Today, we will witness an important moment in the cryptocurrency market. Both Bitcoin (BTC) and Ethereum (ETH) will see the expiration of large-volume options. This, combined with current market conditions, could create significant impacts in the cryptocurrency market. Especially after a major development like the spot Ethereum ETF approval, option data might present different scenarios. Let’s look at the details.

Bitcoin Option Data

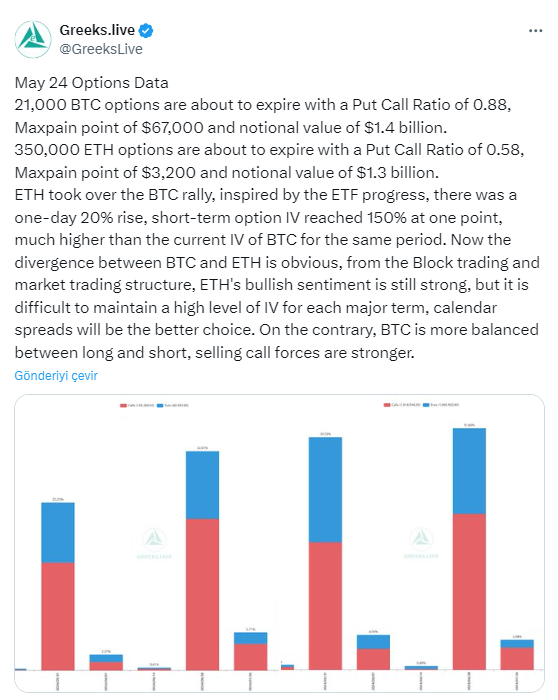

First, let’s look at Bitcoin (BTC). There are 21,000 BTC options set to expire, with a Put Call Ratio recorded at 0.88. This ratio indicates relatively balanced sentiment between bearish (put) and bullish (call) positions, with a slight bullish inclination.

The Maxpain point for BTC is set at $67,000. The Maxpain point represents the price level at which the most options will become worthless, causing maximum financial pain to option holders. The nominal value of these BTC options reaches $1.4 billion, indicating a significant amount of capital at risk.

Ethereum Option Data

In contrast, Ethereum (ETH) options paint a different picture. There are 350,000 ETH options set to expire, with a Put Call Ratio of 0.58, which is quite low. This ratio shows a stronger bullish sentiment for ETH compared to BTC.

The Maxpain point for ETH is $3,200, and the nominal value of these options is recorded at $1.3 billion. These figures reflect investor interest in ETH and the potential high impact on ETH’s price movements when these options expire.

Recent Performance of Ethereum

ETH’s recent performance has largely outpaced BTC, driven by progress in Ethereum ETF developments. This optimism led to a 20% price increase in a single day for ETH, pushing short-term option implied volatility (IV) up to 150%. This IV level is significantly higher than BTC’s for the same period, highlighting increased market activity and speculative interest in ETH.

Currently, there is a clear divergence in market sentiment and trading dynamics between BTC and ETH. ETH’s bullish trend remains strong, as indicated by block trades and overall market structure. However, maintaining high implied volatility is challenging. Thus, investors might see calendar-based price ranges, involving the buying and selling of options with different expiration dates, as a more suitable approach for ETH.

On the other hand, BTC shows more balanced sentiment between short and long positions. Call option sellers are stronger, indicating a more cautious or neutral market outlook compared to ETH. This balanced sentiment suggests that BTC’s price movements may be less volatile in the short term, and investors might seek different strategies to navigate market dynamics.

Türkçe

Türkçe Español

Español