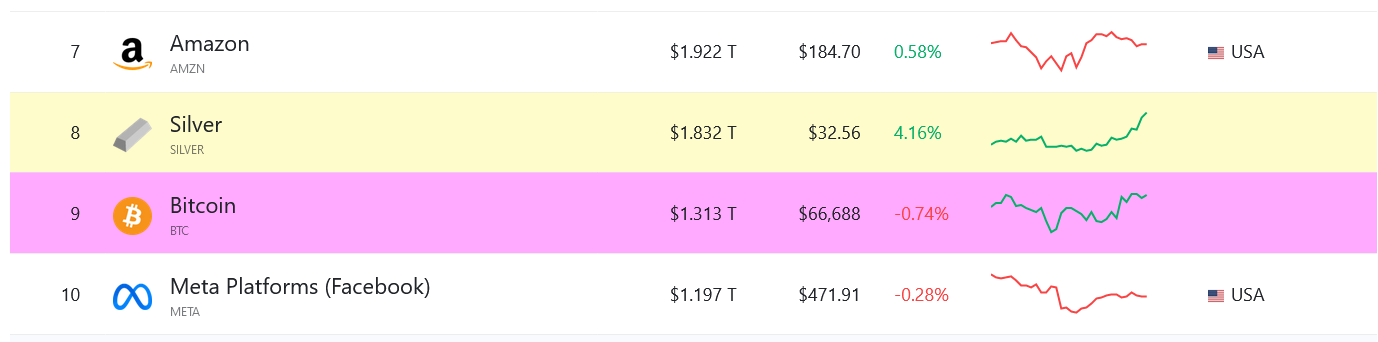

Silver achieved an impressive comeback against Bitcoin this year, surpassing the cryptocurrency as the 8th largest asset by market value after losing its position in March. According to CoinGecko, the world’s second most valuable metal has gained 33.4% since Bitcoin reached a record $73,737 on March 14, while Bitcoin has declined by 9.5% during this period.

The Battle Between Bitcoin and Silver Continues

As a result, silver’s market value of $1.83 trillion is currently $500 billion more than Bitcoin’s market value of $1.31 trillion; this means that Bitcoin would need to increase by 40% to reach $93,000 to reverse silver’s current market value.

Bitcoin is currently the ninth largest asset in the world, following gold, Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Google (GOOG), Saudi Aramco (2222.SR), Amazon (AMZN), and Silver. According to Trading Economics, gold has also stood out with a 22.4% increase since February 13.

It currently has a market value of $16.4 trillion. Industry experts are divided on how Bitcoin’s price will move after reaching an all-time high in March.

What Awaits Bitcoin?

Bitcoin analyst Dylan LeClair previously noted that Bitcoin tends to double within months after reaching new peaks, especially during halving events. However, Bitcoin currently has a much higher market value than in 2020, 2016, and 2012, making such an achievement more challenging.

Galaxy Digital founder and CEO Mike Novogratz stated that Bitcoin would remain in a consolidation phase between $55,000 and $75,000 over the next month and potentially rise towards the end of the second quarter. Analysts at the cryptocurrency trading platform Bitfinex predict that Bitcoin could reach $150,000 within the next 12 months.

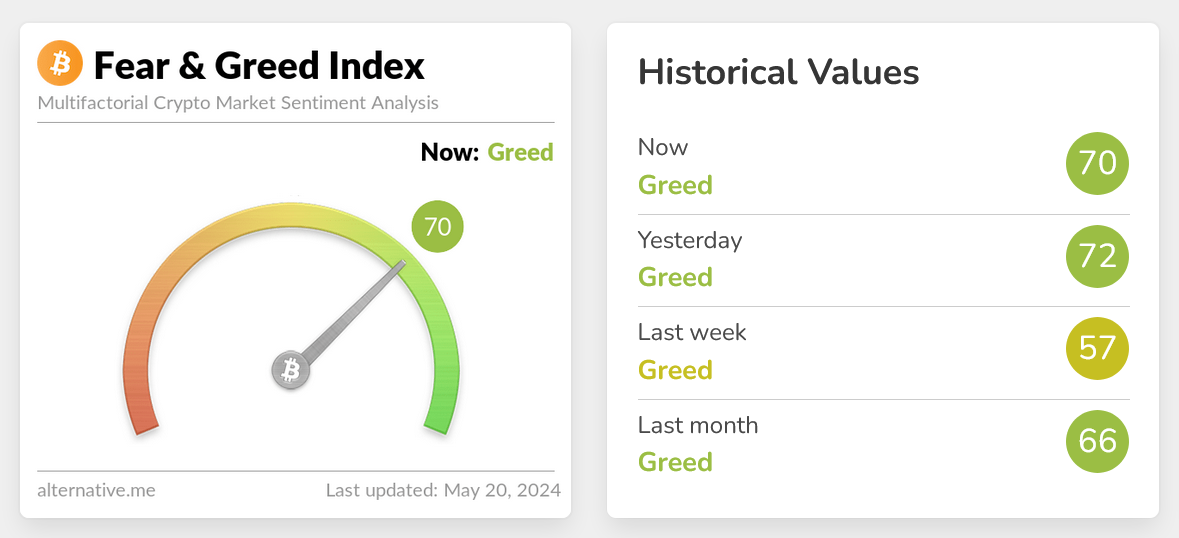

Many industry experts cite spot Bitcoin exchange-traded funds and the post-halving effect as the main factors behind these high predictions. Bitcoin’s market sentiment score is currently 70 out of a possible 100, which indicates greed on the Crypto Fear and Greed Index.