Bitcoin investors are not acting as if the price hit an all-time high of $73,800. On May 28th, new research by blockchain data analysis firm Glassnode revealed that the selling pressure from older cryptocurrencies is only half as intense as previous bull market peaks. Long-term Bitcoin holders (LTHs) continue to resist the urge to take profits even when Bitcoin price action is close to $70,000.

What Is Happening on the Bitcoin Front?

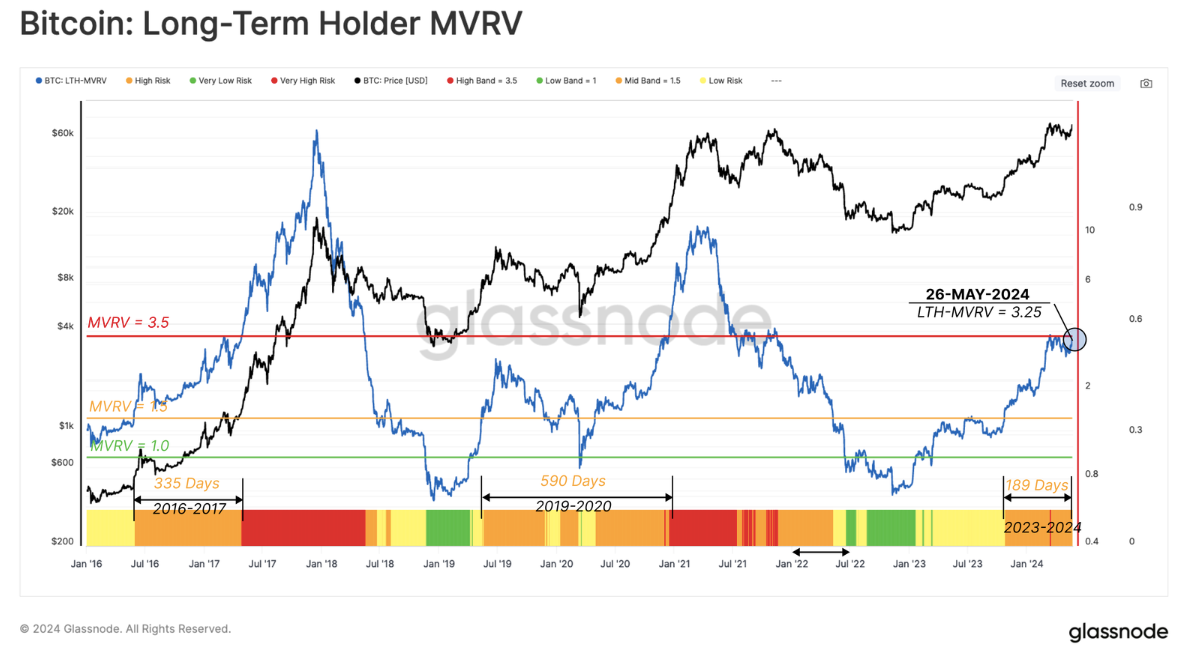

Despite LTH wallets achieving an average of 3.5 times profit, they are not selling Bitcoin at a rate that would make the current bull market unsustainable. Glassnode explained the issue in the latest edition of its weekly newsletter, The Week:

“In response to renewed buyer-side pressure, as prices appreciate, the importance of the counterparty, i.e., the selling pressure from Long-Term Holders, also increases. Therefore, we can evaluate the unrealized profit of the LTH group as a measure of sales incentives and their realized profits to assess the actual sales direction.”

LTHs refer to wallets that hold Bitcoin for 155 days or longer and reflect the less speculative side of the Bitcoin investor spectrum. Glassnode used market value to realized value (MVRV) data to show that LTHs will collectively enter historically high unrealized profit levels in the near future:

“If the market uptrend remains sustainable and new ATH levels are formed in the process, the unrealized profit achieved by LTHs will increase. This will significantly increase the incentives to sell and eventually lead to a selling pressure that gradually depletes the demand side.”

Analysts’ Noteworthy Comments

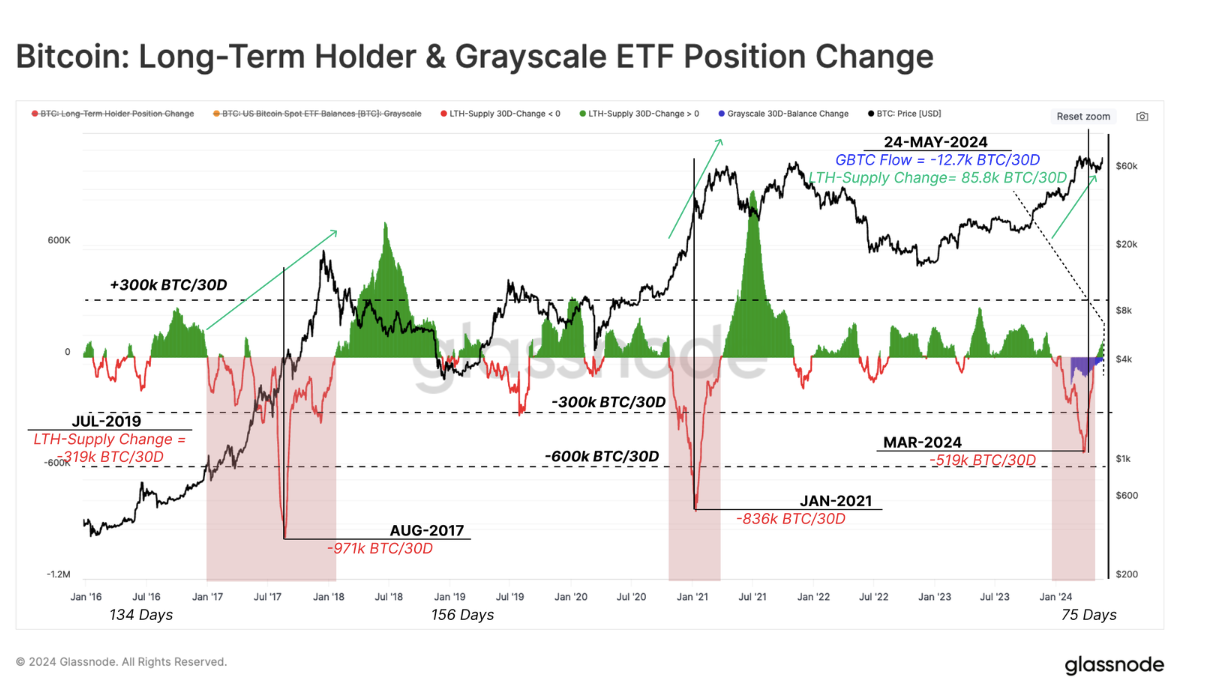

Considering the most recent all-time high in March, the return of Bitcoin price discovery provides room for optimism. Even at the peak of $73,800, LTHs were not dispersing into the market as intensely as in previous bull market peaks. Analysts explained this issue with the following statements:

“In the last two bull markets, the net distribution rate of LTH reached a significant level of between 836,000 and 971,000 Bitcoin per month.”

Glassnode addressed the ongoing sales by investors in the Grayscale Bitcoin Trust (GBTC), an institutional investment vehicle that lost its survey position among spot Bitcoin ETF funds under management this week. The report shows that LTHs have continued the revived investment trend since the end of last year:

“Following a significant amount of long-term investor distribution at the $73,000 ATH level, the selling pressure has visibly decreased.”