Spot Bitcoin ETFs in the US came back into the spotlight this week with rising trading volumes. On May 16, these ETFs recorded a significant net inflow of $257 million. Grayscale’s ETF, GBTC, saw renewed investor interest, recording inflows for the second consecutive day.

US Spot Bitcoin ETFs Attract Attention

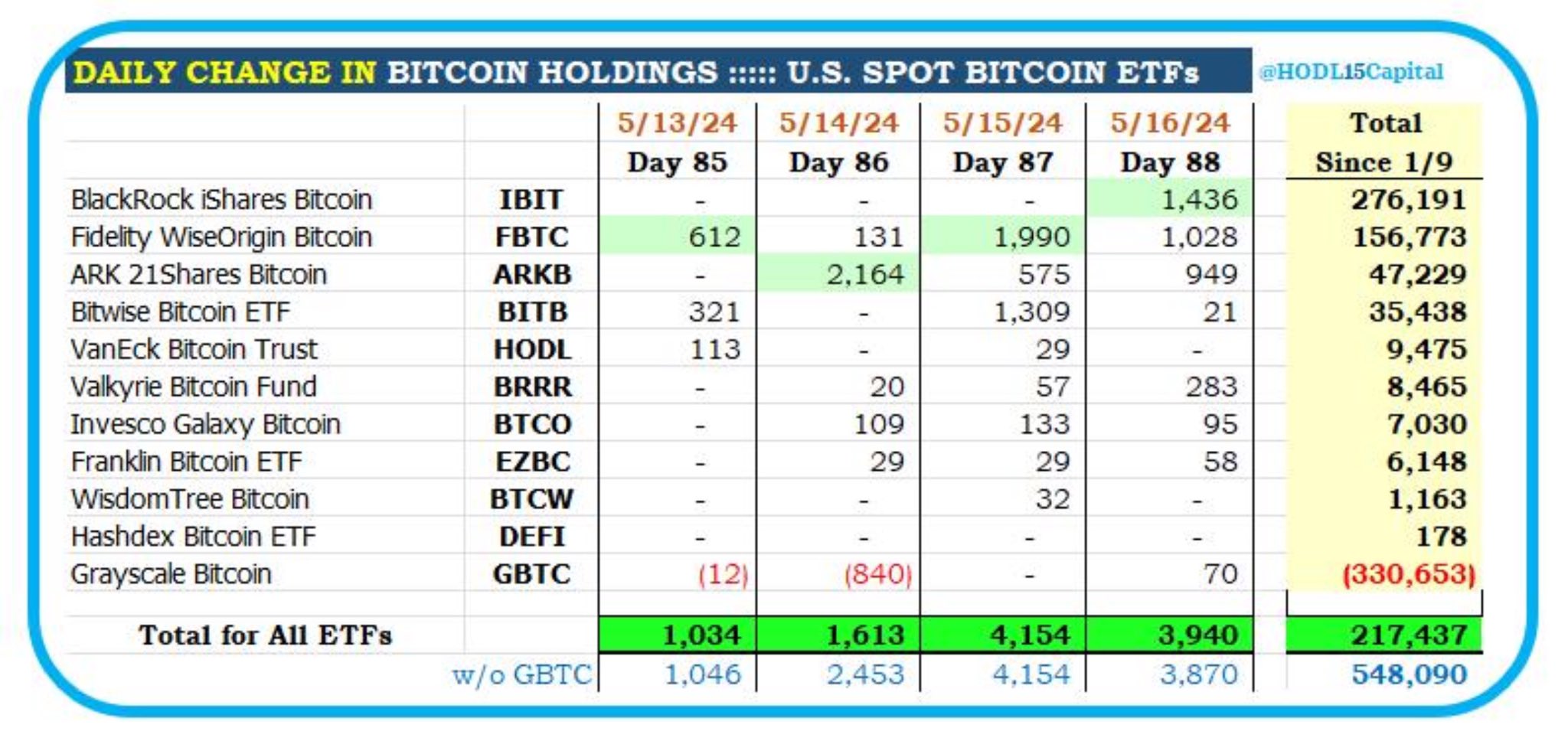

Following significant outflows last week, Bitcoin ETFs in the US experienced a strong recovery. As of the last trading day on May 16, total inflows exceeded $657 million. On-chain data shows that these ETFs accumulated a total of 11,188 BTC, which is nearly five times the number of Bitcoins mined during the same period. This significant accumulation indicates a growing appetite among investors to invest in Bitcoin.

As of May 16, US spot Bitcoin ETFs attracted a total net inflow of $257 million. Grayscale’s ETF, GBTC, recorded a notable net inflow of $4.63 million. BlackRock’s spot ETF, IBIT, recorded a net inflow of $93.70 million, while Fidelity’s spot ETF, FBTC, saw a net inflow of $67.08 million during the same period. These figures indicate strong institutional interest in spot Bitcoin ETFs and reflect a broader trend of increasing participation from traditional finance.

The recent inflows are indicative of a larger trend where significant market players in traditional finance are exposing themselves to spot Bitcoin ETFs. This suggests that institutional participation in spot Bitcoin ETFs is strong and will continue to grow. According to Bitwise Asset Management, more than 700 institutional investors are expected to turn to these Bitcoin funds, which could further increase demand and inflows.

Hong Kong Spot Bitcoin ETFs Face Challenges

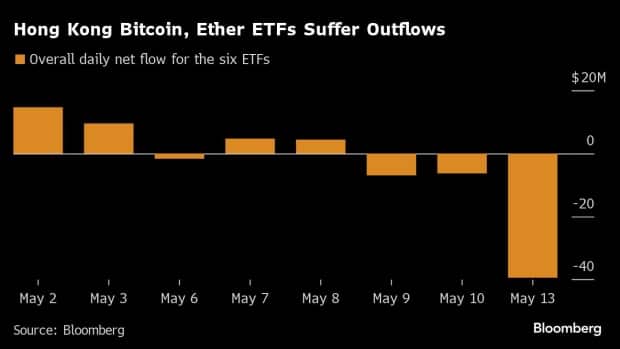

In contrast to the strong performance of US spot Bitcoin ETFs, Hong Kong’s first spot exchange-traded funds (ETFs) investing directly in cryptocurrency are struggling to attract interest. Data from Bloomberg reveals that the total assets of six spot Bitcoin and Ethereum ETFs in Hong Kong have decreased by about $25 million from the $293 million initially raised two weeks ago. This decline indicates a lackluster response from investors.

Le Shi, trading director at market maker and algorithmic trading firm Auros, described the response to the spot ETF launches in Hong Kong as “mild.” Shi attributed this to the US outpacing Hong Kong and the ongoing uncertainty regarding China’s stance on cryptocurrency, which has made potential investors cautious or led them to avoid the jurisdiction altogether.

Despite the initial challenges faced by spot cryptocurrency ETFs in Hong Kong, Bloomberg Intelligence ETF Analyst Rebecca Sin highlighted some positive aspects. She noted that total assets have already surpassed $250 million and predicted that more issuers would join the race as the ecosystem develops. Sin forecasts that these portfolios could accumulate $1 billion within two years, suggesting a more optimistic long-term outlook for Hong Kong’s cryptocurrency ETFs.

Türkçe

Türkçe Español

Español