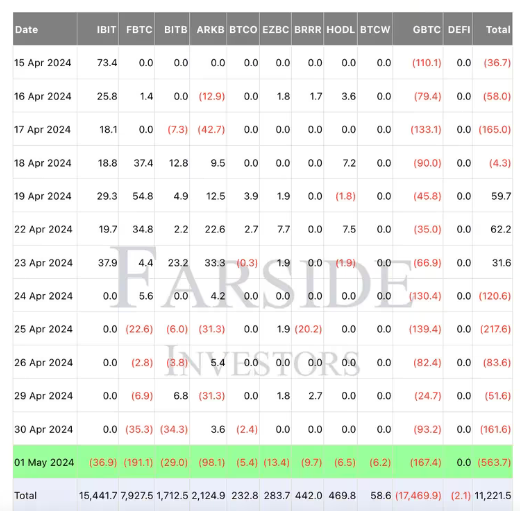

Fed Chairman Jerome Powell’s dismissal of interest rate hikes did not prevent notable market activity on Wednesday as investors exited U.S.-based Bitcoin (BTC) exchange-traded funds (ETFs). According to data from Farside Investors and CoinGlass, 11 ETFs suffered the largest total net outflow since they began trading on January 11, amounting to $563.7 million. Investors have pulled approximately $1.2 billion from ETFs since April 24.

Fidelity Leads Record Outflows

Fidelity’s FBTC led the outflows, losing $191.1 million on Wednesday. This could raise concerns about FBTC and BlackRock’s IBIT consistently drawing funds in the first quarter and regularly offsetting large outflows from the relatively costly Grayscale ETF (GBTC).

On Wednesday, GBTC recorded a significant performance with an outflow of $167.4 million, marking it as the second-largest outflow. It was followed by ARKB and IBIT with outflows of $98.1 million and $36.9 million, respectively. Powell’s notably dovish approach allowed risky assets, including Bitcoin, to find a base, though other funds also experienced losses. A dovish stance means the central bank prefers supporting employment and economic growth over tightening liquidity excessively.

Emphasis on Inflation Figures

The Fed decided to keep the benchmark interest rate between 5.25% and 5.5% on Wednesday, which was in line with general expectations. Powell highlighted that the economy was strong enough not to trigger new interest rate hikes or liquidity tightening fears despite recently disappointing inflation figures.

The Fed also announced it would significantly reduce its alternative liquidity tightening program known as quantitative tightening (QT) starting in June. The U.S. Treasury also announced a program to repurchase billions of dollars of government debt in the bond market for the first time in over twenty years to increase liquidity.

Bitcoin Also Has Sensitive Points

Like other risk assets, Bitcoin is sensitive to expected changes in liquidity conditions. Following Powell’s comments, BTC witnessed a brief rally from $56,620 to $59,430. Along with the dollar index, yields on 10-year and two-year Treasury bonds also fell.

However, BTC’s jump was short-lived, and Bitcoin fell back to $57,300 at the time of writing. Earlier this week, Asia’s first spot Bitcoin and Ethereum (ETH) ETFs were launched in Hong Kong with low volumes, negatively affecting the crypto market atmosphere.