The altcoin Floki (FLOKI), named after Elon Musk’s Shiba Inu dog, is attracting investors with its potential for a significant price surge. Analysts, including market observer Crypto Faibik, predict a 180-200% increase in the medium term, drawing considerable investor interest with their price forecasts.

Gaining Attention with Descending Triangle Formation

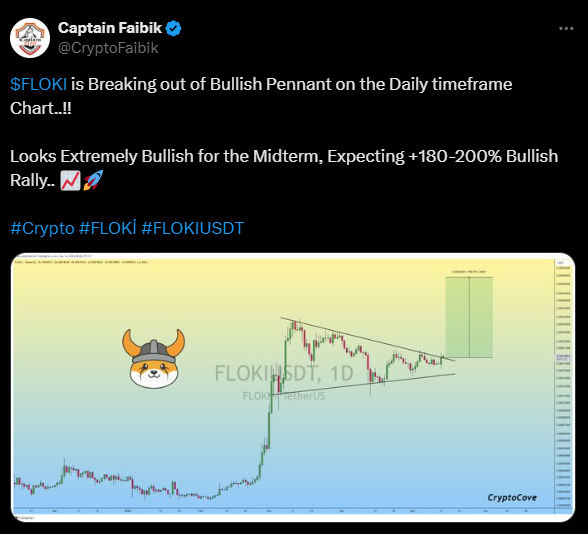

FLOKI’s price movement presents a promising setup. Following a significant rise in early February, FLOKI’s price entered a consolidation phase, forming a descending triangle formation. This formation includes lower highs and a stable support level around $0.00018863, indicating a potential breakout on the horizon.

Key technical levels and indicators provide additional insights into FLOKI’s price dynamics. The support level at $0.00018863 has consistently proven to be a strong foundation. Conversely, the descending resistance line connecting lower peaks indicates a decline in bullish momentum.

In a breakout scenario, the altcoin’s price could rise to a target of $0.00036601, representing an approximately 198.81% increase from the current support level. It’s important to note that while the descending triangle formation typically signals a bearish trend, a bullish expectation could indicate a potential shift in market dynamics.

Understanding the potential outcomes of FLOKI’s price movement requires considering market impacts and future trends. Successfully surpassing the descending resistance line could signal increased buying activity and a reversal of the bearish trend, fueled by positive market sentiment. On the other hand, if the altcoin’s price fails to stay above the $0.00018863 support level, it could face a strong pullback, disappointing bullish investors.

Current Status of FLOKI

At the time of writing, FLOKI is trading at $0.000192. The memecoin‘s 24-hour trading volume stands at $501.91 million, with a notable 10.47% increase in the last 24 hours.

Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Know Sure Thing (KST) indicators show mixed signals regarding the altcoin’s short-term trajectory. While RSI is in a neutral zone, MACD shows some upward momentum, and KST at the zero line indicates potential trend reversal or a consolidation period in the short term.