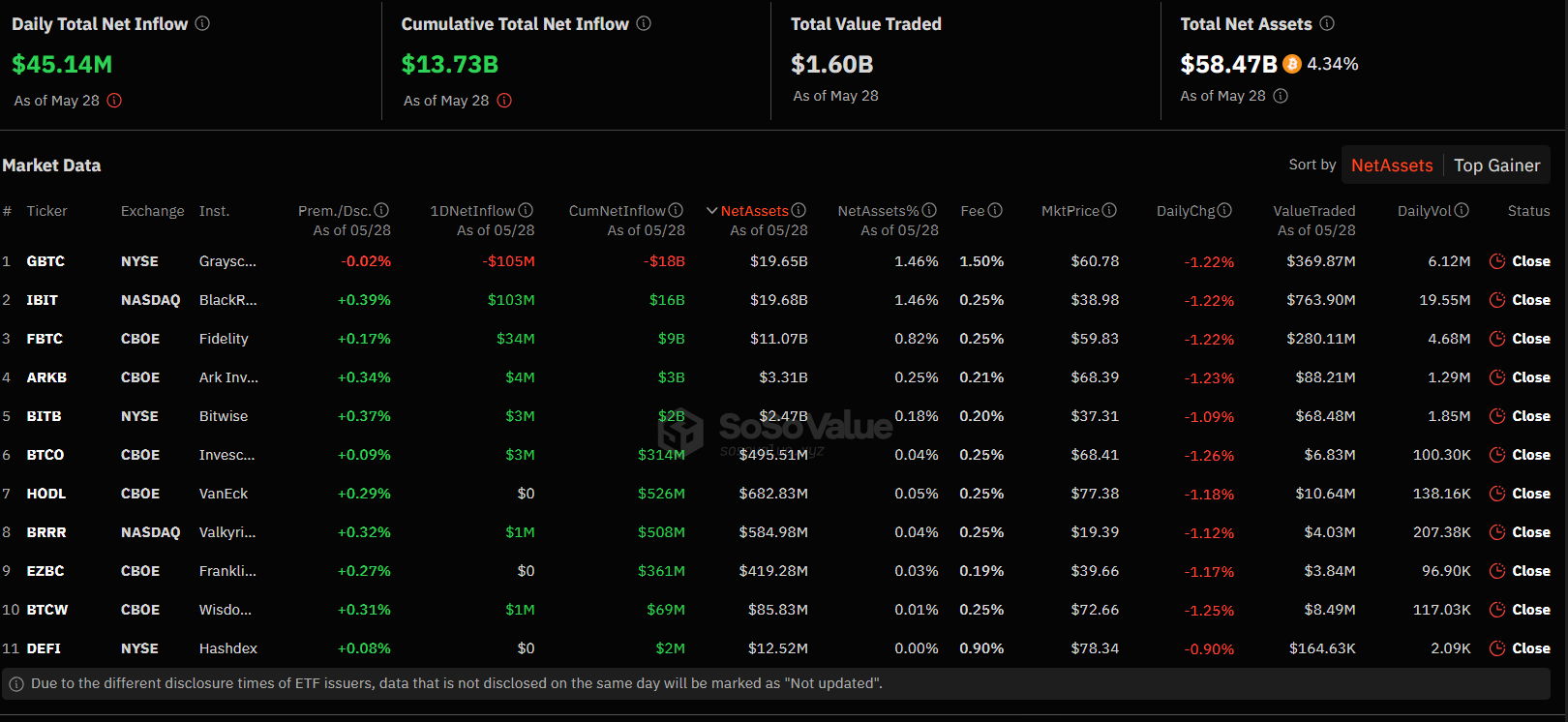

On May 28, 2024, Bitcoin ETFs had a positive day. Significant investment activity occurred in these products. Various companies in this sector received substantial capital inflows, reflecting investor confidence and interest in Bitcoin-related financial products. Overall, there was a net investment inflow of $45 million to the relevant companies. This collective increase indicated strong positive sentiment towards Bitcoin ETFs. The inflows and outflows were unevenly distributed among companies. Some received significant investments, while others saw little to no activity.

BlackRock Leads with $103 Million

Among the top beneficiaries was BlackRock, which received a significant investment of $103 million. This large inflow highlighted BlackRock’s prominent position in the Bitcoin ETF market and demonstrated high investor confidence in its Bitcoin-related offerings. Fidelity also performed well, attracting $34.3 million in investments, showcasing strong confidence in its ability to manage Bitcoin ETFs effectively.

Other companies received smaller but still notable investments. ArkShares received $4.1 million, while Bitwise, Invesco, Valkyrie, and WisdomTree received $3.3 million, $3.4 million, $1.2 million, and $1.4 million, respectively. Although these investments were modest compared to BlackRock and Fidelity, they indicated diversified interest in Bitcoin ETFs among different issuers.

On the other hand, Franklin and VanEck did not receive any new investments during this period. The lack of investment may indicate a lack of competitive advantage or a preference for other ETF providers by investors. This stagnation might prompt these companies to reassess their strategies and improve their offerings to attract future investments.

Grayscale Sees $105 Million Outflow

In contrast, Grayscale saw a significant outflow of $105.2 million, indicating a notable withdrawal from Bitcoin ETFs. This large withdrawal could signal a shift in investor sentiment or dissatisfaction with Grayscale’s performance.

The outflow from Grayscale sharply contrasted with the inflows seen by other companies, suggesting that investments in the Bitcoin ETF market are potentially being redistributed. However, it should be noted that there have been outflows from Grayscale since the introduction of spot Bitcoin ETFs.

The varied investment activities on May 28, 2024, reflected the dynamic nature of the Bitcoin ETF market. While some companies succeeded in attracting significant capital, others struggled to maintain investor interest. As a recent development, BlackRock’s spot Bitcoin ETF product, IBIT, has surpassed Grayscale’s GBTC in total net assets.

Türkçe

Türkçe Español

Español