In the US, the excitement surrounding spot Bitcoin exchange-traded funds (ETFs) largely faded in April, coinciding with a significant drop in the price of the largest cryptocurrency, ending the month with a total net outflow of $343.5 million. This marked the end of a three-month inflow streak for nine new spot Bitcoin ETFs.

Spot Bitcoin ETFs’ April Report Card

In the US, nine spot Bitcoin ETFs saw heavy demand in January, February, and March with inflows of $1.5 billion, $6 billion, and $4.6 billion respectively. However, after a peak daily inflow of $1.05 billion on March 12, Bitcoin’s price dropped 18% from an all-time high of $73,836 on March 14 to the end of April, significantly reducing inflows into ETFs.

In April, the Grayscale’s high-fee GBTC fund led the outflows with $2.5 billion throughout the month. Ark Invest’s ARKB saw a net outflow of $86.3 million, while Valkyrie’s BRRR experienced a minor net outflow of $0.3 million. Despite these outflows, Fidelity’s FBTC and Bitwise’s BITB faced initial daily outflows but overall saw net inflows in April.

BlackRock‘s IBIT emerged as the dominant player among spot Bitcoin ETFs in terms of net inflows, seeing $1.5 billion in April. IBIT was followed by Fidelity’s FBTC with a net inflow of $556.1 million and Bitwise’s BITB with $125 million. However, IBIT’s 71-day inflow streak ended on April 23, followed by five consecutive days of zero fund inflows. Ark Invest’s ARKB was the only spot Bitcoin ETF to see a net inflow on April 30, with a reported $3.6 million.

IBIT Prepares to Overtake GBTC

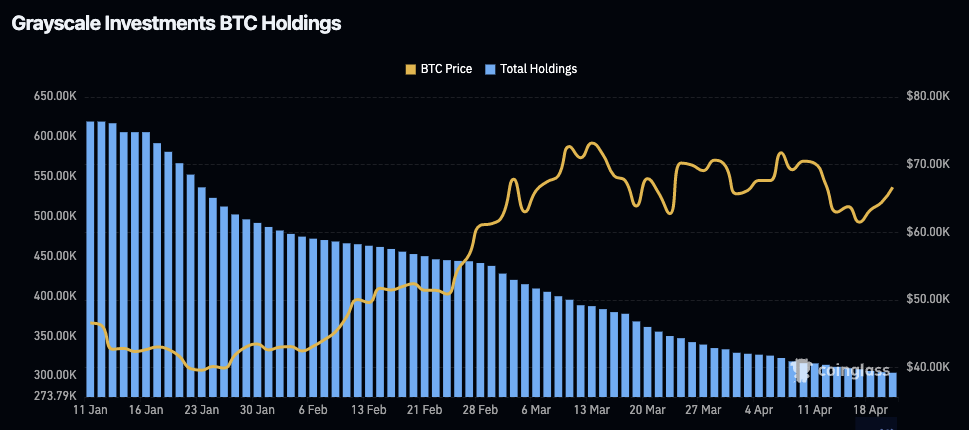

Despite a recent series of zero flows, IBIT appears poised to surpass GBTC in terms of assets under management (AUM). IBIT currently holds 274,462 BTC ($15.6 billion) in AUM, rapidly approaching GBTC’s 296,714 BTC ($16.9 billion).

Since the start of spot Bitcoin ETF trading, the converted GBTC spot ETF has faced a 52% decrease in AUM, while the rise in Bitcoin’s price resulted in a 41% decrease in the dollar value of the fund’s AUM.

Türkçe

Türkçe Español

Español