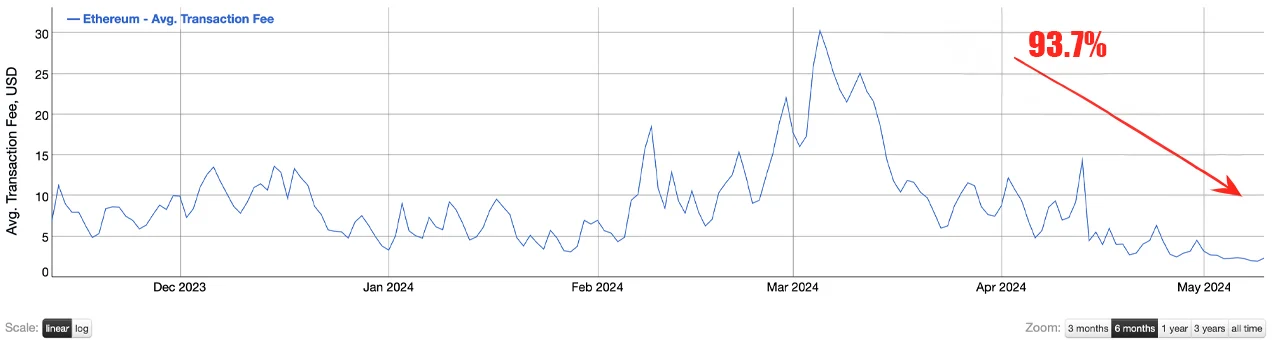

Bitcoin and Ethereum networks have recently seen a significant decrease in transaction costs. Since March 5, 2024, over the past 68 days, Ethereum’s network fees per transaction have plummeted from $30.33 to $1.91, marking a 93.7% decrease. This week, it has become notably cheaper to conduct transactions on the Ethereum blockchain network, as reported by Bit Info Charts.

Ethereum Transaction Fees Decline

Ethereum‘s ecosystem now averages a cost of approximately 0.00065 ETH or $1.91 per transaction. Additionally, according to data gathered by Etherscan’s gas tracker service, a basic ETH transfer currently costs between 4 to 7 gwei, or $0.18 to $0.37 per transfer.

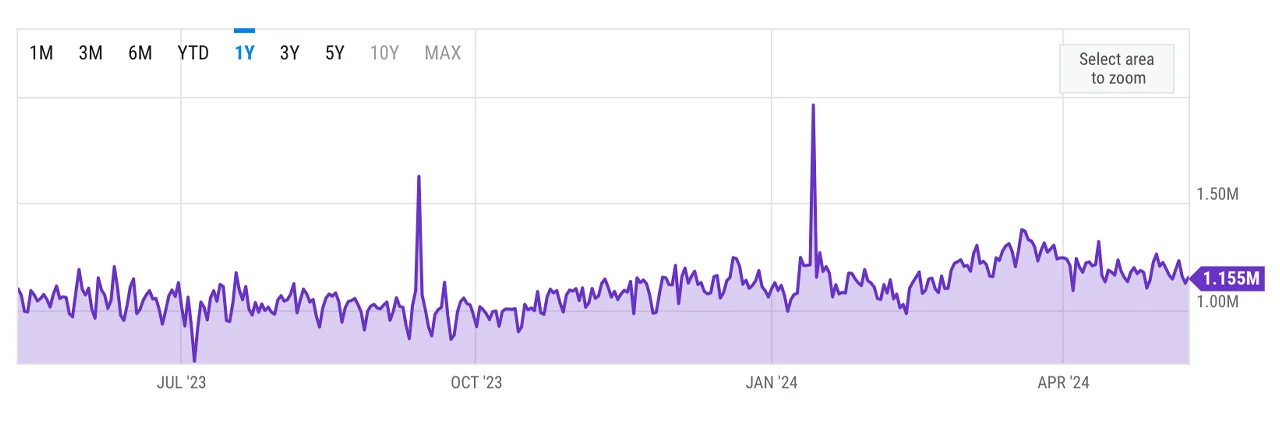

This weekend, the cost of conducting a decentralized swap on Ethereum ranged between $4.16 and $7.28, while executing an NFT sale varied from $7.03 to $12.31. Over the last 50 days, Ethereum has processed just over one million transactions daily. The busiest day was March 22, 2024, with 1.324 million transactions, and the slowest was April 4, 2024, with 1.091 million transactions. The average daily transaction count during this period was approximately 1.212 million.

What’s Happening in the Ethereum Ecosystem?

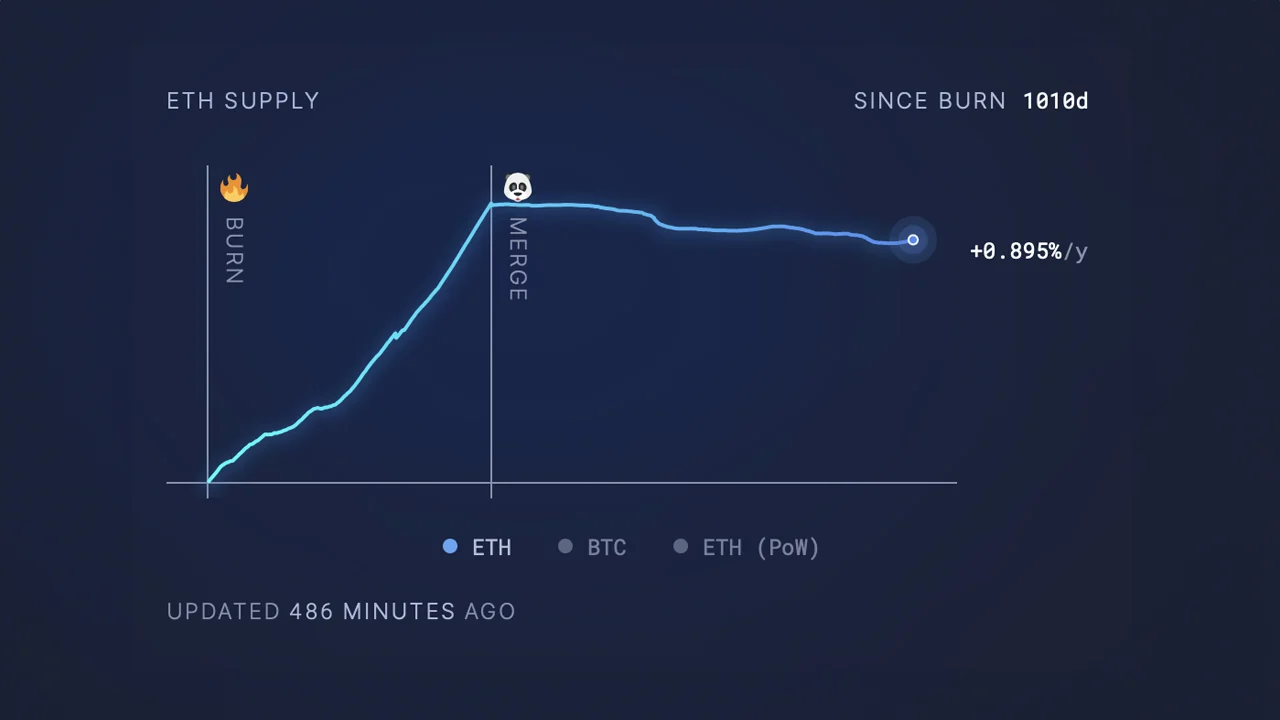

According to Ultrason money’s figures, Ethereum is currently experiencing an annual inflation rate of 0.895%. However, if Ethereum had not transitioned from the proof of work (PoW) system to the proof of stake (PoS) framework, the annual issuance rate under PoW would have been 3.923%. Additionally, it has been 1,010 days since the London fork upgrade on August 5, 2021.

The London upgrade primarily introduced Ethereum Improvement Proposal (EIP)-1559. This change transformed the transaction fee structure from the initial price auction model to a more stable base fee that is burned, permanently removing it from circulation. Since this implementation, 4.29 million ETH valued at $12.51 billion has been burned to date. While Ethereum passes through an inflationary phase, the low transaction fees are advantageous for users but create financial challenges for validators.

These discounted fees affect the economic incentives tied to network security. In comparison, Bitcoin has seen a hash power output of 100 exahash per second (EH/s) since its last halving event due to falling hash prices. This highlights the complex balance between ensuring affordability for users with adoption goals and providing adequate compensation for validators while improving Ethereum’s monetary policy and transaction cost structure.

Türkçe

Türkçe Español

Español