According to a Messari report, Polkadot (DOT), made significant progress in the first quarter of 2024, achieving a record increase in daily active addresses. During this period, DOT’s market value, revenue, and Cross-Consensus Message Format (XCM) activity saw noteworthy developments.

Increase in DOT’s Market Value

Firstly, DOT’s market value rose by 16% to $12.7 billion compared to the last quarter of 2023, although it is still 80% below its all-time high. In terms of revenue, there was a 2,880% increase to $2.8 million compared to the last quarter of 2023. However, significant declines in revenue metrics were observed in the first quarter of 2024. This indicates that Polkadot tends to have relatively low revenue compared to its competitors due to its structural design.

XCM activities followed a positive course. Daily XCM transfers increased by 89% to 2,700, while non-asset transfer use cases known as “XCM other” increased by 214% to an average of 185 transfers per day.

Additionally, the total number of daily XCM messages increased by 94% to 2,800, while the number of active XCM channels increased by 13% to a total of 230. These developments can be considered a positive indicator of Polkadot’s dynamic ecosystem and the adoption rate of XCM.

Bullish Signal for Polkadot Price

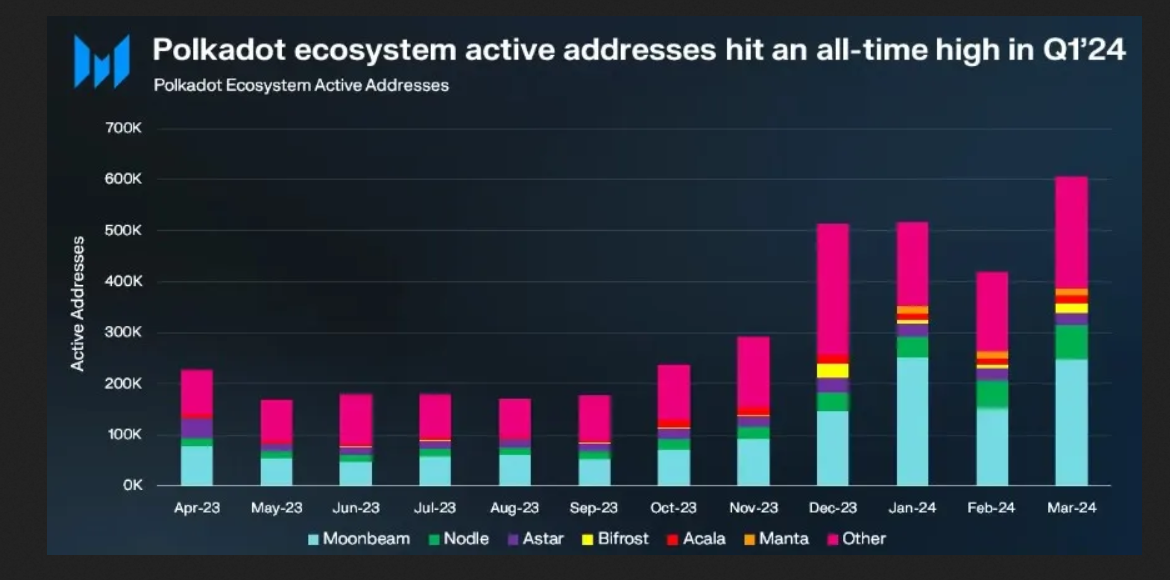

The first quarter of 2024 started impressively for Polkadot’s parachains, reaching unprecedented levels in active address count. With 514,000 active addresses, this period marked a significant 48% growth, reaching the highest level in history.

Moonbeam maintained its position as the leading parachain with a strong 110% increase to 217,000 monthly active addresses compared to the previous quarter. Nodle closely followed, doubling to 54,000 monthly active addresses. Particularly, the Manta Network stood out in the first quarter of 2024, showing a significant increase in daily active addresses, reaching 15,000.

In terms of price performance, Polkadot’s native token, DOT, saw its highest level of the year at $11 on March 14, followed by a sharp decline to $5.8. However, it recently started regaining its upward trend. Last week, DOT rose by 7% to $7.20, although its trading volume in the last 24 hours saw a slight decrease of 4.7% to $320 million compared to the previous session.

If the upward trend continues, the $7.4 region for Polkadot will be the first resistance point before potentially retesting the $8 resistance barrier. On the other hand, the $6.4 support level was successfully tested two days in a row this week, emerging as a crucial level for upward movement expectations.