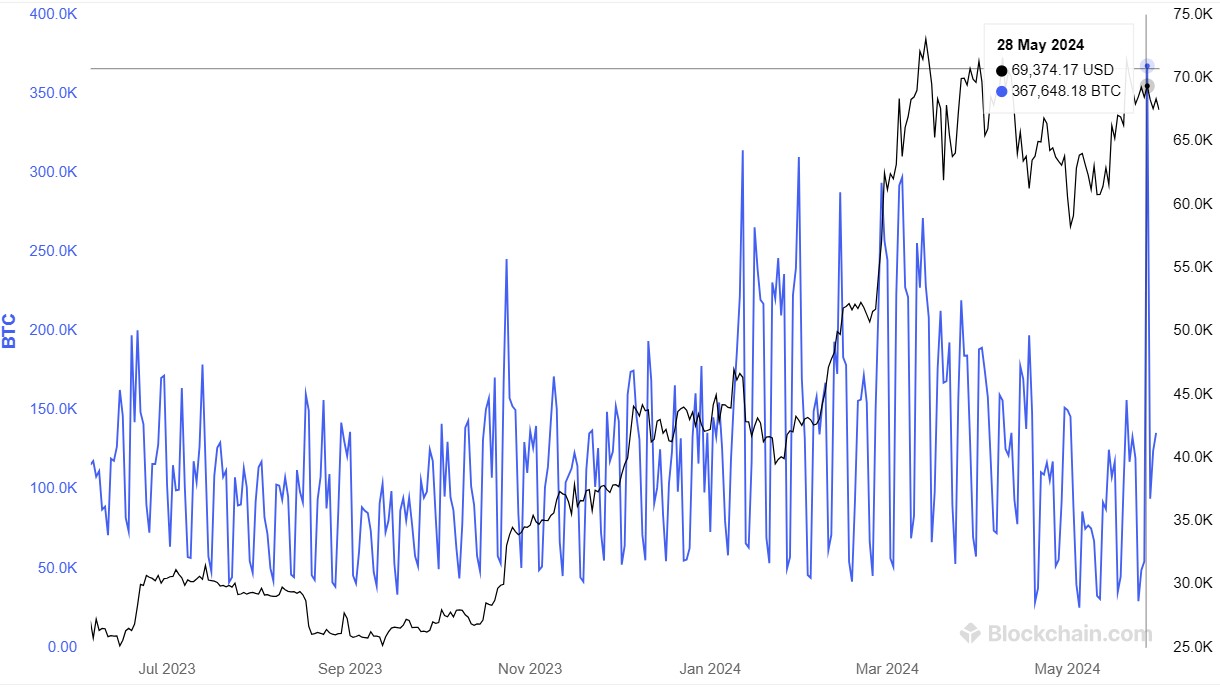

Bitcoin‘s (BTC) price struggles to surpass a significant resistance level, while the Blockchain network reached an important milestone towards the end of May. On May 28, the estimated value of transactions on the Bitcoin network exceeded $25 billion, reaching the highest level in USD terms compared to the previous year. Despite the price struggles, this increase in transaction value indicates continued growth and adoption of the Bitcoin network.

367 Thousand BTC Transferred

Data from Blockchain.com reveals that approximately 367 thousand BTC were transferred on May 28, marking the largest volume since June 13, 2022. Although this amount is slightly lower than the previous peak, Bitcoin’s price hovering above $69,000 contributed to a total transaction volume of $25.5 billion. Interestingly, despite the increase in transaction value, the actual number of transactions remained relatively low at around 597 thousand.

Bitcoin’s price stability around $69,000 is attributed to a demand zone ranging from $66,900 to $68,900. In this range, over two million wallet addresses collectively accumulated one million BTC, indicating significant buying activity and forming a crucial support level. This support helped Bitcoin maintain its value amidst market fluctuations.

Spot Ethereum ETFs Discussed but Interest Remains in Spot Bitcoin ETFs

Despite concerns about Bitcoin’s price falling below $70,000, investor sentiment remains bullish. Since January, the launch of spot Bitcoin ETFs has attracted billions of dollars in investment, and despite recent focus on spot Ethereum ETFs, spot Bitcoin ETFs continue to hold their ground. Notably, a university professor convinced the Wisconsin State Investment Board to invest $160 million in a spot Bitcoin ETF, citing its strategic value.

The professor praised the approval and launch of spot Bitcoin ETFs in the US in January, highlighting increased opportunities for investors and growing institutional interest. So far, ETFs have offered significant investment opportunities and brought more attention to Bitcoin as a viable asset.

Meanwhile, analyst Peter Brandt, with over 40 years of experience in financial markets, predicts that Bitcoin could reach $130,000 by 2025, drawing parallels with previous post-block reward halving cycles.

Türkçe

Türkçe Español

Español