Since September 2023, the weighted sentiment around Dogecoin (DOGE) has reached -1.562 on the charts. Here, weighted sentiment can be defined as the result of the average comments made on social media about a token. This situation has led to an increase in positive comments about DOGE. However, recent data revealed that for every 1 good comment about the cryptocurrency, there were 1.56 contrary comments.

Negative Market Conditions for DOGE

Generally, if negative sentiment dominates the market, demand for the meme token may decrease. However, history looks different for Dogecoin. The altcoin price rose to $0.097 in less than three months. This rise is called a “hated rally” by the meme token community. This situation can occur when a pessimistic outlook on a cryptocurrency triggers a price increase on the charts. If history repeats itself, this pattern may reappear.

Additionally, if assumptions come true, DOGE’s price could reach the annual high of $0.27 before the next quarter begins. At the time of writing, the meme token’s value was at $0.16. On the other hand, data from IntoTheBlock revealed that 84% of all DOGE holders increased their gains at the aforementioned price level. For 100% of the total supply to be profitable, the meme token’s price needs to reach $0.32. This was the average price for the 755,230 addresses accumulating DOGE.

BTC and DOGE Correlation

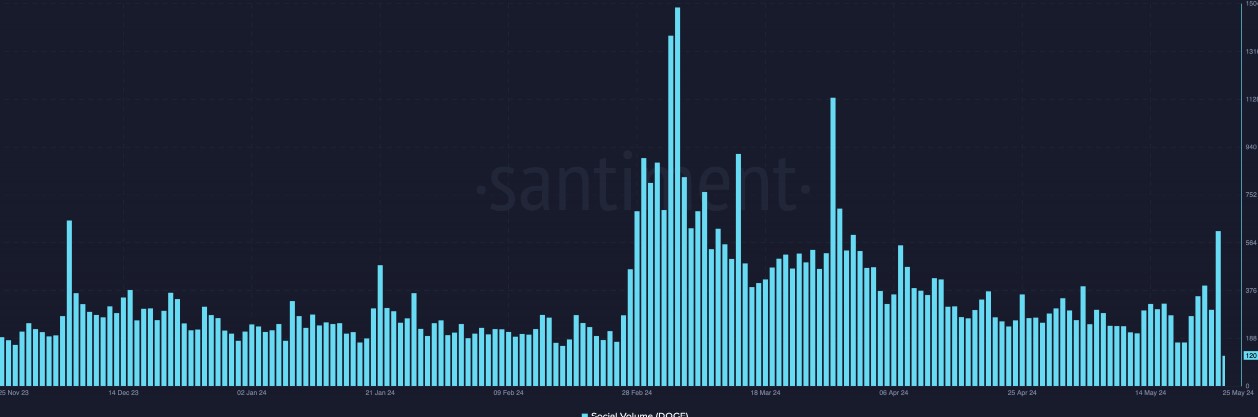

On-chain data recently revealed that Bitcoin’s price is at a good accumulation point at its current position. Based on this assumption, it might be accurate to say that DOGE is in a similar situation. Therefore, a notable increase in Bitcoin could also raise DOGE’s price. Additionally, it evaluated the meme token’s social volume. At the time of writing, this measure had dropped from 614 to 120. From a price perspective, this decline could strengthen the idea that demand might decrease. At the same time, since most participants have been uncertain about the token’s short-term performance recently, this situation could also present a buying opportunity.

Türkçe

Türkçe Español

Español