Cryptocurrency investors and enthusiasts often market Bitcoin (BTC) as “digital gold,” while Ethereum (ETH) is still searching for a similarly effective and straightforward marketing approach. The challenge lies in attracting the baby boomer generation to spot Ethereum exchange-traded funds (ETFs). Glassnode’s chief analyst James Check noted in a post on X on May 24 that despite years of efforts, Ethereum has not captured an “easy-to-understand” narrative that resonates with this demographic.

Lack of Clear Messaging for Ethereum

Eric Balchunas, an ETF analyst at Bloomberg, highlighted the difficulty of summarizing Ethereum‘s purpose in a way that older investors can easily grasp. He reiterated the simplicity of Bitcoin as “digital gold” and pointed out that there is no equivalent for the king of altcoins.

Balchunas emphasized that the success of spot Ethereum ETFs depends on how well the investment’s value can be distilled into a simple and engaging message for investors aged 60-80.

Ethereum’s more complex nature compared to Bitcoin is a significant hurdle. In the May 24, 2024 episode of the Bankless podcast, Bitwise Chief Investment Officer Matt Hougan discussed how confusing it is for newcomers to the crypto market to differentiate between Bitcoin and Ethereum. He likened this distinction to the difference between software companies like Salesforce and Microsoft that use software differently. Hougan emphasized that both Bitcoin and Ethereum serve as both assets and blockchains, optimized differently to serve various purposes.

Potential Value Propositions for Ethereum

Despite the various challenges, there are some suggestions to summarize Ethereum’s value. One common suggestion is that while Bitcoin is for value preservation and a safe haven, Ethereum is more suitable for accessing decentralized finance (DeFi) services.

Another analogy proposed by Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, is “Ethereum is like digital oil. It is the gas that powers decentralized protocols. It is productive and yields returns.” This analogy highlights Ethereum’s role in powering various decentralized applications (dApps) and protocols.

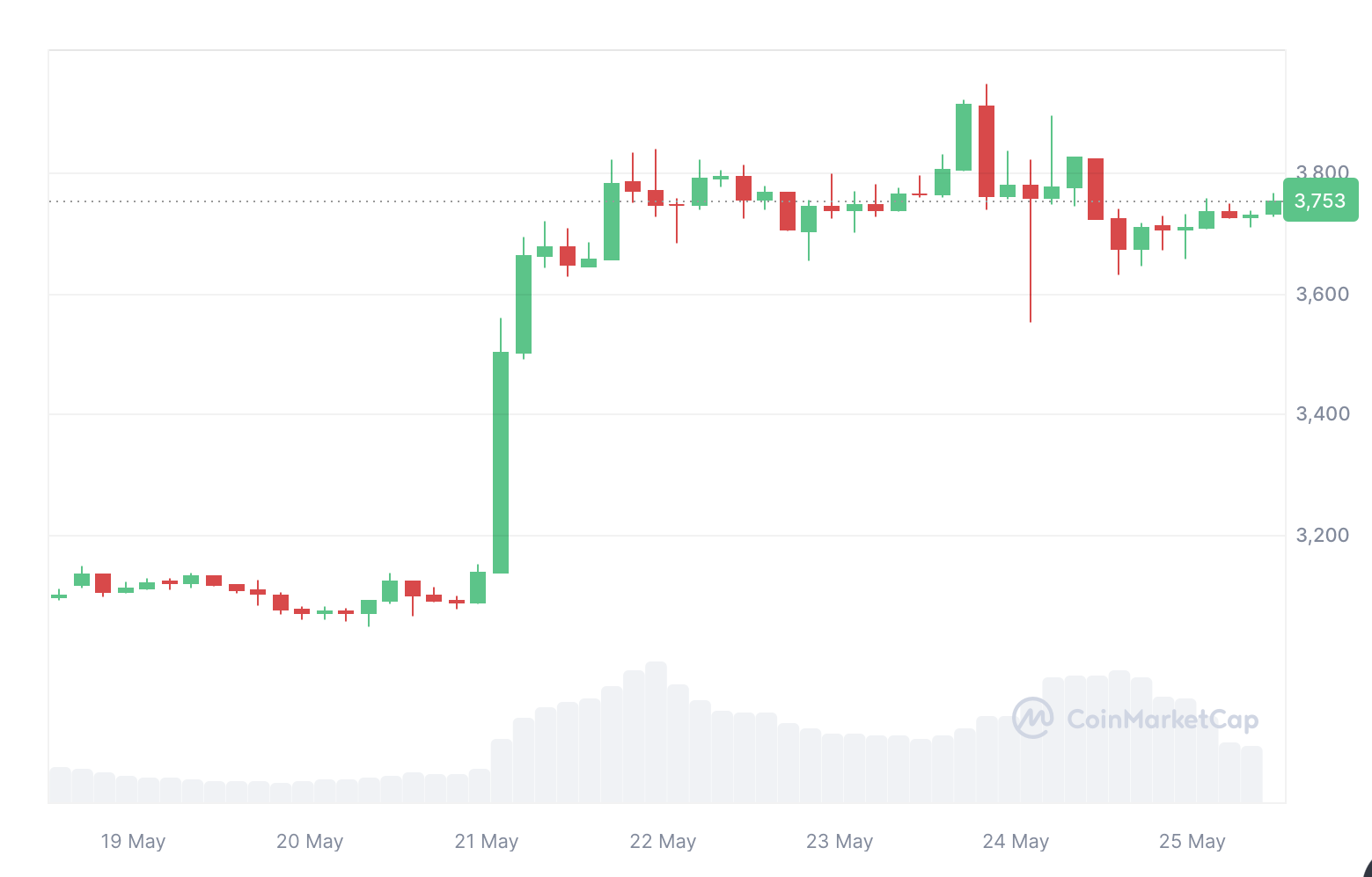

As is known, the U.S. Securities and Exchange Commission (SEC) approved eight spot Ethereum ETFs on May 23, 2024, sparking significant interest and optimism in the cryptocurrency market. Following this news, the price of ETH increased its gains over the last 7 days to 19.56%. This approval marks a potential shift from the SEC’s previously strict stance on ETF approvals, indicating a more favorable regulatory environment for Ethereum and related financial products.

Türkçe

Türkçe Español

Español