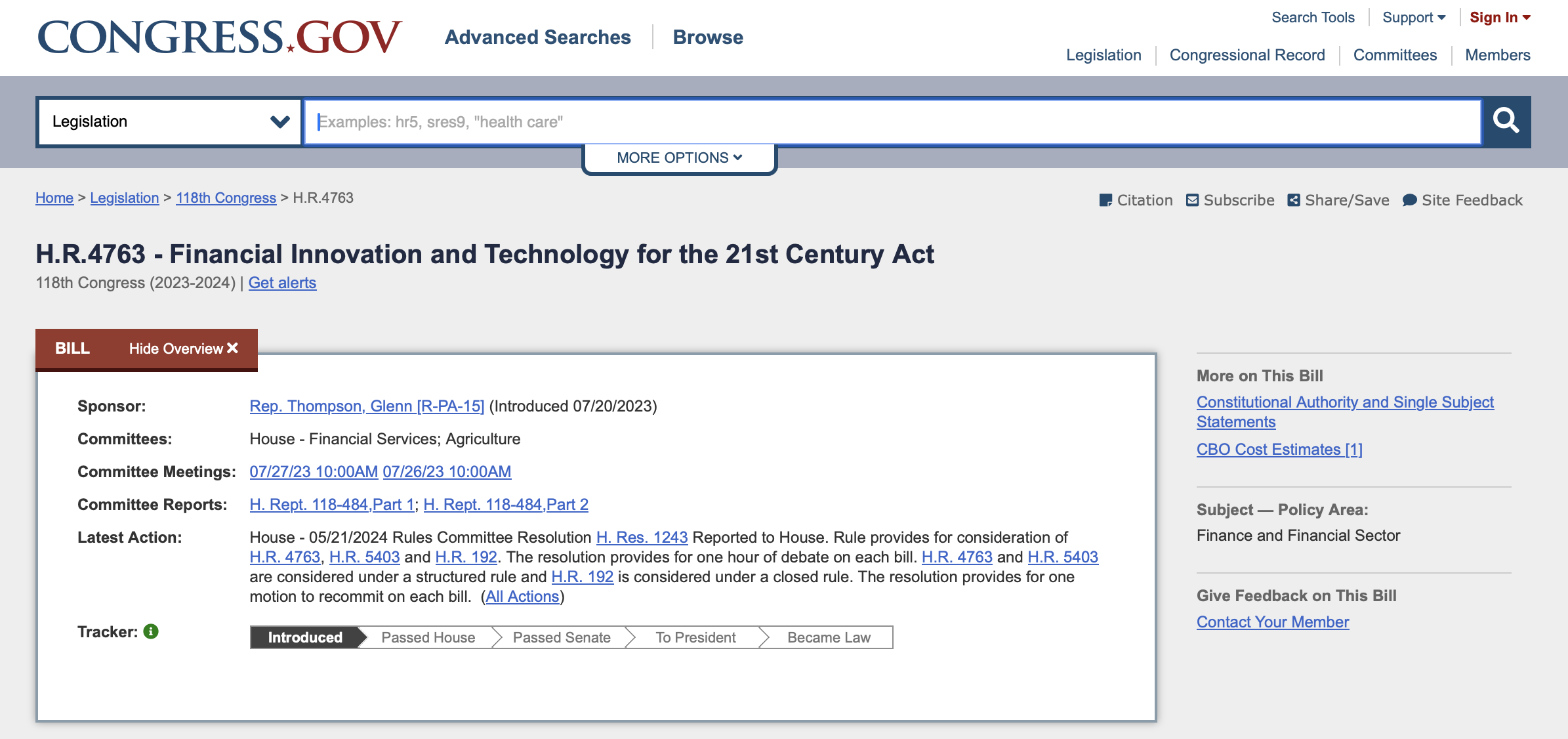

The U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler strongly opposed the Financial Innovation and Technology Act for the 21st Century (FIT21 Act), expressing concerns that the proposed legislation would weaken investor protection. Gensler argued that FIT21 would create new regulatory gaps, disrupt the SEC’s longstanding oversight of investment contracts, and expose both investors and capital markets to significant risks.

Gensler’s Fear: Lack of Investor Protection

Gensler’s primary concern with the bill, known as H.R. 4763, is that it would reclassify cryptocurrencies, removing them from the SEC’s jurisdiction and potentially hindering investor protection. He warned that the bill could allow cryptocurrency companies to self-certify their investments as “decentralized” and categorize them as “digital commodities” under a “special class,” thereby avoiding SEC scrutiny.

According to Gensler, this self-certification process not only jeopardizes the cryptocurrency sector but also destabilizes financial markets by providing opportunities to bypass strict regulations and barriers against fraud and theft.

The SEC Chairman highlighted the potential dangers of allowing companies to bypass securities laws by identifying themselves as decentralized systems. He noted that such exemptions could open the door to pump and dump schemes and other fraudulent activities, undermining investor confidence and security. Additionally, he criticized the bill for excluding cryptocurrency trading platforms from the definition of exchanges and overriding established regulatory frameworks like the Howey test that historically protect investors.

FIT21 Act Increases CFTC’s Powers

Supported by the U.S. Republican Party, the FIT21 Act aims to reform the cryptocurrency market structure by assigning more regulatory responsibilities to the U.S. Commodity Futures Trading Commission (CFTC).

The bill has garnered support from 60 crypto organizations, including major firms like Gemini, Kraken, and Coinbase, which argue that current securities laws are outdated for digital assets. Former U.S. President Donald Trump and his advisors also backed the bill, with Trump recently announcing that he would accept cryptocurrency donations for his campaign, clarifying his stance.

While House Speaker Nancy Pelosi is reportedly considering putting the bill to a vote, the U.S. House of Representatives is expected to vote on it soon.

Despite the strong support for the bill, Gensler reiterated that the issues in the cryptocurrency industry stem not from a lack of rules but from non-compliance with existing regulations. He emphasized that the industry’s history of failures and fraud highlights the need for strict oversight to protect investors and maintain market integrity.