Cryptocurrencies have been occupying an increasingly significant place in the financial world in recent years. Specifically, open interest in Ethereum futures on centralized crypto exchanges has seen a noticeable increase recently. This rise is considered a sign of significant momentum in trading activities around ETH, the second-largest cryptocurrency by market value.

Ethereum Futures Open Interest Hits Record High

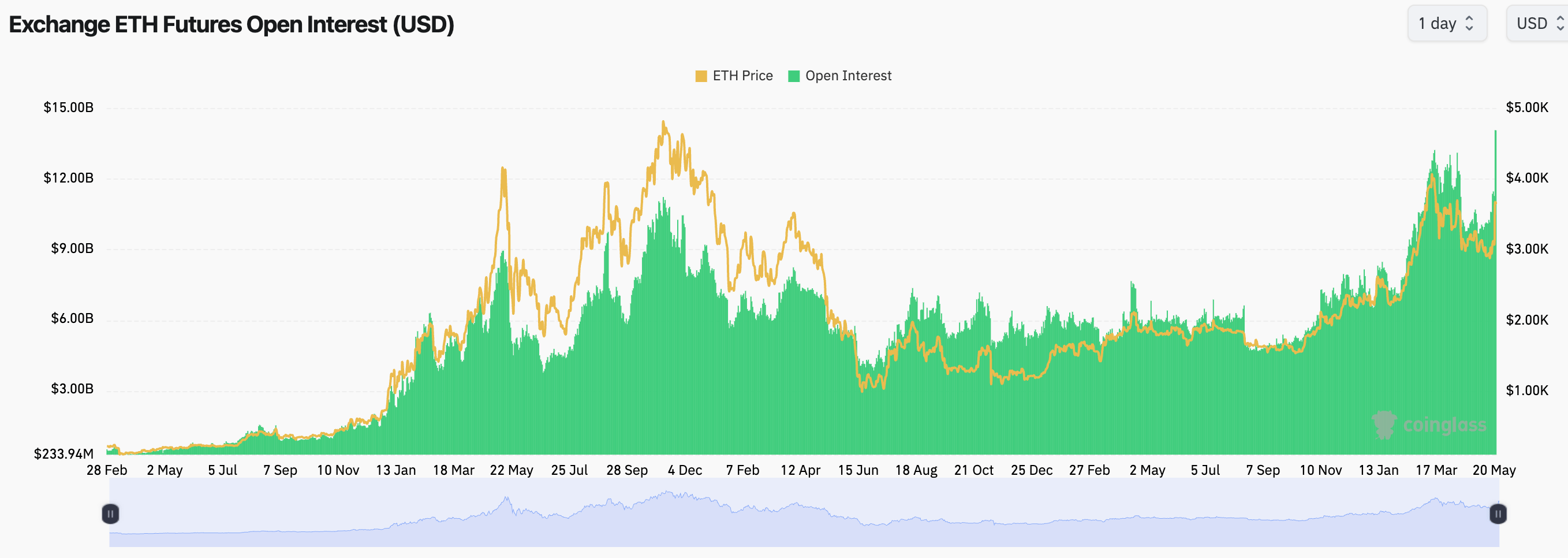

According to CoinGlass, total open interest in ETH futures reached a record high of $14 billion on Tuesday. This development shows that the cryptocurrency market is strongly active and that investor interest in this area is increasing.

Since the beginning of 2024, daily open interest in Ethereum futures has increased by more than 40%. This indicates a significant shift in the dynamics of the cryptocurrency market and growing investor interest in futures trading.

Open interest measures the total value of all outstanding or “unresolved” futures contracts on exchanges. This shows market activity and trader sentiment around a particular asset. Therefore, the increase in open interest in ETH futures demonstrates how active the cryptocurrency market is and the growing confidence of investors in this area.

Coincides with Ethereum Price Increase

According to The Block’s price page, this increase in open interest coincided with ETH’s price rising 18% in the last 24 hours to $3650. This indicates that ETH is in a strong upward trend and investors are trying to capitalize on this trend.

Additionally, a new optimistic outlook for the approval of a spot Ethereum exchange-traded fund (ETF) has been a significant catalyst. Bloomberg ETF analysts James Seyffart and Eric Balchunas note that the likelihood of the US Securities and Exchange Commission (SEC) approving spot ETH ETFs in the US has increased from 25% to 75%.

Reports indicate that the SEC has asked issuers to update and resubmit Form 19b-4. These documents require the agency’s green light for spot ETH ETFs to come into effect. The first round of spot ETH ETF application deadlines is approaching this week, with VanEck on May 23 and Ark Invest/21Shares on May 24.

Türkçe

Türkçe Español

Español