Bitcoin (BTC) price history shows the largest cryptocurrency often oscillates between bear and bull cycles influenced by block reward halvings. Traditionally, a bull market starts after a block reward halving, with the two years preceding this event characterized by bearish trends. However, the current cycle deviates from this model, displaying unique dynamics.

Current Bull Cycle Dynamics

The ongoing bull run, which began in mid-2023, was initially driven by excitement surrounding the potential approval of spot Bitcoin ETFs in the US. When these ETFs were approved at the beginning of 2024, Bitcoin’s price surpassed its all-time high from 2021, reaching approximately $74,000. This marks the first time Bitcoin has reached a new peak before a block reward halving.

The approval of spot Bitcoin ETFs, especially with major financial institutions like BlackRock and Fidelity backing these products, signifies BTC’s legitimacy as an investment asset. The subsequent influx of investments significantly boosted Bitcoin’s price. Although demand has stabilized in recent weeks, BTC’s price remains strong, fluctuating between $60,000 and $70,000.

Speculations that the Federal Reserve (Fed) might lower interest rates later this year also contribute to the bullish sentiment towards Bitcoin. Lower interest rates generally favor riskier assets, including cryptocurrencies. This potential monetary policy shift could support the rise in Bitcoin’s price.

The most recent Bitcoin block reward halving, which occurred a month ago, also played a role in shaping the current market dynamics. While some experts believe the impact of block reward halvings has diminished over time, the reduction in new BTC production to approximately 450 BTC per day is significant. This supply constraint, combined with continued accumulation by ETFs, whales, and individual investors, suggests that higher price levels are inevitable.

The Current Bull Run Could Continue for 11 More Months

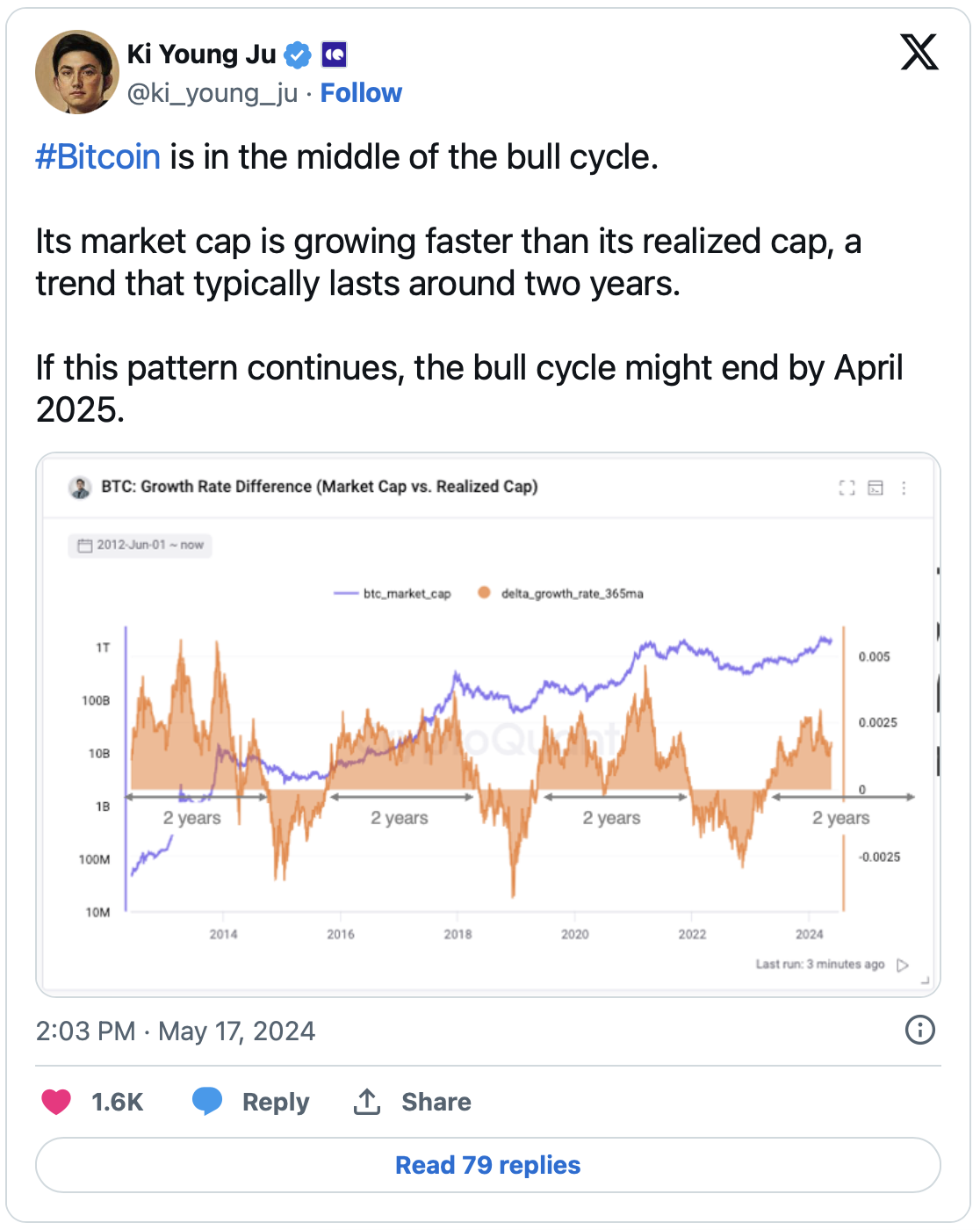

According to CryptoQuant CEO Ki Young Ju, Bitcoin is currently in the middle of a bull cycle. Ju emphasized that Bitcoin’s market value is increasing faster than its realized value, indicating a healthy market.

Typically spanning two years, this trend suggests that the current bull run could continue for an average of 11 more months.