Cryptocurrency investors have been waiting for this moment for months, and the anticipated day has finally arrived. The exciting development is related to spot Ethereum ETF applications. This decision by the SEC will further solidify its stance on crypto and will be a crucial juncture for mid-term ETH price predictions.

Spot ETH ETF Decision Date

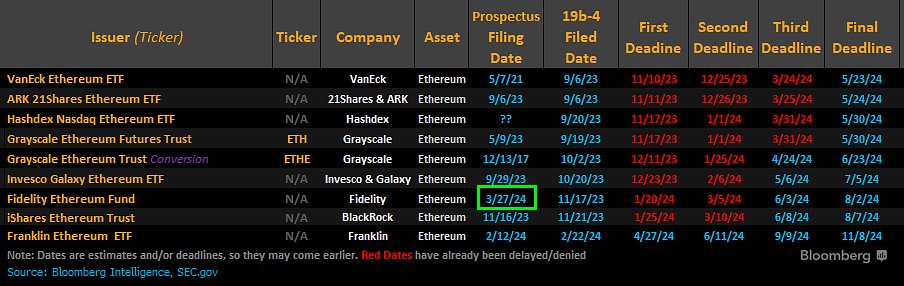

Final decisions for VanEck and Ark&21Shares applications will be made on May 23 and 24. The final decision for Grayscale‘s application will be announced on May 30. If the SEC follows its precedent with BTC ETFs, it will need to announce approval or rejection for all Ether ETFs. The decision dates for ETF applications by trillion-dollar giants like BlackRock and Fidelity are also on May 23 and 24.

Will the SEC Approve?

Only 14% of investors believe the SEC will approve ETH ETFs. The regulatory body, which has been simultaneously acting against ConsenSys, Uniswap, Ethereum Foundation, and others, has been signaling a rejection for months. Gensler has been hinting early on that Ethereum’s transition to PoS makes it a security.

In his congressional testimonies, Gensler has not definitively labeled Ethereum as a commodity or security, laying the groundwork for a comprehensive legal battle. These actions against major players in the Ethereum ecosystem and directly against the Ethereum Foundation indicate that the security decision for the largest altcoin was made long ago.

Meanwhile, the CFTC clearly states that Ether is a commodity, not a security. This has led to direct criticism of the SEC by its members Peirce and Uyeda. Two of the five SEC members openly state, “We are making a mistake, we are trying to stifle crypto.” However, Gensler ignores this.

This Thursday and Friday, we might see volatility in ETH prices. The SEC will likely announce approval or rejection for at least two ETFs on Wednesday or Thursday. Although the market has already priced in a rejection, a shock drop could occur. The reasons cited by the SEC for rejection and whether it will simultaneously reject applications from BlackRock and other giants could affect the severity of the drop.

Türkçe

Türkçe Español

Español