Ethereum (ETH) successfully broke above a rising wedge pattern a few days ago. Since then, the leading smart contract platform has continued its upward momentum, rewarding its investors.

Expert Opinion on ETH

A popular cryptocurrency analyst, World Of Charts, recently tweeted highlighting that ETH broke out of a descending wedge pattern. The token’s price had been consolidating within the formation since March and started to rise a few days ago. However, this rise might just be the beginning as the breakout has the potential to increase ETH’s price by 45%. Yet, lower volatility in the last few hours has somewhat paused ETH’s rise.

According to CoinMarketCap, ETH’s price showed only a marginal increase in the last 24 hours. At the time of writing, ETH is trading at $3,131.77 with a market cap of over $376 billion. According to CryptoQuant’s data, ETH’s net deposits on exchanges were low compared to the seven-day average. This could mean that the selling pressure on ETH is low. Additionally, both transfer volume and active addresses remained high, which can be considered an optimistic sign. Although the mentioned metrics seem promising, a few others raised concerns.

Analytical Reports on ETH

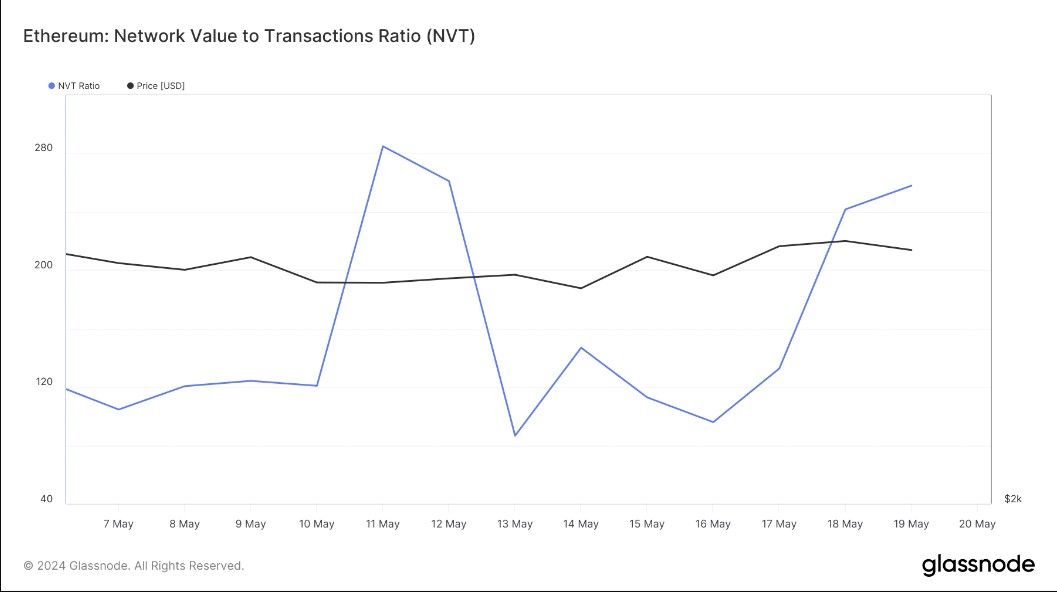

According to Glassnode data, ETH’s NVT ratio has sharply increased in the last few days. The NVT ratio is calculated by dividing the market cap by the on-chain transaction volume measured in USD. An increase in this metric suggests that ETH might be overvalued, indicating a potential price correction soon. Another fundamental indicator also showed a bearish trend.

Ethereum’s fear and greed index was at 83% at the time of writing, indicating that the market might be in an “extreme fear” phase. When this metric reaches such levels, it often suggests a high probability of a token’s price falling. The MACD showed a bullish trend. Additionally, ETH’s relative strength index (RSI) recorded an increase from the neutral level. The money flow index (MFI) followed a similar trend. These factors might indicate a low likelihood of a significant price correction.

Türkçe

Türkçe Español

Español