Popular altcoin Shiba Inu (SHIB) saw a notable 10% price increase today, making it one of the best-performing altcoins in the cryptocurrency market. According to CoinGecko, SHIB is currently trading at approximately $0.00002612. This price surge coincided with a significant increase in whale activity, indicating large transactions and growing interest from major investors.

Increase in Transaction Volume

Data from IntoTheBlock reveals a sharp increase in SHIB’s total daily transaction volume for transactions over $100,000, reaching approximately $135 million. This represents a 99% increase from the previous day, reflecting a significant rise in large-scale trading activity. This revival has been beneficial for investors. Now, 65% of HODL investors are in profit on paper, and whales control 73% of the circulating supply.

This scenario is the opposite of last September when about 90% of SHIB investors experienced losses. The current positive sentiment and price performance reflect a significant turnaround for the altcoin.

Factors Contributing to SHIB’s Rally

Several factors have contributed to SHIB’s recent rally. Chief among these is the token burn mechanism, which has seen a dramatic increase in activity. On June 4, the token burn rate exceeded 10,000%, and approximately 370 million SHIB were burned and removed from circulation last month. The purpose of this mechanism is to reduce SHIB’s circulating supply, thereby increasing its scarcity and potentially its value over time, assuming demand remains constant or increases.

Another factor is the progress of Shibarium, a Layer-2 scaling solution for the Shiba Inu ecosystem. Shibarium aims to reduce transaction fees, increase speed, and improve scalability. As of the end of May, Shibarium had processed over five million blocks, reaching a significant milestone in its development since its launch last summer.

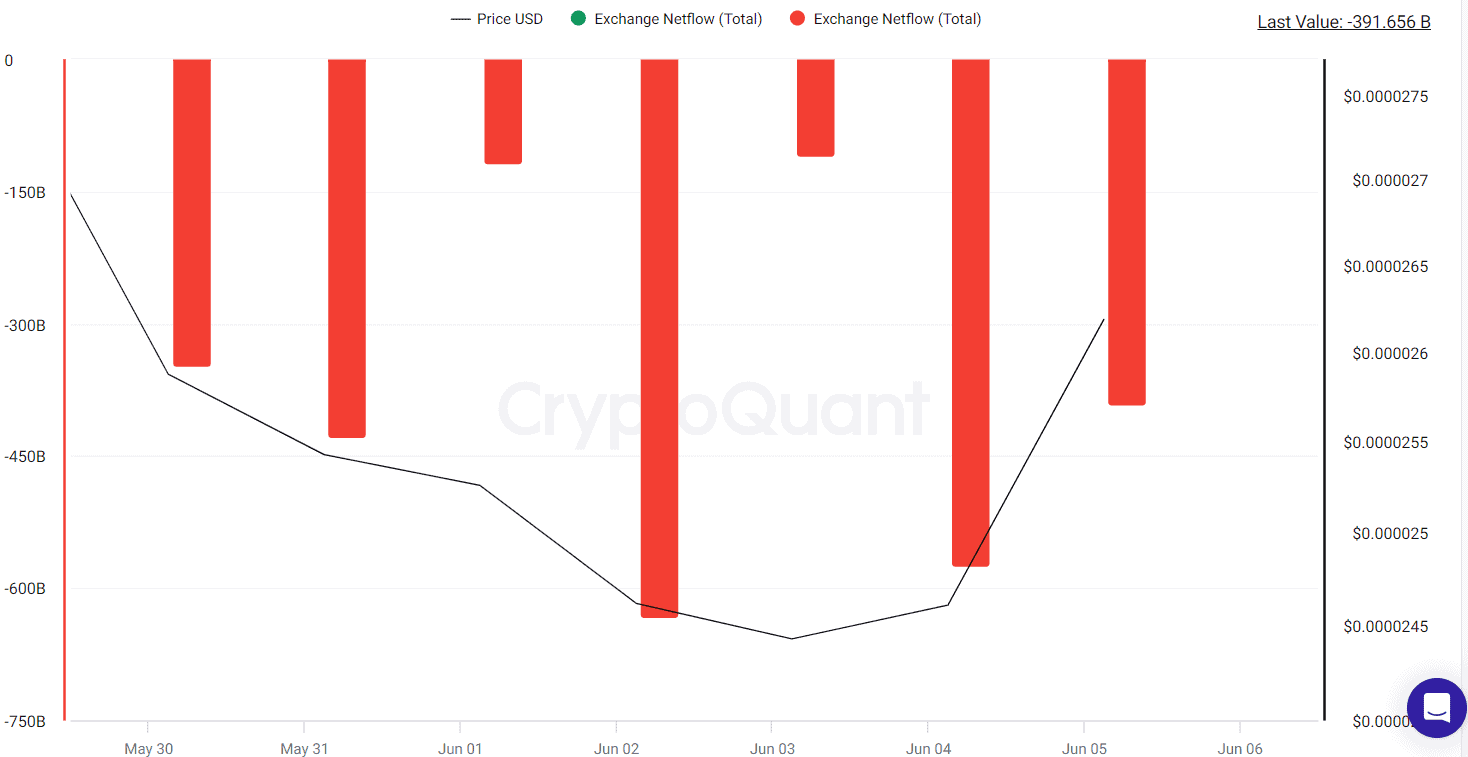

Lastly, SHIB’s net flow to exchanges has shown a trend where outflows have exceeded inflows in recent days. The shift from centralized cryptocurrency exchanges to self-custody methods is seen as bullish, as it reduces immediate selling pressure and indicates a preference for long-term holding among investors.

Türkçe

Türkçe Español

Español