This year, following a significant bull run, the cryptocurrency market may have entered a consolidation phase, but Pepe (PEPE) stands out as a notable player with significant accumulations that have caught investors‘ attention. On-chain data reveals that market participants purchased approximately 650 billion PEPE in the last 24 hours, creating optimism about the altcoin’s future price movements.

Investors Accumulate PEPE

Despite facing a sharp decline earlier this year, PEPE surged from a low of $0.0000009 to a high of $0.0000099 in March, challenging the overall market trend and fueling rumors of a potential correction. Indeed, a correction occurred to some extent. However, recent accumulations potentially by whales or investors reached trillions, increasing curiosity about PEPE’s future price trajectory.

According to data from the on-chain data platform LookOnChain, investors bought a total of 649.16 billion PEPE in the last 24 hours, with four unknown wallet addresses predominantly accumulating large amounts from cryptocurrency exchanges.

Particularly, one wallet address withdrew 350 billion PEPE worth $3.44 million from the leading cryptocurrency exchange Binance. This wallet address is known for its expertise in swing trading, profiting $2.66 million from trading PEPE. Meanwhile, other wallet addresses also made significant purchases, contributing to the optimism surrounding PEPE’s potential rise.

Current State of the Altcoin

Despite ongoing strong accumulation trends among wallet addresses, PEPE’s price experienced significant fluctuations in the last 24 hours. At the time of writing, the altcoin’s price has slightly decreased by 0.27% to $0.00000867, and the price chart shows trading activity in both red and green zones. Moreover, the lowest and highest levels of the last 24 hours reflect a period of horizontal trading that mirrors the market’s uncertainty.

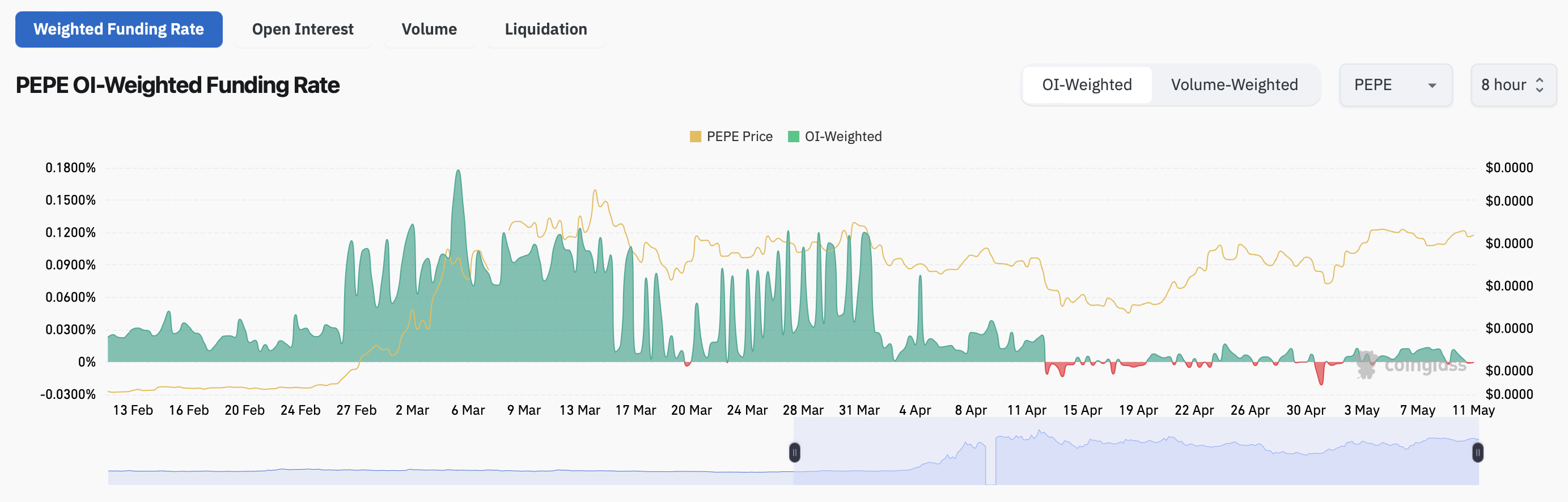

The example of a whale-level wallet address purchasing approximately 350 billion PEPE indicates increased optimism about the altcoin’s future price movements. This accumulation trend shows buying pressure for the altcoin against the general market trend. Moreover, data from Coinglass shows an increase in PEPE’s open interest (OI) and a slight decrease in derivatives volume, potentially contributing to short-term volatility. Nevertheless, especially considering Bitcoin’s recent block reward halving and significant accumulations observed in recent days, market sentiment remains optimistic about PEPE’s long-term prospects.