Bitcoin (BTC) price was seen stuck in a certain price range over the past 3 months. This situation gave way to a rise following the ETF approval news that emerged for Ethereum (ETH) last week. While the future of the cryptocurrency market remains uncertain, some altcoins have been found to be overbought recently. According to CoinGlass data, the 24-hour relative strength index (RSI) heat map showed signs of overbuying in these altcoins, especially on May 29. We examined two of them.

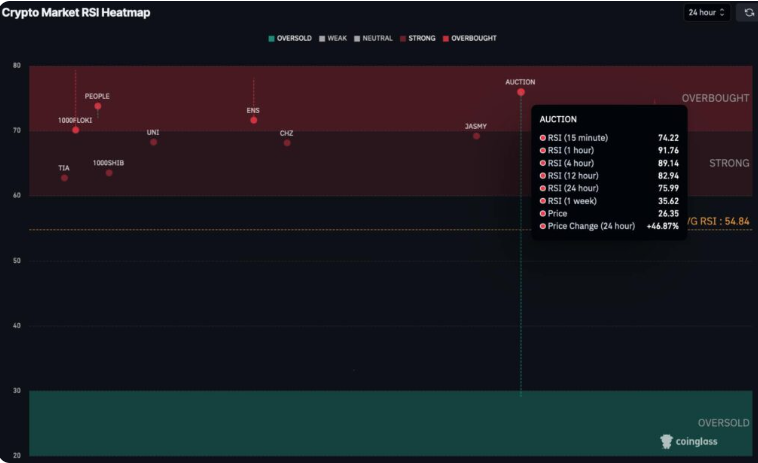

Bounce Token (AUCTION) Latest Status

The first altcoin examined was Bounce Token (AUCTION). The 24-hour RSI indicator for AUCTION suddenly shifted from an oversold position to an overbought situation. When examining CoinGlass’s heat data, the token continues to trade at $24.54 after a 35% increase in the last 24 hours.

On the other hand, AUCTION’s hourly RSI value indicates 91.76, showing how much overbuying occurred in a short period. AUCTION’s 4-hour, 12-hour, and 24-hour RSI values are seen as 89.14, 82.94, and 75.99, respectively.

On the other hand, the weekly timeframe for Bounce Token shows weak momentum at 35.62 against short-term continuity.

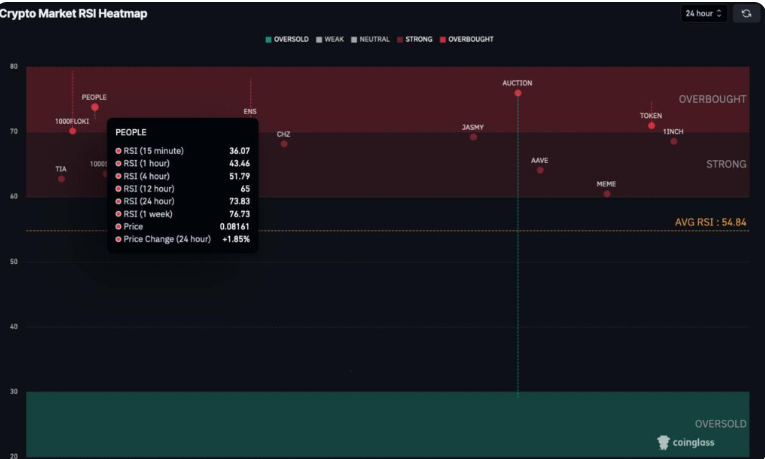

ConstitutionDAO (PEOPLE) Comments

Another cryptocurrency showing overbought signals was ConstitutionDAO token PEOPLE. Contrary to the market, the positive price movement in PEOPLE had been attracting investors’ attention for a while, and the weekly RSI value appeared to have reached an overbought state after all this process. After this, everything turned around.

After the price movements in recent hours, things seemed to have turned around. The PEOPLE token saw a 1.81% increase during the day, but after the latest outlook, the price fell to $0.07964 following a 12% drop. Indicators pointed to the possibility of such a situation, and it happened.

Despite the idea that the overbought RSI indicator on the PEOPLE side brought a correction, there can be no guarantee of a correction in cryptocurrencies. It is also crucial to understand that such indicator changes come after bulls demonstrate strength and are usually seen during ongoing bull market periods.

Türkçe

Türkçe Español

Español