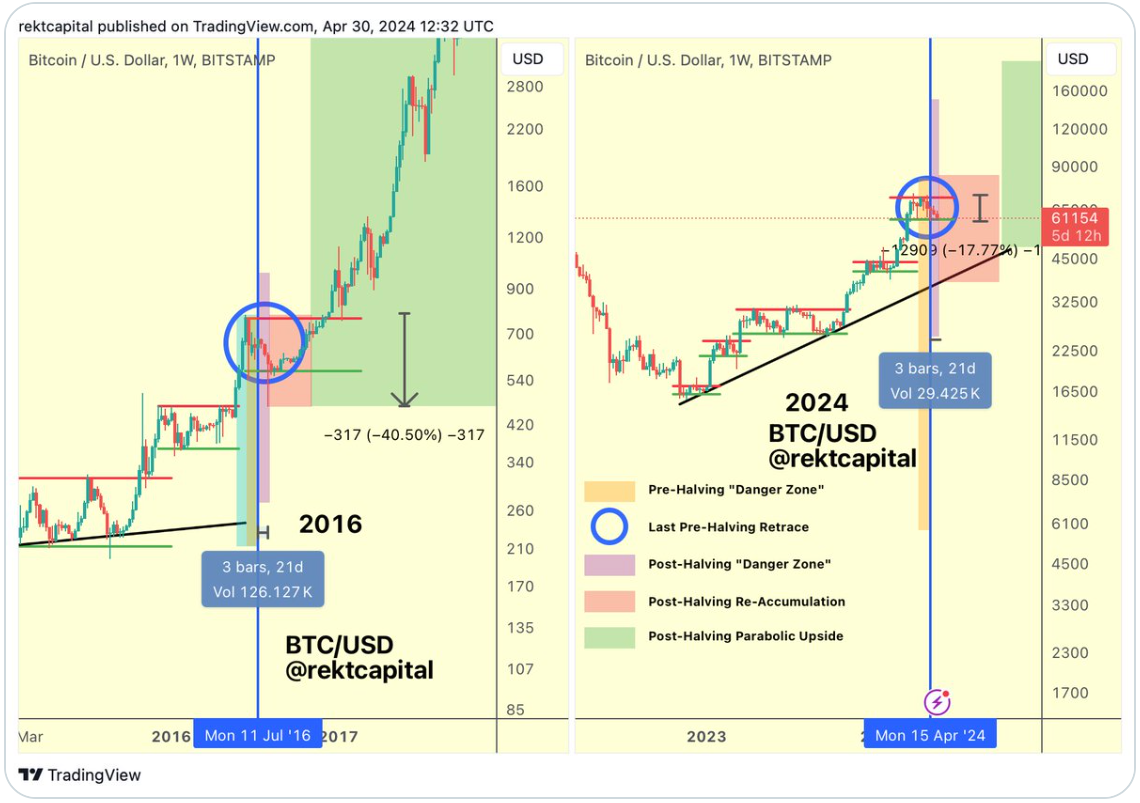

Bitcoin, challenged its history by declining after the 2024 halving event, but independent analyst Rekt Capital argued that the declines remain an essential part of the classic bull market setup. He compared the current Bitcoin cycle with previous halvings in a chart uploaded to X and stated that the price behaved exactly the same, even producing a negative wick below the low range level.

According to Rekt Capital, Bitcoin’s price is currently in a re-accumulation range that typically develops before the halving and forms a large part after the halving:

“The current target is for Bitcoin to move sideways to breathe and calm the market after the fantastic price performance before the halving.”

Türkçe

Türkçe Español

Español