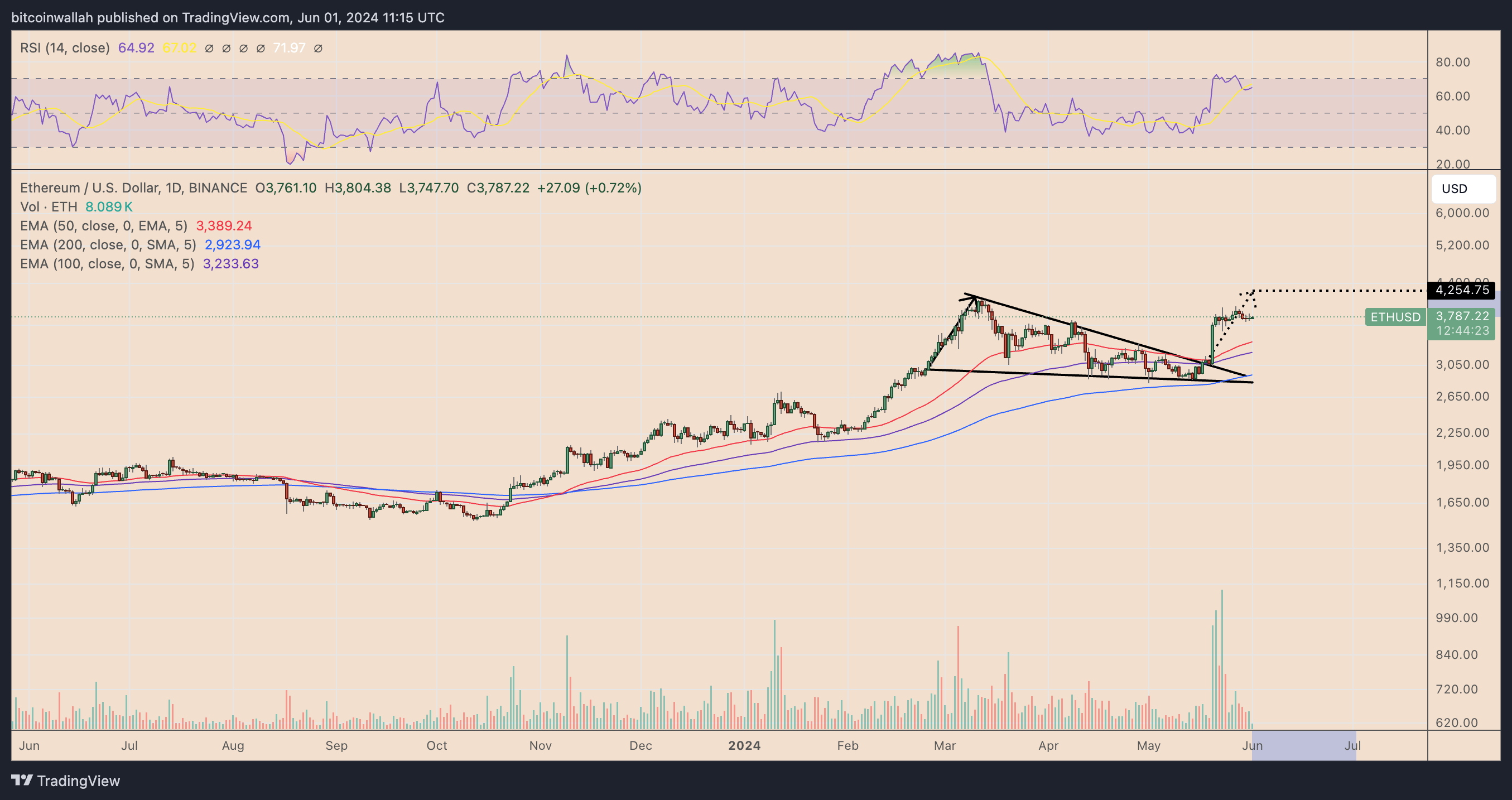

Important developments continue to occur in the crypto market. Ethereum price has increased by approximately 67% so far in 2024 and, according to a mix of on-chain, fundamental, and technical indicators, it may continue its upward movements in June. As of June 1, the breakout phase of the descending wedge pattern dominating Ethereum’s daily chart had come into focus.

Ethereum Chart Analysis

The descending wedge is notable as a bullish reversal pattern characterized by two descending, converging trend lines. As a rule of technical analysis, this pattern resolves when the price breaks above the upper trend line and rises by the maximum height of the wedge.

On May 20, Ethereum’s price broke above the upper trend line of the wedge with an increase in trading volumes, confirming the tendency to reach the upward target of the formation at approximately $4,255 by the end of June with a 12.65% increase from the current price levels.

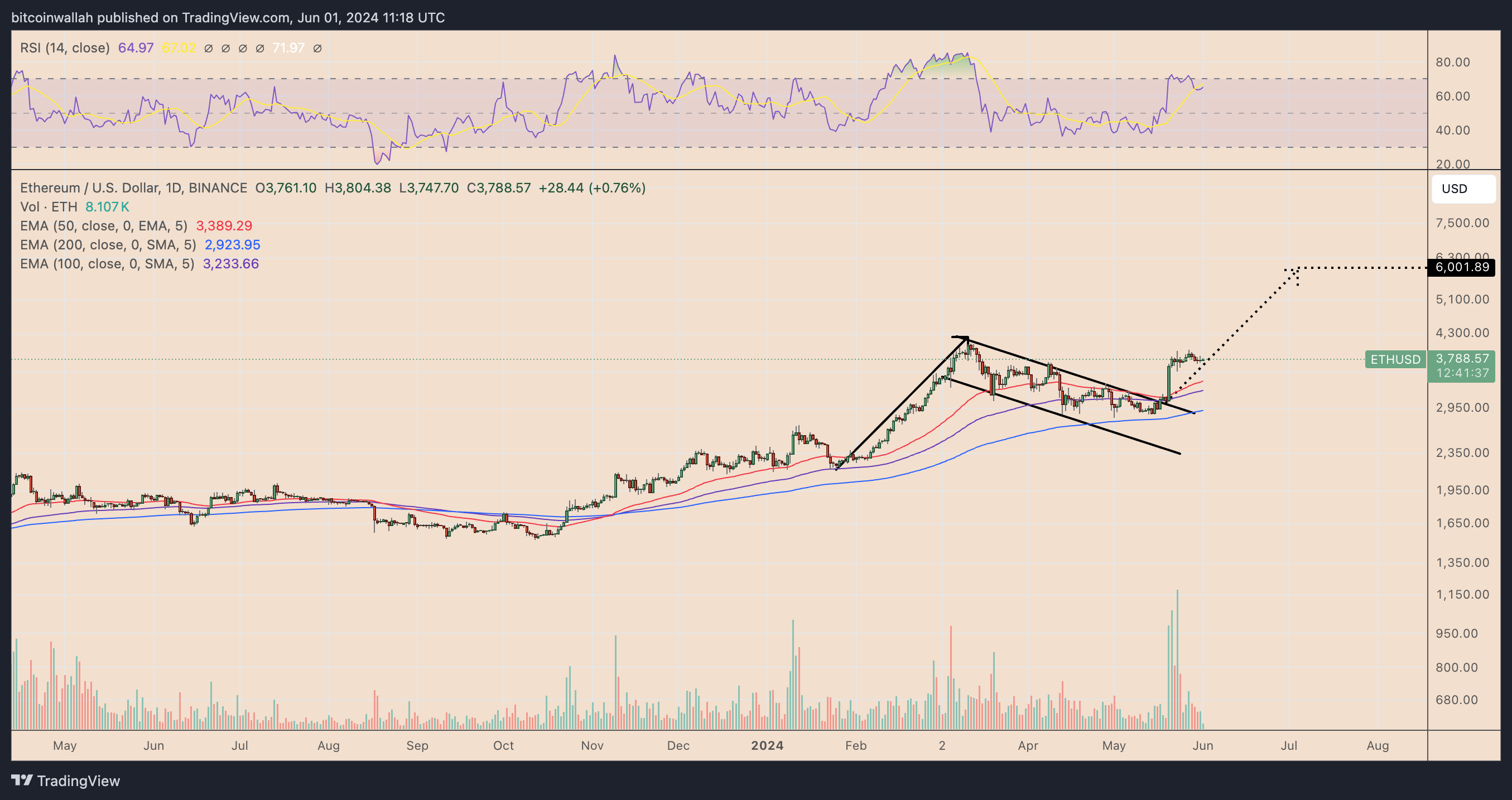

Interestingly, the ongoing breakout appears to be part of a bull flag pattern characterized by two parallel downward-sloping trend lines.

As a rule of technical analysis, bull flags resolve when the price breaks above the upper trend line and rises by the height of the previous uptrend. This indicates that Ethereum could reach $6,000 by the end of June or early July.

Interest in Ethereum Continues

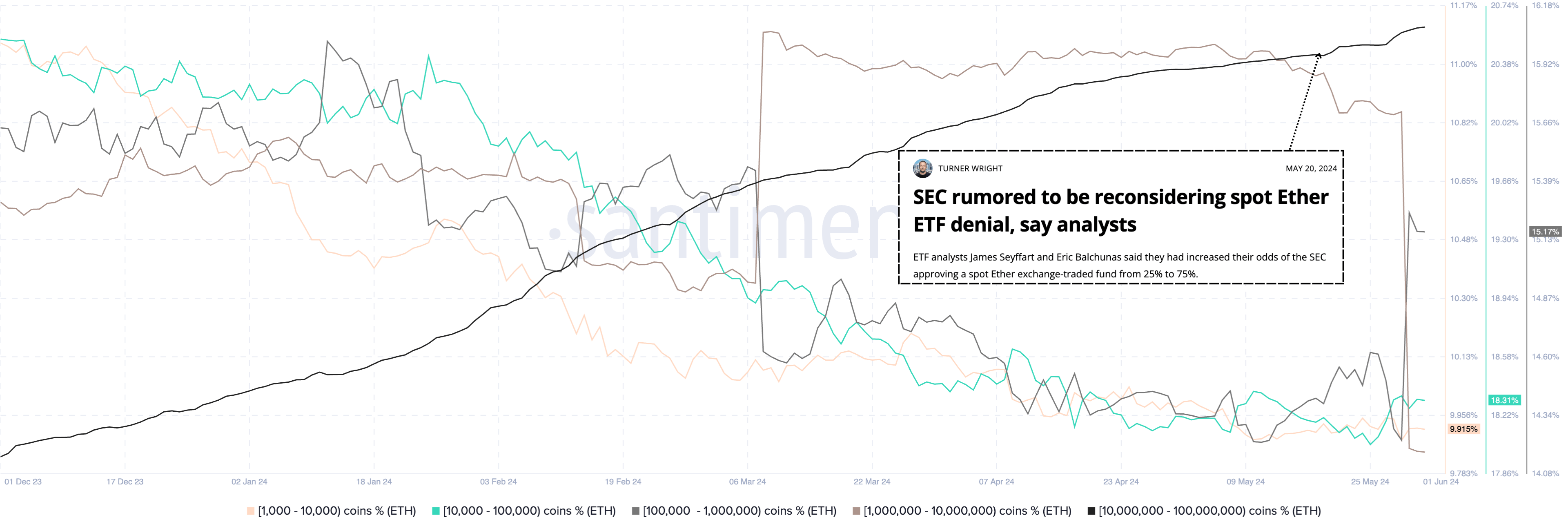

Ethereum’s potential to reach $4,000 is further strengthened by the wealthiest whale cohort. According to blockchain data analysis platform Santiment, the Ethereum supply held by entities with balances of 10 million to 100 million Ethereum has increased by approximately 0.5% since May 20, when rumors of the US Securities and Exchange Commission (SEC) emerged. The reassessment of the spot Ethereum ETF rejection has begun.

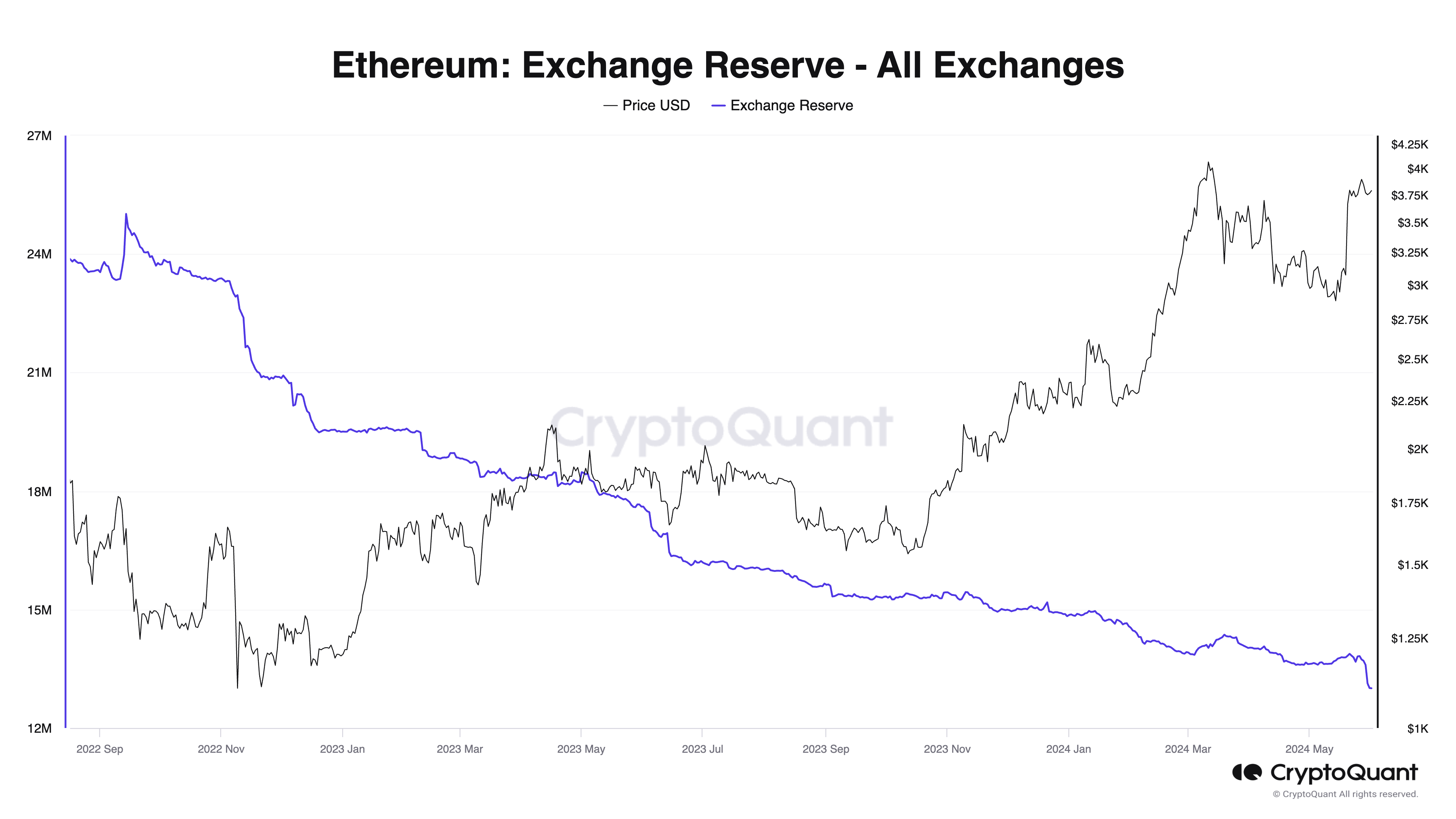

The accumulation coincided with the price increase in the ETH/USD pair. The growth continued after spot Ethereum ETF funds received official approval from the SEC on May 23. Conversely, the Ethereum supply held by entities with balances of 1 million to 10 million Ethereum (brown) sharply decreased during the price rise, indicating profit-taking. However, Ethereum reserves across all crypto exchanges have recently experienced a sharp decline.

This indicates that most investors are withdrawing their Ethereum holdings from crypto exchanges, which can be seen as a sign of increasing accumulation sentiment, boosting Ethereum’s potential to continue rising above $4,000 in June.

Türkçe

Türkçe Español

Español