Following the recent surge in cryptocurrencies, attention has shifted to market analysts. The general sentiment among these analysts appears to be optimistic about the rise. In this context, a well-known cryptocurrency analyst mentioned that it is time for altcoins to rise, and a major memecoin will benefit from this situation.

Market and DOGE Analysis by the Analyst

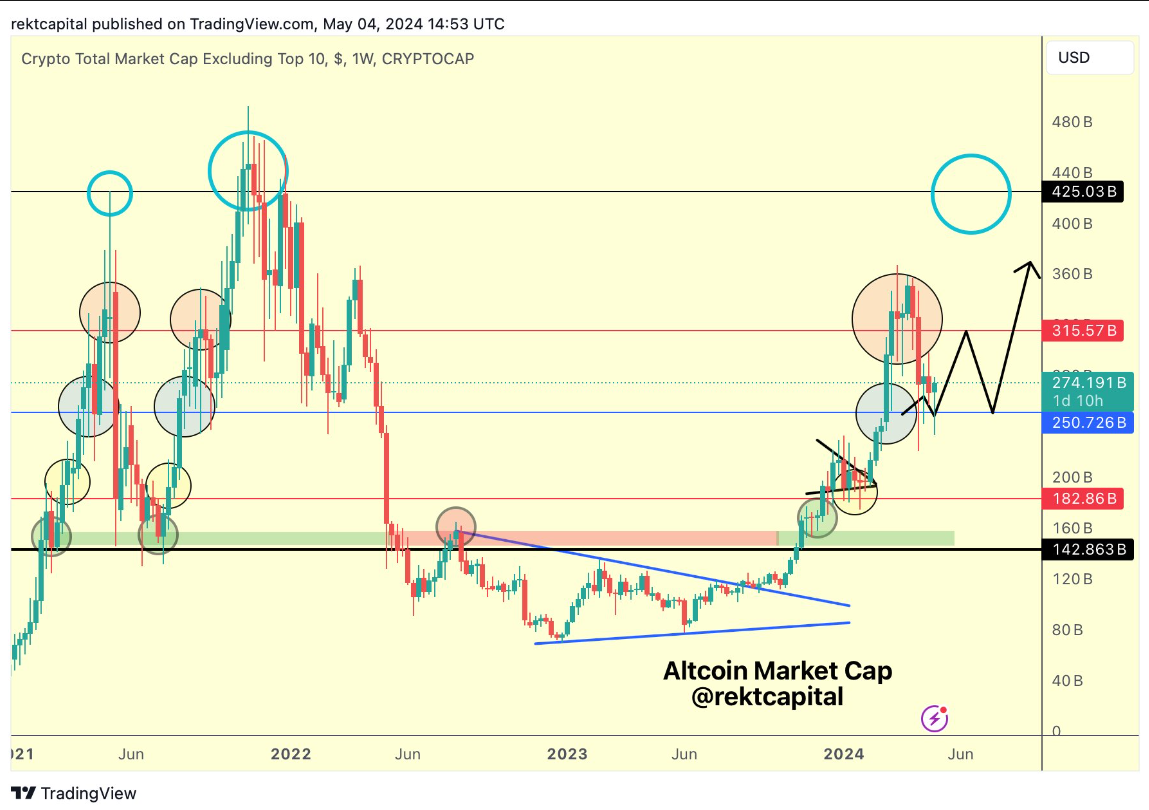

Rekt Capital, an analyst, informed his thousands of followers on social media platform X that the market value of all cryptocurrencies, except the top 10, is likely to rise above $250 billion as shown in the OTHERS chart.

The analyst points to the chart he shared, stating that the first target is the $315 billion level before reaching the old high at $325 billion.

The Altcoin Market Value still holds $250 billion as support, positioning itself for an upward movement through the black path.

On the other hand, examining one of the leading meme coins, Rekt Capital confirmed a strong macro bullish outlook after successfully retesting the $0.12 level for Dogecoin (DOGE).

Looking at the chart shared by the analyst (below), the next notable resistance level is between $0.20 and $0.278.

Dogecoin, after successfully retesting the combined support area of the blue Macro Downtrend and the black Low Range (orange circle area), achieved a +30% recovery. The Macro Downtrend has ended, fully confirming the new Macro Uptrend.

As of the time of writing, DOGE was finding buyers at $0.1557 after a 3.43% drop, while its market cap had fallen to $22.4 billion.

The 24-hour trading volume saw a 5% increase, reaching $1.7 billion, which could also be interpreted as growing investor interest.

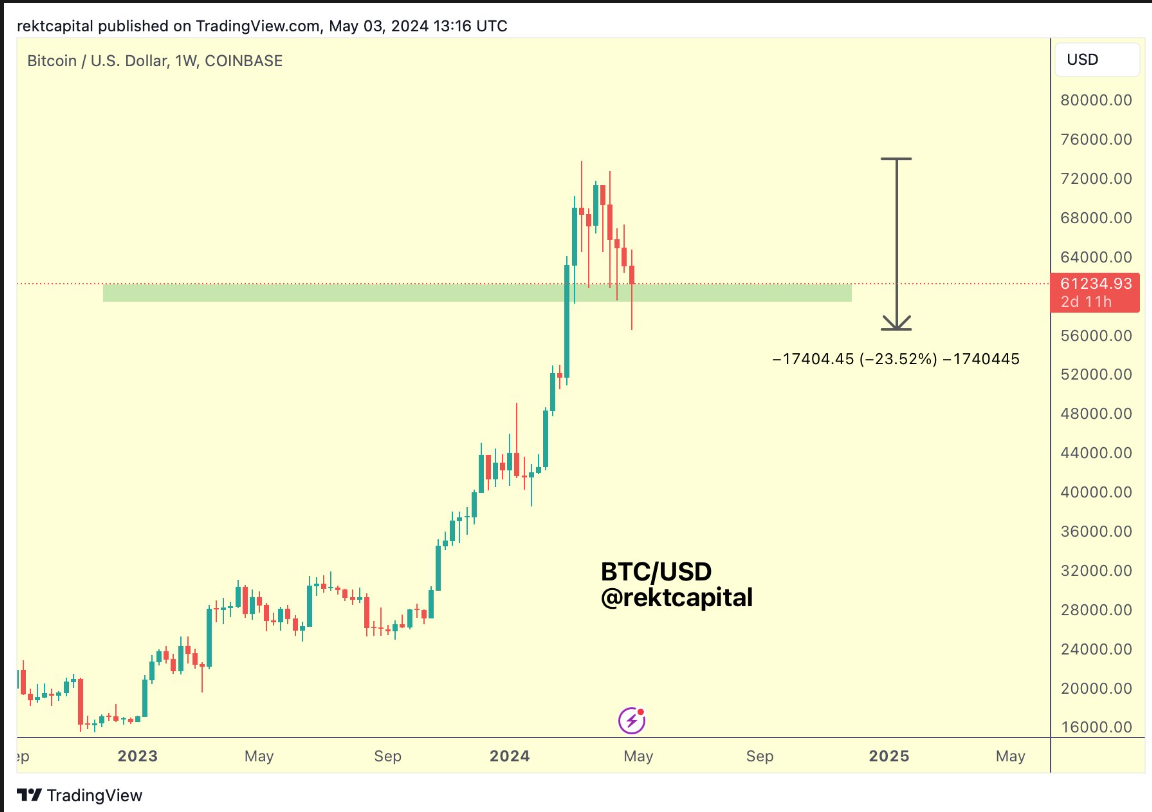

Bitcoin Dollar Chart

On the other hand, the analyst also commented on Bitcoin (BTC), highlighting a strong support at the potential $60,000 level for BTC, which is at the peak of cryptocurrencies.

It appears to be just a downward wick. Weekly closures like this will confirm this liquidity pool as a safe support.

As of the time of writing, BTC continues to trade around the $63,372 area, approximately 6% above the support level mentioned by the analyst.