The market experienced a frenzy linked to the spot Ethereum ETF all week. Data following the ETF approval reveals numerous long liquidations on exchanges after the Ethereum ETF approval.

Ethereum Price Drops

Yesterday, the US Securities and Exchange Commission (SEC) approved all eight pending Ethereum spot exchange-traded funds (ETFs) on the final decision date for the VanEck ETF. In short, spot ETFs are investment tools that allow investment based on ETH’s price movements without any token investment.

ETFs are known as a familiar tool for investors in the traditional market. Through ETFs, investors who do not want to waste time with crypto exchanges and wallets can invest in crypto assets.

In the market, a similar approval decision was expected for ETH, akin to the Bitcoin spot ETF process approved in January. Looking back, despite declines after approval and processing, ETFs are known to have driven BTC to its ATH.

Similarly, sales were observed following the Ethereum spot ETF approval. During this process, besides the negativity seen in the rest of the market, the ETH price also experienced a nearly 3% drop.

Liquidations in Cryptocurrencies

According to data provided by Coinglass, the cryptocurrency derivatives market experienced significant impacts from volatile price movements over the past day.

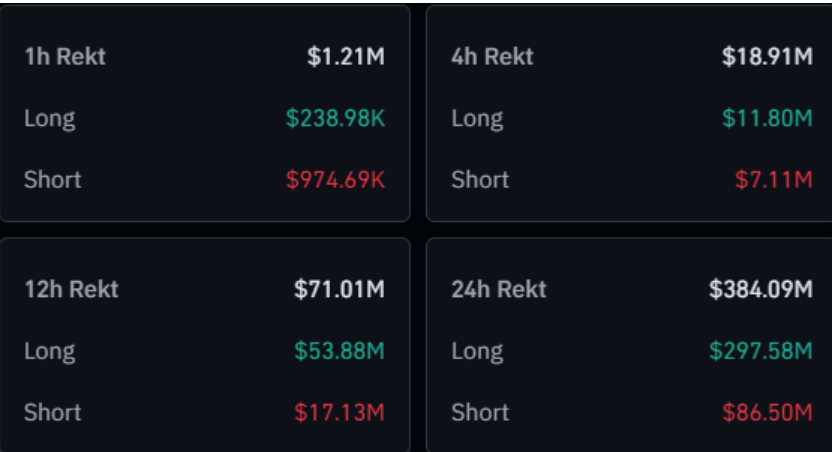

The liquidation data in the table below clearly shows the volatility experienced. During the period shown in the table, over $384 million in futures positions were liquidated. Of the liquidations, over $297 million came from long positions held by investors.

These data indicate that investors opening upward positions constituted 77% of the liquidity. Due to the overall downward price movement seen yesterday, this was naturally observed in long positions.

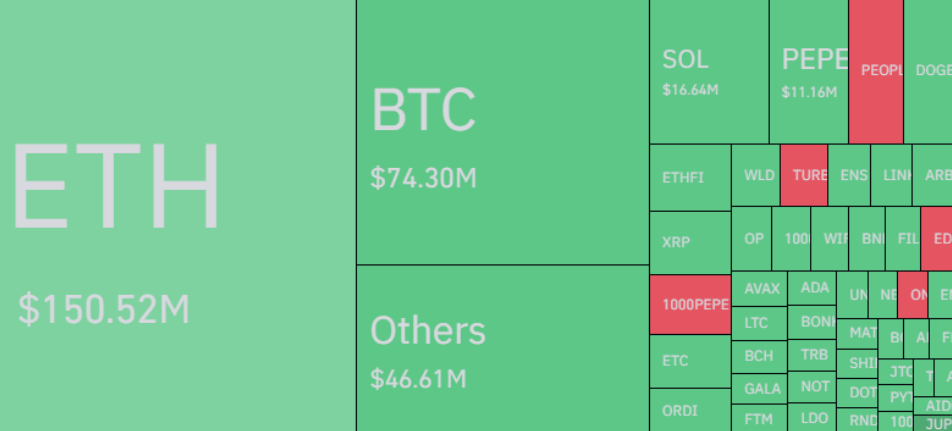

As seen in the table below, it was not surprising that Ethereum, which has recently been a focal point, hosted the largest liquidations during this period.  Ethereum, with over $150 million in liquidations, even surpassed Bitcoin, which saw positions worth $74 million liquidated.

Ethereum, with over $150 million in liquidations, even surpassed Bitcoin, which saw positions worth $74 million liquidated.

Türkçe

Türkçe Español

Español