Fetch.ai (FET) price is close to a correction due to potential investor sell-offs. Additionally, the altcoin FET is sensitive to the death cross formation, which could drop it to $1.7. Analysts believe Fetch.ai’s price is close to a decline due to decreasing investor support.

Critical Formation in FET

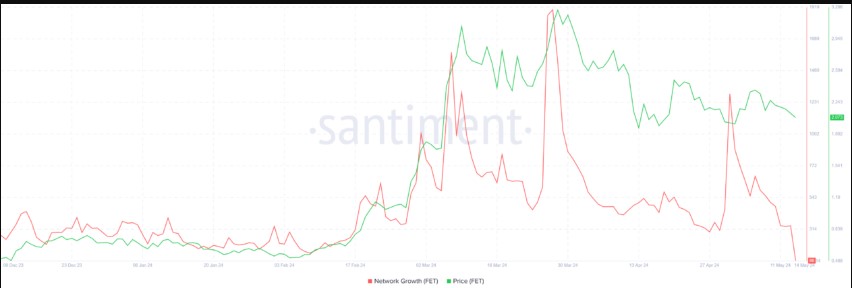

Network growth has fallen to a seven-month low following the recent rally. Network growth is used to assess a project’s strength in the market and is calculated by the rate of new address formation. A similar decline indicates that potential investors see little incentive to join the network. This is likely due to profit saturation among FET holders. According to the Historical Break Even indicator, over 97% of the supply is currently above the purchase price.

The remaining 3% is allocated to loss-making investors who bought at all-time high prices. Therefore, this scenario presents a stronger sentiment of selling or profit-taking among holders. This also poses a threat to price movement as mass dumping could lead to a correction. Fetch.ai’s price saw a 12.7% decline within a week, and the altcoin remained at $2.08, close to the $1.96 support level. Increasing bearish sentiment among investors could push it below this support.

Price Prediction for FET

Additionally, the altcoin could be vulnerable to the death cross. The death cross occurs when the short-term 50-day exponential moving average (EMA) crosses below the long-term 200-day EMA, indicating a potential downtrend. This formation could drop FET to $1.71. On the other hand, the $1.96 support has been tested several times recently but has not broken below. If this level holds, Fetch.ai’s price could recover and push FET to $2.26. Breaking and turning this level into support could enable a rise to $2.46 and above, invalidating the bearish thesis.

Türkçe

Türkçe Español

Español