Analysts at Bernstein are quite optimistic about Bitcoin. Gautam Chhugani and Mahika Sapra, in a note sent to clients today, mentioned that Bitcoin’s price movement has been flat. However, the analysts do not believe this indicates a significant drop.

Expected Upward Movement in Bitcoin Price

According to analysts, with the growing interest in Bitcoin ETFs and increased allocations by institutional funds to asset platforms, an upward movement in Bitcoin’s price is expected.

Particularly, while expecting Bitcoin’s price range to stay between $50,000 and below $60,000, analysts believe the price will continue to rise with institutional adoption.

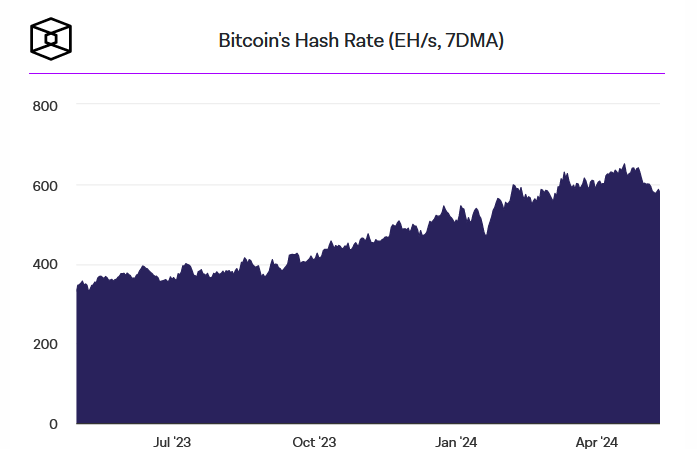

Bitcoin Mining Hash Power Drops After Halving

On Thursday, Bitcoin mining difficulty fell by 5.7%. This drop marks the largest negative adjustment since the lowest levels of the bear market when Bitcoin was trading around $17,000.

Bitcoin mining difficulty is a relative measure of how difficult it is to find a new block. It is automatically adjusted every 2016 blocks, approximately every two weeks, to accommodate changes in the number of miners.

For instance, when there is an increase in the number of miners, the Bitcoin mining difficulty also increases. Conversely, when the number of miners decreases, the protocol lowers the mining difficulty, making it easier for the remaining miners to discover blocks. This recent drop indicates a significant change in the level of mining difficulty.

Positive Outlook for Miners

Analysts state that weaker price support and nearly doubled costs post-halving have led to the shutdown of higher-cost mining equipment, resulting in a decrease in hash power.

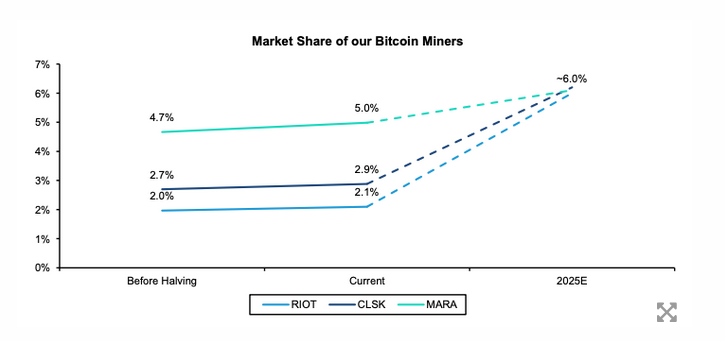

However, according to Chhugani and Sapra, despite a general decline in the total hash power of the Bitcoin network following the fourth halving event, publicly traded miners like Marathon Digital, Riot, and CleanSpark have seen a slight increase in market share by 0.2%. Considering their strong Bitcoin balances and cash positions, these miners are expected to further strengthen their market shares through organic growth and mergers/acquisitions.

Focus on Moves by Bitcoin Mining Companies

Analysts recently noted that CleanSpark has purchased approximately $20 million worth of three mining sites in Mississippi and agreed to buy two more sites in Wyoming for about $19 million. Marathon has also recently purchased new sites for approximately $265 million. Additionally, Riot is expanding its Corsicana site in Texas, aiming to triple its capacity.

Chhugani and Sapra finally commented:

“Overall, the temporary pause in Bitcoin price, limited hash power, aggressive capital expenditures by strong miners to increase their market share, and their merger/acquisition plans actually present a positive situation for low-cost Bitcoin miners. When Bitcoin price gains momentum, miners can achieve higher dollar revenues with higher production.”

Türkçe

Türkçe Español

Español