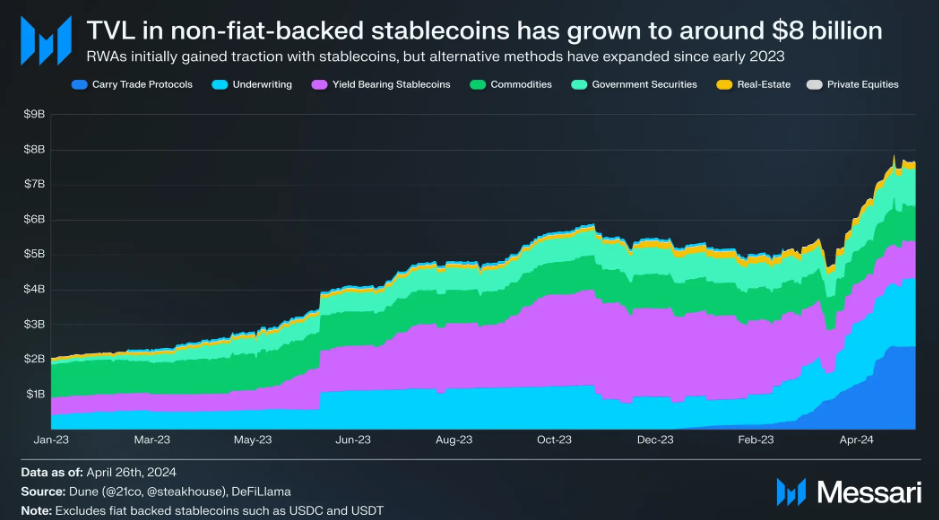

Blockchain analysis firm Messari‘s latest report indicates that the total value of real world asset (RWA) tokenization protocols has reached approximately $8 billion, marking a nearly 60% increase since February. This significant rise highlights the massive growth in the sector and the increasing importance of RWA protocols in the financial ecosystem.

Significant Revival Noted in RWA Protocols

According to Messari, RWA protocols experienced a significant revival last year, becoming a preferred choice for debt-based and high-yield investments. However, Messari’s data shows that this $8 billion in total value locked (TVL) does not include fiat-backed stablecoins.

Specifically, RWA protocols have grown by about 60% since February. Although the total RWA TVL is around $6 billion according to decentralized finance analysis platform DeFiLlama, the growth rate in this sector is quite impressive. Since the beginning of 2023, the protocol TVL has recorded an increase of over 700%.

Increase in Active User Count as Well

This growth is not limited to the total locked value. According to Dune Analytics, the number of active users in RWA protocols has also increased. Protocols such as the digital carbon market platforms Toucan and KlimaDAO, and the real estate tokenization protocol Propy, have largely contributed to this increase.

In addition to the increase in active users, tokenized treasury bonds have also shown remarkable growth. In the environment of high inflation and interest rates in the US, the yields on these bonds have remained high, supporting growth in this area. According to RWA.xyz, there is currently $1.29 billion worth of tokenized US treasury bills and bonds. This figure has increased by about 80% since the beginning of 2024, influenced by protocols like Securitize and Ondo.

RWAs Could Shape the Future

Lastly, the growth of the RWA market has been significantly influenced by BlackRock’s Ethereum-based Corporate Digital Liquidity Fund (BUIDL) and the Franklin OnChain US Government Money Fund (FOBXX). The performance of these funds has contributed to the sector’s growth, further enhancing the importance of RWA protocols.

All this data demonstrates the increasing popularity of real world asset tokenization protocols and their growing importance in the financial ecosystem. The substantial growth since February indicates that the sector is rapidly expanding, with more innovations and opportunities likely to emerge in the future.

Türkçe

Türkçe Español

Español