Toncoin’s (TON) price is attracting attention with notable gains, placing it among the best-performing assets. However, as close as TON is to achieving success, it is equally close to observing a decline after the rise. Toncoin’s price could see an all-time high in the coming days as the altcoin is close to breaking the previous one.

What’s Happening on the Toncoin Front?

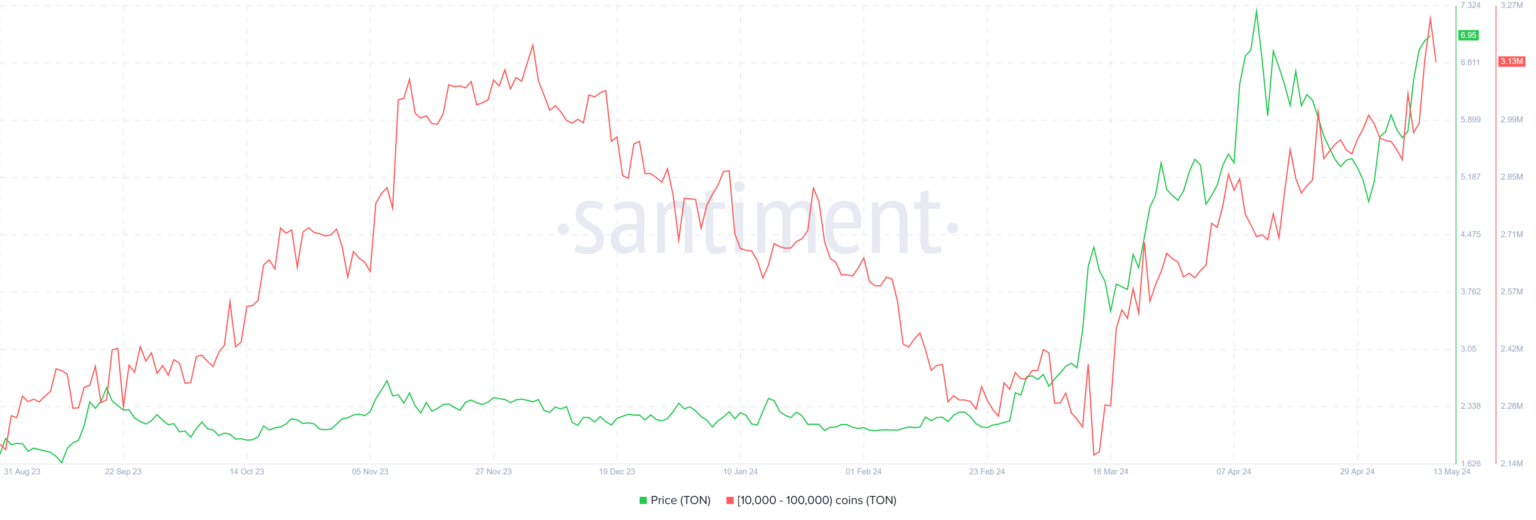

This rally is also being aided by whale addresses that have been continuously accumulating over the past week. More than 350,000 TON were added to addresses holding between 10,000 and 100,000 TON within five days. This supply of $2.5 million marks the largest buying wave noticed in a week since mid-March.

This indicates that large wallet holders are eagerly anticipating a new ATH level. However, this also means they might sell off when the $7.3 ATH is surpassed. The resulting decline could quickly pull back the altcoin’s price.

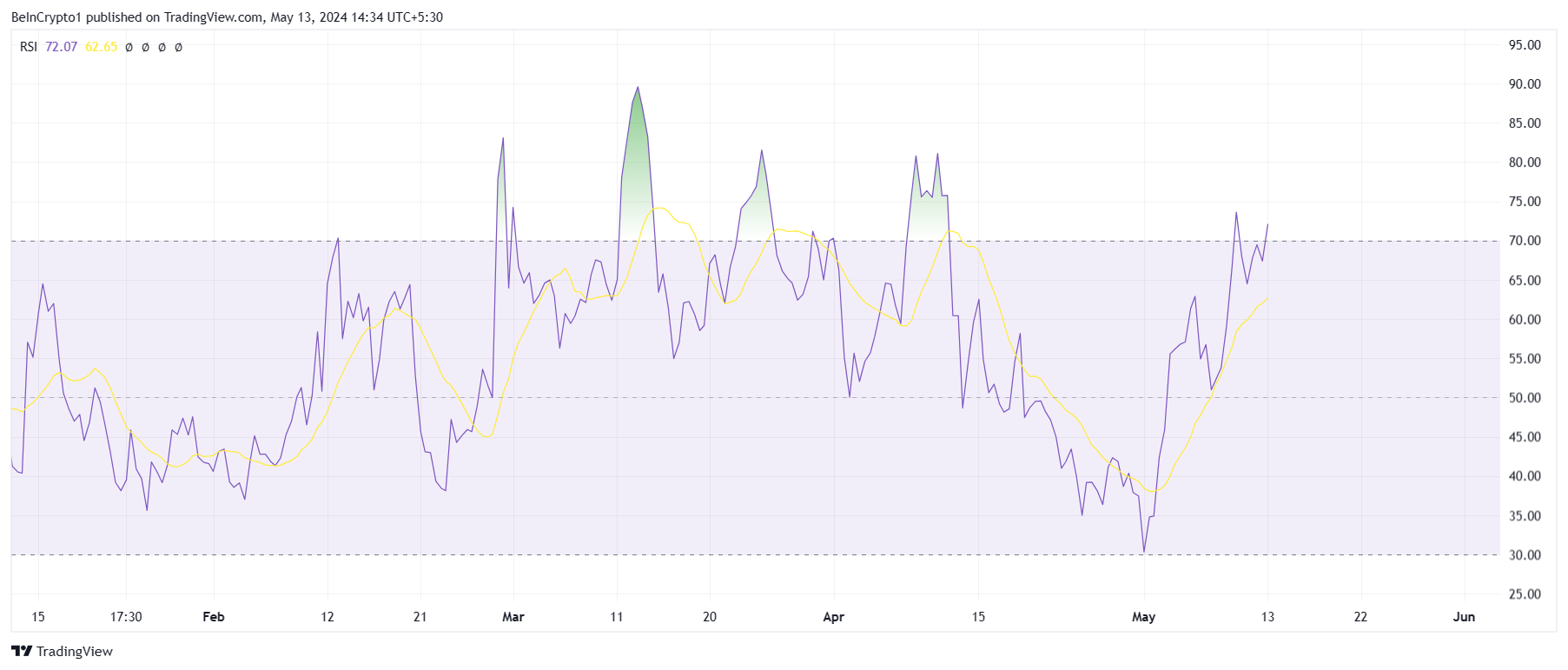

The same sentiment is observed in broader market hints from the Relative Strength Index (RSI). RSI, a momentum data, helps measure the speed and change of price movements and is used to identify overbought or oversold conditions in a market.

According to this data, TON appears visibly in the overbought zone, well above the 70 threshold. Historically, after a breach in this zone, the market cools down when a correction comes, but the rise continues for a day or two before it starts. If the same result occurs this time, Toncoin’s price could see an increase for another 48 hours before the decline begins.

TON Chart Analysis

Toncoin’s price was trading at $7.3 at the time of writing and was close to breaking the $7.6 resistance. This resistance marks the all-time high level for the altcoin, and TON is potentially on its way to rewriting it, given the conditions mentioned above. If the breach occurs and the rise continues, and TON holders refrain from selling, Toncoin’s price could reach up to $8.

However, if TON investors start profit-taking before creating an ATH, it may not be safe to notice corrections in the cryptocurrency, and this could invalidate the bullish thesis. The same could happen if the rise saturates the market. Consequently, Toncoin’s price could drop to $7 and even lower.

Türkçe

Türkçe Español

Español