Dogecoin was rejected from the local resistance zone at $0.165, which was also the highest level of the trading range in April. Since the peak level on May 6, Monday, DOGE has recorded a 12% loss.

Dogecoin Analytical Report

A recent analysis report indicates that a significant portion of Dogecoin holders are still in profit. The recent market retreat has been deep, reversing all gains made in the latter half of March. However, the selling pressure from these holders is not as severe as feared.

The cryptocurrency‘s price fell below $0.2, turning the level into resistance since April. There have been increases in social dominance, but social volume has remained largely unchanged. This does not indicate an upward trend, but it shows that Dogecoin’s presence on social media is at least consistent. Looking at on-chain metrics, we see a significant drop from the highest levels of daily active addresses in February, consistently low for the last six weeks.

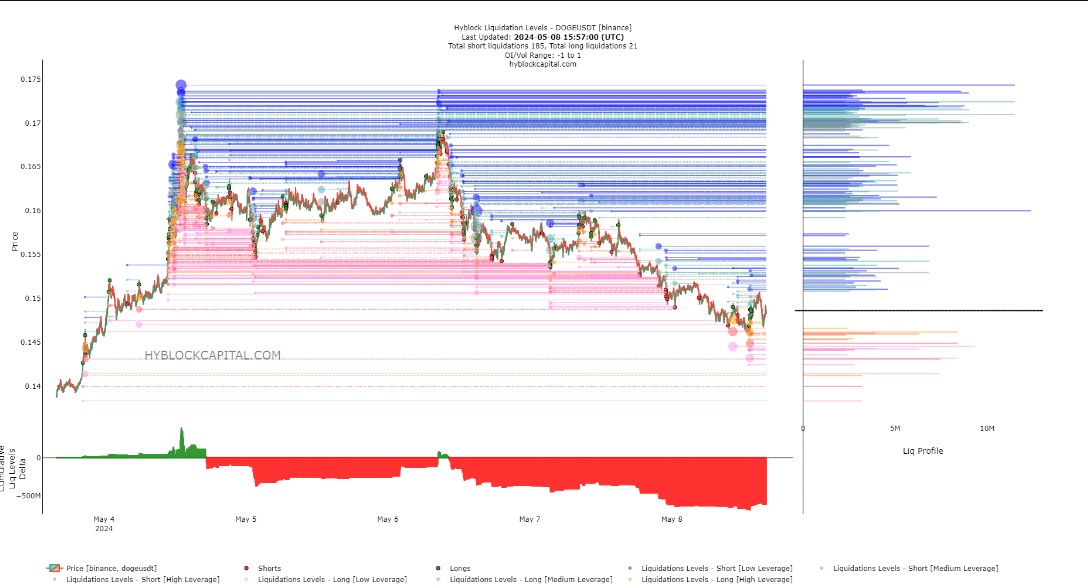

DOGE Liquidations

This situation was a sign that addresses were not engaging in transactions, indicating a decrease in demand. The transaction volume was relatively consistent in the first half of April. Since then, there has been a dramatic drop towards the end of the month. There has been some recovery in the last ten days, which was encouraging but does not signify a bullish trend for the token.

Inactive circulation saw a significant increase on April 26, likely indicating a large amount of tokens being transferred, possibly for sale. Since that time, the metric has remained quiet, signaling a reduction in selling pressure. The total liquidation levels delta was quite negative, showing that short liquidations significantly outweighed long liquidations. Consequently, we might expect prices to rise further to eliminate the indicated liquidations, which could occur after removing the nearest liquidity pockets at $0.147 and $0.144. For this reason, we might see a movement towards the $0.144 liquidity cluster followed by a short-term rise to $0.155-$0.16.

Türkçe

Türkçe Español

Español