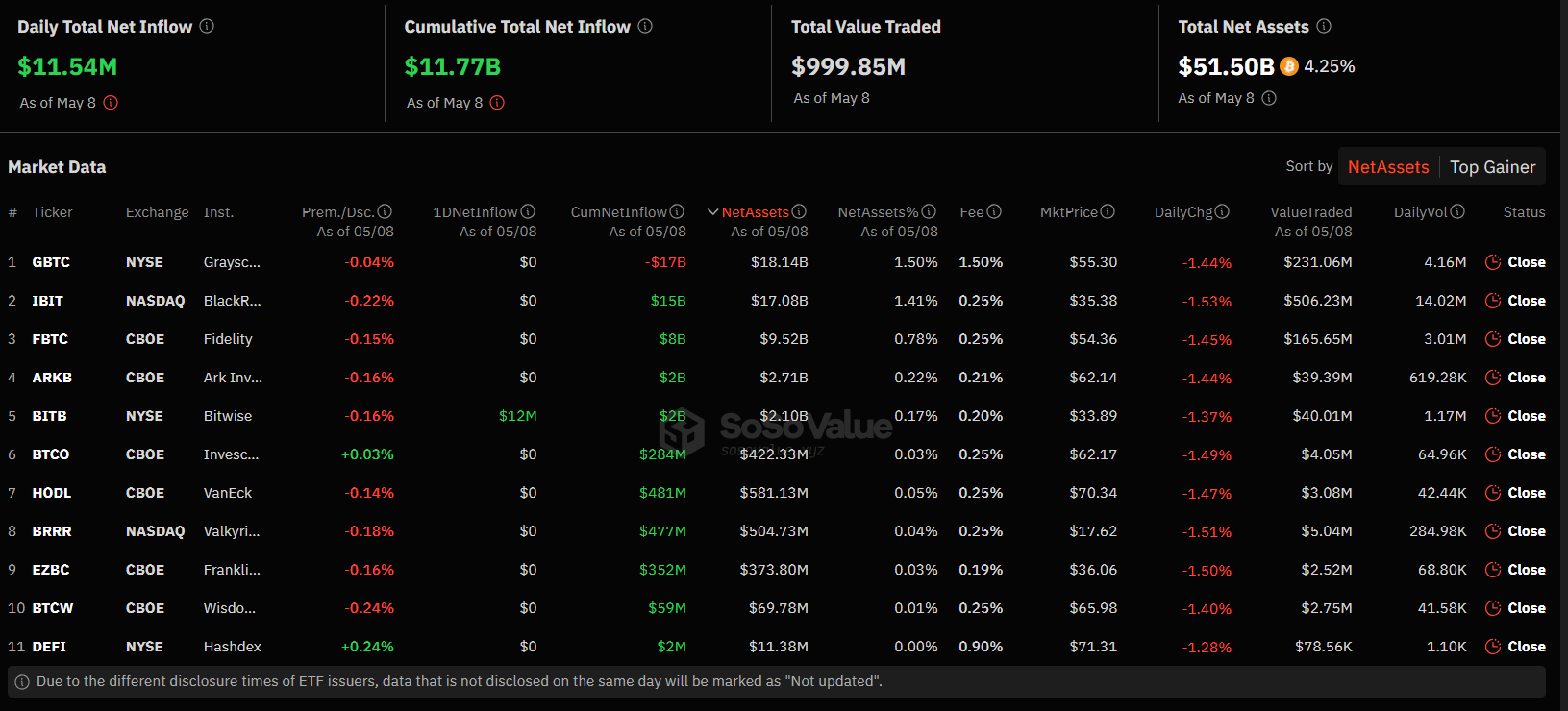

According to recent data, yesterday only the Bitwise Bitcoin ETF recorded a net inflow among spot Bitcoin ETFs. There was no net outflow in Grayscale’s Bitcoin Trust. Spot Bitcoin exchange-traded funds in the United States saw net inflows yesterday following no net inflow or outflow in Grayscale’s Bitcoin Trust. This situation was noted as a significant movement in the market.

Bitwise Bitcoin ETF Records Record Inflows Yesterday

Since being converted into a spot Bitcoin ETF, Grayscale’s GBTC has generally experienced heavy outflows that suppressed inflows into other products. However, no change was observed in this situation as of yesterday. According to SoSo Value data, there was approximately $17 billion in net outflows.

On the other hand, apart from the Bitwise Bitcoin ETF, which saw about $12 million in inflows yesterday, no other Bitcoin ETF recorded net inflows. This indicates that a particular ETF is standing out in the market.

Spot Bitcoin ETFs in the US have seen a cumulative net inflow of $11.77 billion since their listing. However, volumes have been steadily declining since reaching a peak in early March. This highlights a shift in market dynamics.

Other Significant Developments in the Sector

Other significant developments related to crypto ETFs include Grayscale’s withdrawal of its proposal to list and trade shares of its Ethereum futures ETF. Additionally, the Securities and Exchange Commission’s decision to delay its ruling on spot Ethereum ETFs is also noteworthy in the sector.

In light of all this data, it is important to monitor the activity of crypto ETFs, especially Bitcoin ETFs, and the changes occurring in the market. Investors should act by assessing the opportunities and risks arising from these dynamics. On the other hand, the current state of the cryptocurrency market continues to be a concern for investors.

Looking at the Bitcoin price, BTC is trading at $61,390, having fallen to $60,888 during the night. Ethereum is trying to overcome the $3,000 resistance, currently at $2,985.

Türkçe

Türkçe Español

Español