Analysts expect the launch of spot Ethereum ETF funds within weeks after significant changes in applications by issuers like Fidelity and Ark 21Shares. Although the approval by the U.S. Securities and Exchange Commission (SEC) remains uncertain, these developments could be a significant moment for the crypto market. The SEC recently requested changes in the 19b-4 forms submitted by asset managers for spot Ethereum ETF funds.

Ethereum ETF Excitement Continues

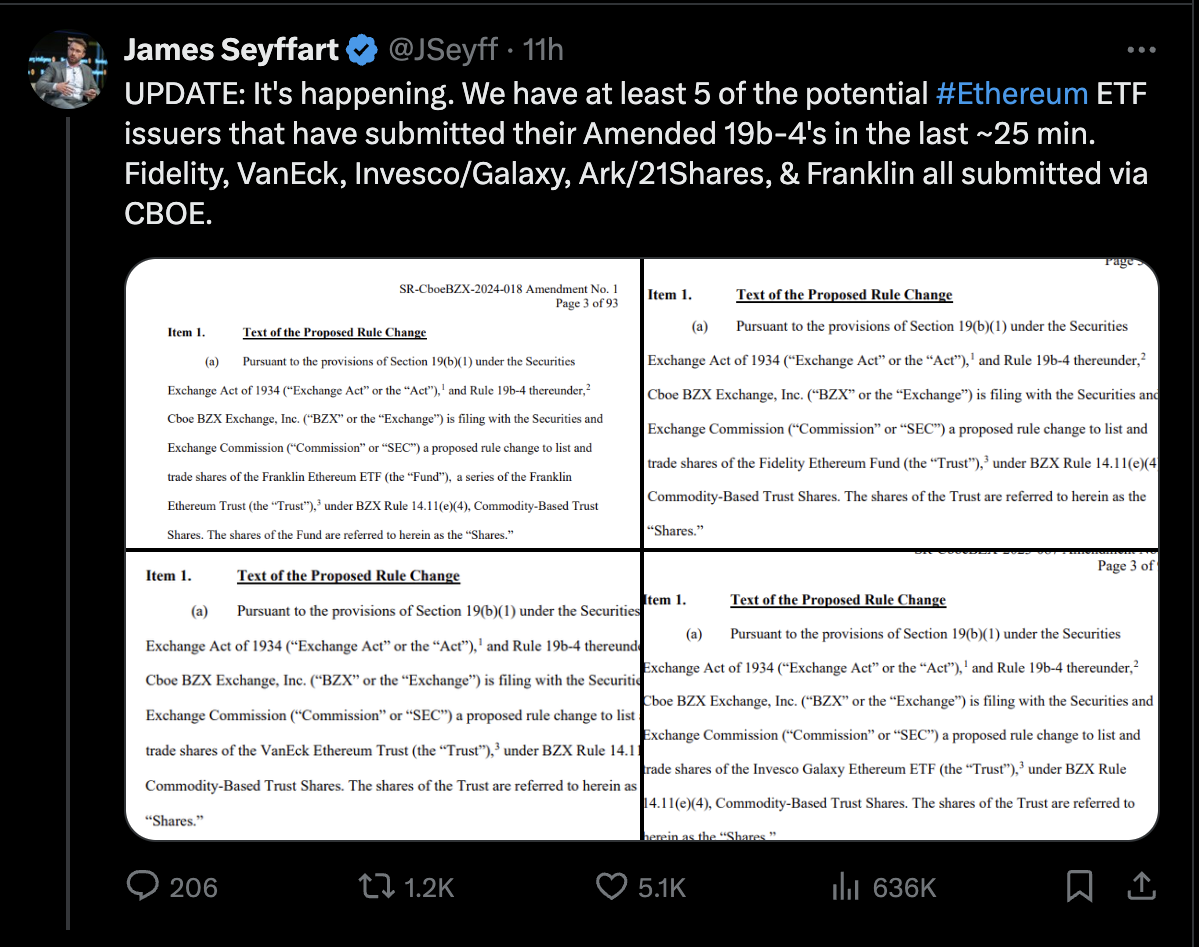

Five potential issuers, Fidelity, ARK 21Shares, Invesco Galaxy, VanEck, and Franklin Templeton, complied with this process and made the necessary changes through Cboe. They removed the staking process and added clear statements that the funds cannot be staked by anyone. The process included the following statements:

“No person associated with the Trust or Fund will take any action directly or indirectly involving any portion of the fund’s Ethereum if it is subject to Ethereum proof. The amended documents confirm that staking verification is done or used to earn additional Ethereum or to gain income or other profits.”

The Depository Trust & Clearing Corporation’s (DTCC) website also listed VanEck’s proposed ETHV code spot Ethereum ETF fund. Despite these positive developments, SEC approval is not guaranteed. Bloomberg Intelligence ETF analyst James Seyffart commented on the matter:

“We need to see SEC approval orders for all 19b-4s and then S-1 approvals.”

What Are the Details?

The 19b-4 applications propose rule changes necessary for listing new products like spot Bitcoin or Ethereum ETF funds on exchanges. Meanwhile, S-1 registration forms provide detailed information about the new securities offered to the public, including the fund’s structure, management, and investment strategy. Issuers need approval for both forms to officially launch ETF funds. Despite this, Seyffart expressed optimism after seeing this progress:

“The launch of Ethereum ETF funds could take weeks or more.”

Despite his optimism, Seyffart confirmed that the approval rate remains at 75%. Many experts see the approval of spot Ethereum ETF funds as a bullish signal for the broader crypto market. However, the approval of these ETF funds without allowing staking could disadvantage investors seeking additional returns from staking rewards.

Türkçe

Türkçe Español

Español