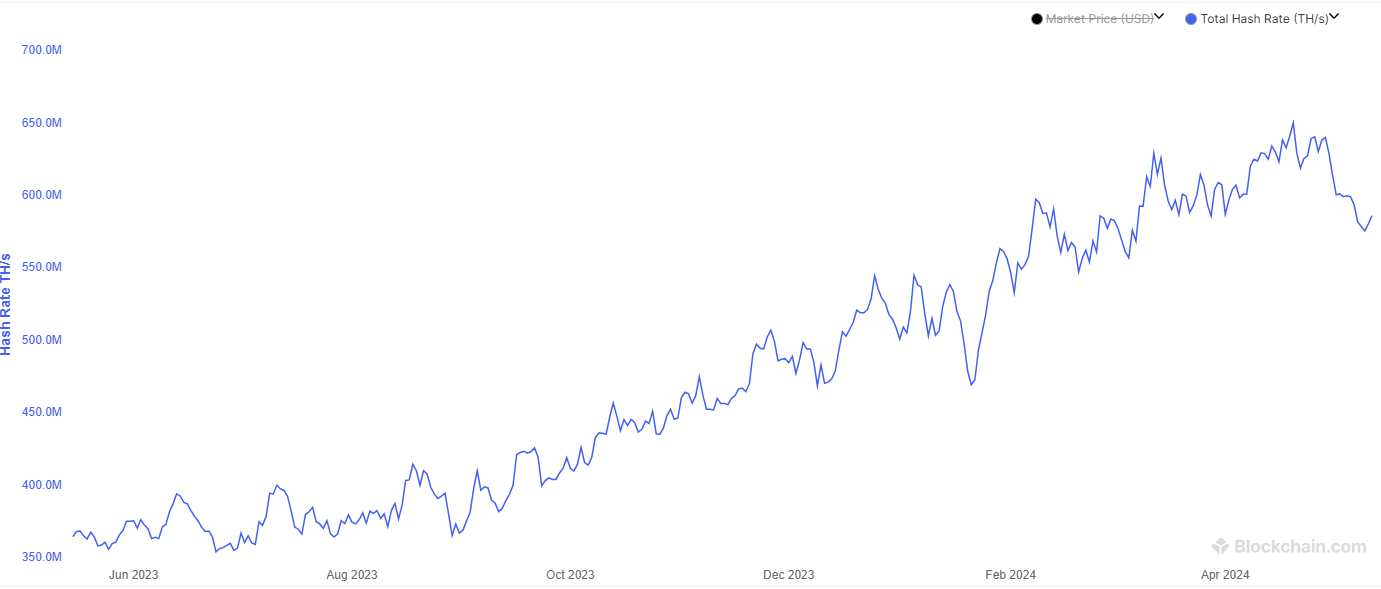

Bitcoin mining firms continue to shut down unprofitable platforms following the fourth Bitcoin halving event, causing a decline in the Bitcoin hash rate. According to Blockchain.com data, the Bitcoin network’s hash rate dropped to 575 exahash per second (EH/s) on May 10, the lowest in two months, before a slight recovery to the current 586 EH/s.

What’s Happening in the Mining Sector?

According to a May 13 post by CoinShares research head James Butterfill, the hash rate decline can be attributed to miners shutting down unprofitable platforms. CoinShares’ April 19 report had predicted this temporary drop, expecting the hash rate to rise next year. The report stated:

“Our model predicts the hash rate will rise to 700 exahash by 2025, but it could drop by 10% as miners shut down unprofitable ASICs post-halving.”

The report attributes the temporary decline to the increased costs of Bitcoin mining and rising electricity costs due to the halving:

“Key mitigation strategies include optimizing energy costs, improving mining efficiency, and securing favorable hardware supply conditions.”

Notable Remarks from a Prominent Figure

According to TeraWulf co-founder and COO Nazar Khan, only smaller mining operations with less energy-efficient equipment will be at risk after the 2024 halving process. In an interview, Khan stated:

“If you are a firm with just a group of machines and are not profitable, you will face challenges. A company with a quality infrastructure that can provide low-cost energy is a real asset, and if anything, the fundamental value of that asset has increased.”

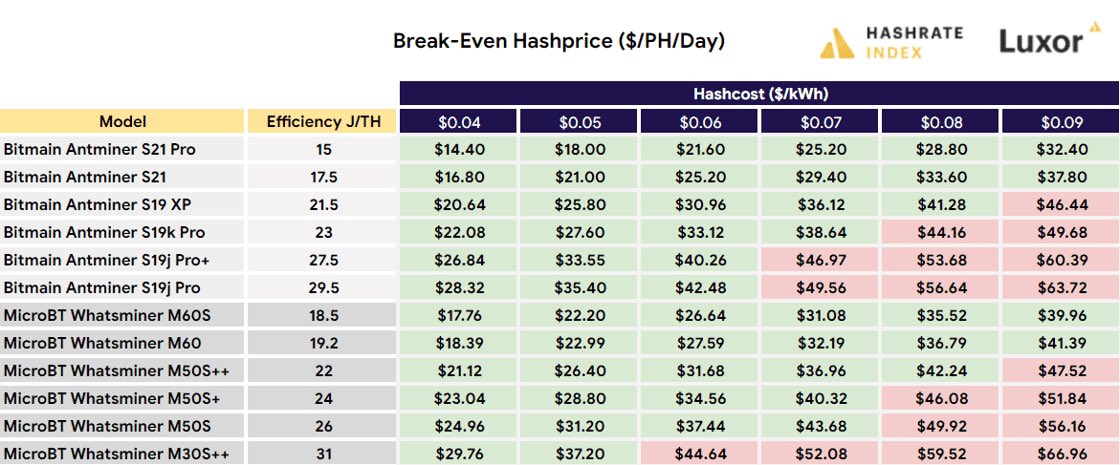

According to Companiesmarketcap, TeraWulf is the world’s eighth-largest Bitcoin mining company with a value exceeding $670 million and plans to further expand its mining operations this year despite the halving of block rewards. However, the profitability of mining operations largely depends on the cost of electricity paid by the companies. According to a May 2 post by the Hashrate Index, two older ASIC models, the S19 XP and M50S++, operate with electricity costs above $0.09/kWh:

“The S19 XP and M50S++ will operate at a loss if the hash cost exceeds $0.09/kWh. The M50S+ will be unprofitable at >$0.08/kWh, and the S19j Pro+, j Pros, and M30S++ will struggle at $0.06-0.07/kWh.”

Türkçe

Türkçe Español

Español