Despite a challenging period that began in May 2022, cryptocurrencies showed resilience and continued integrating into global financial systems. The year 2024 started with the approval of the first spot Bitcoin (BTC) exchange-traded funds (ETFs) in the US, significantly increasing investors‘ investments in the cryptocurrency market.

Significant Increase in Wallet Addresses Holding At Least $1 in BTC

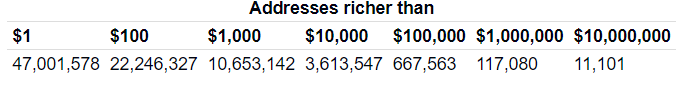

The growing adoption of Bitcoin is becoming more evident with the increase in the number of addresses holding at least $1 worth of BTC. In 2022, there were approximately 35 million addresses, representing 0.4% of the world population. By May 2024, this number rose to 84 million addresses, meaning around 1% of the world’s 8.1 billion people hold some BTC.

However, since investors often hold their BTC in multiple addresses, there may be significant deviations in this figure. The increase in the number of addresses is partly related to the notable rise in Bitcoin’s price. Currently priced around $70,000, the largest cryptocurrency has gained over 66% in value since the beginning of the year.

Current Catalysts of the Cryptocurrency Market

Various factors, including the ongoing boom in the cryptocurrency market and bullish predictions related to the fourth Bitcoin block reward halving in April, are driving Bitcoin investment.

Moreover, the approval of spot Bitcoin ETFs by the US Securities and Exchange Commission (SEC) in January played a significant role in legitimizing the largest cryptocurrency, attracting more traditional investors to the market.

While some cryptocurrency advocates criticize the SEC’s strict approach, they emphasize that the actions of the US regulator likely help present cryptocurrencies as more viable investments. This higher level of regulatory scrutiny and enforcement brings a sense of order to the previously unregulated market, making the cryptocurrency market more attractive to traditional investors.

Türkçe

Türkçe Español

Español